Some traders feel more comfortable while trading with trend following strategies, while others like more range trading. It pretty much depends on what type of trader you are. Do you prefer to follow the trends or do you prefer to trade in the range, buy when the price is cheap, and sell when the price is expensive?

EA Studio generates both types of trading strategies, and in this lecture, I will show you how to recognize them. Moreover, I will give you some examples.

So for the beginner traders, let me open the TeamViewer and I will just use the chart to show you what is a trend following strategy and what is the opposite thing when we have range trading, as I call it. When we want to buy at a cheaper price and sell when the price gets expensive.

Trend Following Strategy Example

So the trend following strategies are the type of strategies when we buy together with the direction of the trend.

Let me just go quickly through some of the strategies.

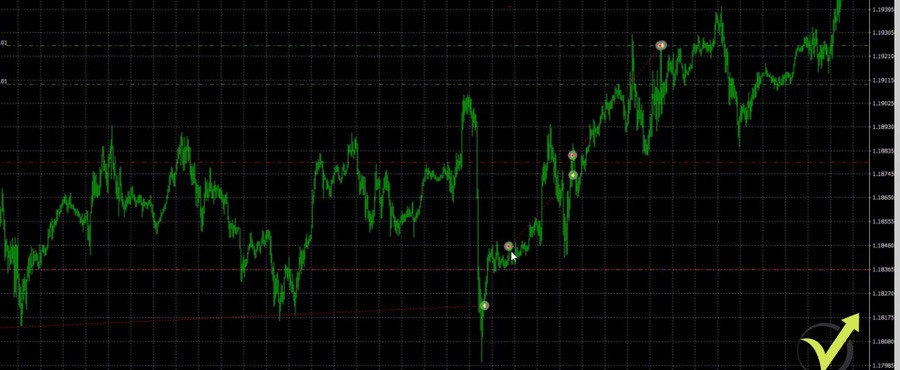

And I think here we had a few trades that show that this EURUSD strategy on the H1 chart is a trend following strategy. So you see in November 2020, EURUSD has been very bullish. The trend is going upwards.

What is an uptrend?

For the beginners, what is the trend? This is when we have a series of higher highs and higher lows. This is how the uptrend is defined.

The trend goes up. What we have from this strategy are long trades. So it follows the trends.

Range Trading Example

And if I switch to the other EURUSD strategy on M15, you can see that this period, especially the last week or the last 2 weeks have been bad for this strategy because it’s a range strategy.

You see that I had 2 short trades that ended on losses.

So in this case, the strategy Sells when the price is expensive. But this is just for that period of time.

And then it will buy when the price is cheap. But this is based on the Indicators that stand behind the Expert Advisor.

The buy signal

So if you see that period of time right here, this value is expensive. The strategy sells. However, the price continues upwards. And this type of strategy is very, very appropriate when the market is in a range just like that period over here.

So this type of strategy will try to buy when the price is cheap and they will try to sell when the price is expensive.

Just when the price goes in the range, they work much better than the trend following strategies where I have a similar strategy on H1.

Range Trading Strategies in EA Studio

So let me show you how you can recognize these strategies on EA Studio in the collection.

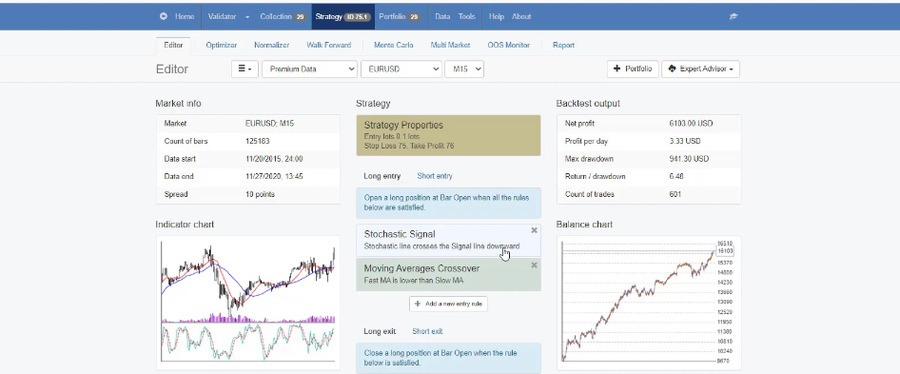

If I click on the 1st strategy, let’s see what we have here, Stochastic line crosses the signal line downward and this is for long entry or for the buy signal.

