How to do Forex trading with many strategies and diversify the risk.

How to do Forex trading, not with one but many strategies is what I am specialized in. Hello, dear traders, it’s Petko Alexandrov. And in this lecture, I will teach you how to create many strategies. This is a free lecture from the Forex Algorithmic trading course – Top 10 GBPUSD Expert Advisors.

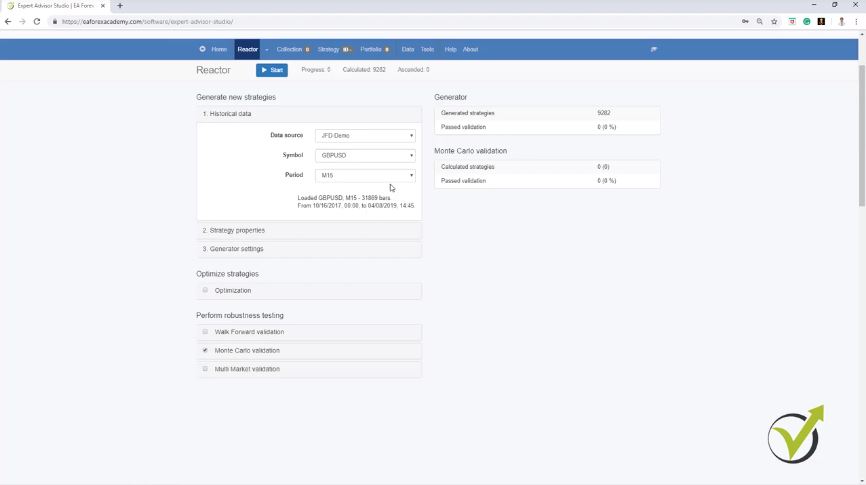

In the previous lectures I have placed the historical data from my broker, I have selected the Symbol, here I will show you how I generate strategies for different periods or for different time frames.

Now I will start with M15. But instead of the generator, I will use the reactor which is generator + robustness testing. OK? Very same thing like the generator that I showed you, but as well we can add some robustness testing which validates the strategies if they are robust enough to trade with them. Alright?

So let’s start step by step. I will go to strategy properties. Here, I will leave it the way it is.

The Range for the SL and TP is important when you select the strategies on how to do Forex trading.

Entry lots, 0.01. Stop Loss and Take Profit, I prefer to use and I give it the range between 10 to 100. This means that the generator will find me the value for the Stop Loss and the Take Profit according to the strategy, and I will see it later.

And I don’t limit the generator with predefined Stop Loss or Take Profit but I give it a range between 10 pips and 100 pips. For generator settings, I will leave it for 600 minutes. This is normally how much I run it.

And because it’s in the afternoon now, I will leave it to work till tomorrow morning. So this will be like 10 hours and this way the generator will calculate thousands of strategies, probably hundreds of thousands, or sometimes millions of strategies, depending on how much time you run the generator.

The next thing is how I will filter the strategies

And Search best, I will leave it to net balance. So on the top, I see the strategies with most balance. And here is the Out of Sample, something I have been using recently and I shared it already in one of my previous courses.

So if I leave it In Sample, this means that the generator will use the whole data that I have. But if I select to use, for example, 20% Out of Sample, this means that the generator, let me demonstrate it to you very quickly. The generator will generate strategies which will be generated over 80% of the historical data, and with the rest 20%, it will simulate trading. So this is how to do Forex trading with tested strategies.

This is one of the very good ways to skip Demo trading and to go straight to live account. But this is for the more advanced traders of course, who are used to the process. And the idea here is that the generator works only on the white field, and in the green field, it simulates trading.

Acceptance criteria are used to filter the strategies

For example, you can see if I refresh and load the new strategies that were generated, the strategy was generated until 80%. And after that, it shows a profit. And this is simulated trading.

So this is something like, we have placed this strategy for trading before some time or exactly before 20% of the whole period. Alright? Let me stop it and I will delete all of these strategies. And I will go to the reactor one more time, and in generator settings, I will leave it to 20% Out of Sample.

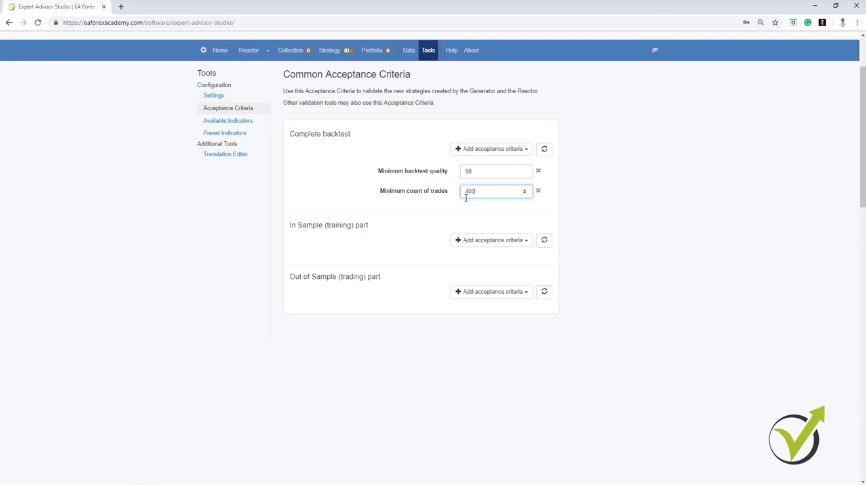

And here I will select to use the common Acceptance criteria. So what is the Acceptance criteria? Basically, here I can place filters that will filter the strategies before going into the collection.

Minimum backtest quality is the first one I choose

Because I don’t want to have hundreds and hundreds of strategies randomly generated. I want to see strategies that pass predefined rules or they fit my trading style because when I’m trading with Expert Advisors or with strategies I want them to have minimum criteria. And here I will add some of the Acceptance criteria and this is the best way how to do Forex trading with selected strategies.

For example, I like to have minimum backtest quality, I will leave it to 98. I’m not going to explain it in details but it is a criterion connected to the historical bars that we have imported. And if there are some bars when there is uncertainty, if the trade was opened within one bar and the Stop Loss, our Take Profit is within this bar, the Expert Advisor Studio will take it as a negative.

So it will be a more skeptical way of backtesting. Now the next thing I will choose is a minimum count of trades. This is very important in algorithmic trading.

As more count of trades we have, the more reliable the strategy is.

Normally I keep it to 300. I want to see in the collection, strategies that have minimum 300 counts of trades but now I will increase it even to 400. So this means that all the strategies that will pass these Acceptance criteria, they will be strategies with above 400 count of trades.

This means that for the period that we are testing the strategy we want to see a minimum of 400 times this strategy executed. Which is a great sign of robust strategy because if we have a strategy that opens just 2, 3, 5, 10, or 20 trades for this period it means this is actually not an active strategy. It opens rarely.

How to do Forex trading with many strategies?

- use the Historical data if your broker

- EA Studio to generate the strategies

- filter them with acceptance criteria

- minimum of 400 count of trades

- profit factor above 1.2

And if we ignore the backtesting period and we just focus on the count of trades, obviously we don’t want to base our trading on a strategy that opened just a couple of trades. But when it opened 400 times the trades according to the entry and exit conditions, this gives us a sign that this strategy might continue being profitable in the future. And I will add another Acceptance criteria here which is the Profit factor.

How to do Forex trading: strategies with good Profit factor

This is one of my favorite criteria and I will increase it to 1.2. And for the newbie traders, the Profit factor is defined as the gross profit divided by the gross loss. And we’re including commissions or any taxes if we have spread in Forex or anything.

Just the gross profit divided by the gross loss. This is the minimum Profit factor and I want it to be 1.2. And this Acceptance criteria is for the complete backtest.