One more time Stochastic line crosses the signal line downwards and the next condition is the Fast Moving Average is lower than the Slow Moving Average.

The long trade

What that means is that it is a range strategy. It doesn’t follow the trend because it wants to Buy when the Stochastic line crosses the signal line downwards, or in other words, when the price goes down.

And as well, the Moving Average is lower than the Slow Moving Average. 2 of them will identify when the price is going down.

Let me click on the Indicator chart and I will show you what we have. Let me find the 1st long trade so it will be easier for you to understand it. Here it is.

The Stochastic line crosses the signal line downwards, and in that time, the Fast Moving Average is below the Slow Moving Average.

The confirmation

There was a huge drop of the price which forced the Fast Moving Average to go below the Slow Moving Average. And then what happened? The Stochastic shows that the market was overbought. The Stochastic goes below the signal line which usually is a Sell signal. But in this case, it is a Buy signal and we Buy. And you can see that the price hit the Take Profit a little bit later.

Let me look for some other examples. For example, here is a short trade.

The Fast Moving Average is already above the Slow Moving Average, which means that we had an up move. And then when the Stochastic line crosses the signal line upward, we have the confirmation and we Sell. So you see the price goes up, we Sell and it goes down.

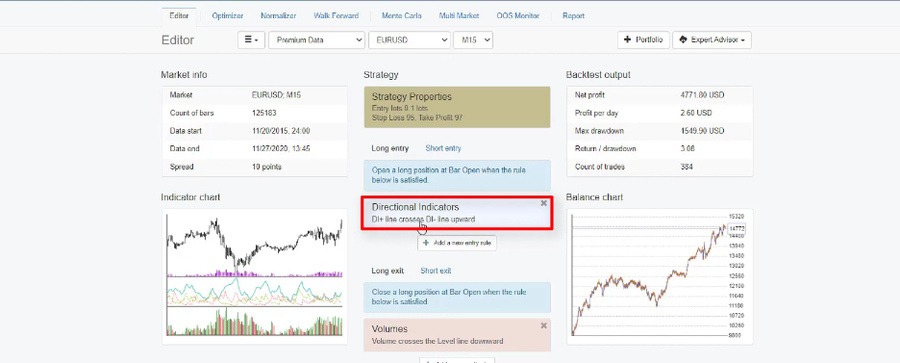

These are the type of range strategies. Now, let me look for a strategy that follows the trend. Here it is.

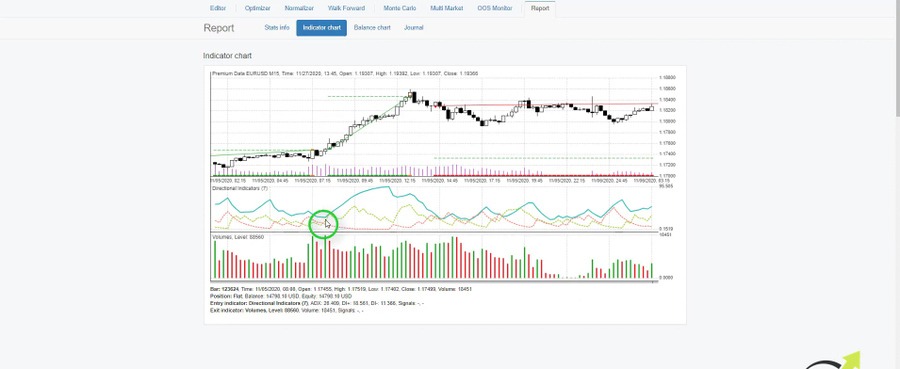

The directional Indicators, DI+ line crosses DI- line upwards. Let me click on the chart.

The short trade

So this is how the directional Indicators look like. And we have the Buy signal at this moment right here when the green line crosses the red line upwards.

The Take Profit was hit.

Here is a short trade.

The negative one crosses the positive one upwards. So you see, we are following the direction. The price goes down, we Sell price starts to go up, we Buy. So these are the trend following strategies and they work obviously great when the price is in a trend.

But usually, the statistics show that about 70% of the time the price stays in a range and only about 30% of the time the price trends. So what I personally prefer to do is to have the 2 of them together combined. I would like to have a strategy that follows the trend and I want to have a strategy that works better when the price is in a range.

It’s up to you to decide which kind of trader you want to become. That is why on the chart I showed you 2 different strategies, one on M15 and one on H1.

One more time, it’s up to you if you are a trend follower and you want to trade only with the trend. Absolutely understandable. Many of the traders do it.

At the same time, there are many swing traders and people who prefer to trade channels and they want to Buy when the price is cheap and they want to sell when the price is expensive. So then you might want to look for the strategies when the Indicators cross opposite.

How to Recognize Trend Following Strategies in EA Studio

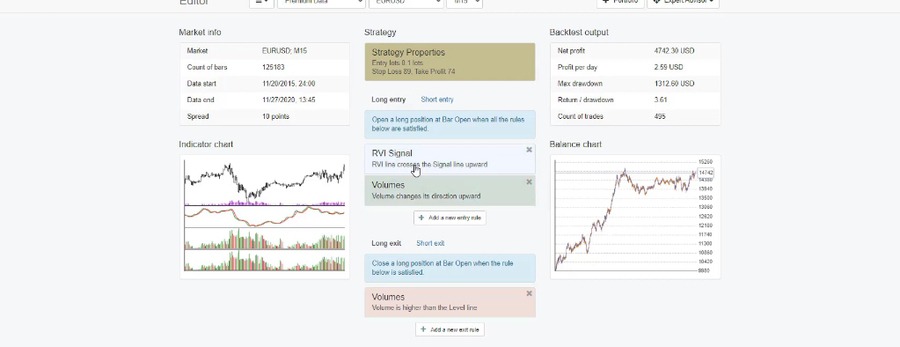

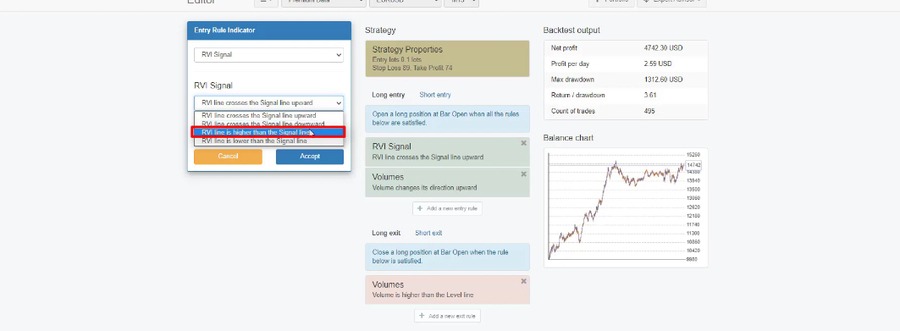

So, one more time, let me click on any of the strategies and I hope now you recognize it.

The RVI line crosses the Signal line upwards, and Volume changes its direction upward. This is for a long. When we want to Buy, when we see upward, it means that this is a trend following strategy. Because it will Buy when the event or the cross of the Indicators is in the same direction as the direction we want to go.

The Trend Following Strategy

And if I click on it, you will see that there are different entry rules. But on EA Studio, first, we see the long entry and then if I go to short, we will see the opposite thing. But by default, it stays long. So when you open the strategy and you see what are the rules, you will understand if this a trend following strategy or it’s not.

And what will give you the tip that this is a trend following strategy when you see the words upward or the line is higher than the Signal line, for example.

If something is higher than the other thing or it crosses upward, then we are going up in the same direction.

If you see the opposite with the long entry going down is below, downwards, then this means that the strategy will buy when the price gets cheaper and it will sell when the price gets more expensive. Or in other words, it’s a range strategy.

I hope I have explained that clearly. It’s really not easy to understand it, I guess if you are a beginner.

And of course, if you have hard times with it let me know in the comments below. But if you play a little bit more with EA Studio I’m pretty sure that you will learn to recognize the strategies and select the type of strategies you want to trade with.

I hope I have succeeded to explain clearly what’s the difference between trend following strategies and range trading strategies. Thanks for watching. If you have found that video useful give it a thumbs up and subscribe to our YouTube channel if you haven’t done it yet.

Have a wonderful day! Bye!