For all the historical data that we have. Now below we have the In Sample and Out of Sample part. Which means that we can add different or same Acceptance criteria, and they will be related to the In Sample, which is the training part where the strategy is being generated.

You can add any Acceptance criteria.

In this case, I said it will be 80% of the time. And separately, we can add the Acceptance criteria for the Out of Sample part or the rest 20%, where the software will simulate trading just as if the strategy was on the trading account. So here, I will add the very same minimum Profit factor of 1.2. One more time, you can add any of these Acceptance criteria. This will assure that the strategies that will be tested will have a good equity line – the way I found how to do Forex trading with many strategies.

But for the purpose of this course, I will stick to the minimum Profit factor. Here it is and I will increase it again to 1.2. And as well here, Profit factor, I will increase it to 1.2. OK?

So this is the Acceptance criteria that I will use. I want for the complete backtest for the whole time to have 98 minimum backtest quality, 400 Minimum count of trades, minimum Profit factor of 1.2, and a minimum Profit factor of 1.2 for the In Sample and for the Out of Sample part. Now going back to the reactor, I will not use the optimizer because I want to avoid having over-optimized strategies.

How to do Forex trading:Walk Forward validation is the key thing.

Below I have 3 robustness testing. One is the Walk Forward validation, which is a little bit advanced tool. And I have described it in details in the last course “The USDCAD” where I shared my top 10 USDCAD Expert Advisors.

And in this course, I want to make it a little bit simpler and easier for the beginner traders. But in a few words, the Walk Forward validation proves to us if the strategy is over-optimized. But here, I am using the Out of Sample, which is very similar.

And basically, Walk Forward validation, it uses Out of Sample. So when I am using Out of Sample I actually don’t use the Walk Forward validation. Now below is the Monte Carlo which I will use and I will tell you what is that.

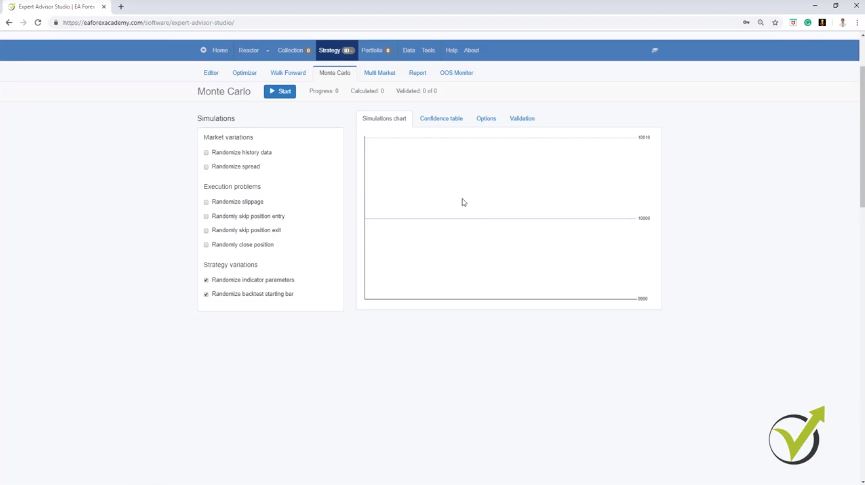

The Monte Carlo – the tool that tries to break the strategy

The Monte Carlo runs a variety of tests. By default, we have 20 tests and it’s just fine. And validated tests 80% which means that the strategy will be validated if 80% of the simulated tests are on profit. OK?

And here we have different simulations that we can run. For example, we can run simulations with randomized history data, with a randomized spread. So it will run simulations with higher or with a lower spread.

You can choose execution problems, Randomize slippage, Randomly skip positions, but I don’t have such problems with the broker. So normally I don’t test those. What I like to test are the last two, Strategy variations.

How to do Forex trading when we are testing the strategies?

I want to have simulations with randomized indicator parameters. So, for example, if I have the RSI indicator it will perform tests with RSI 9, 10, 11, 8, 7, 6. OK? Different variations for the parameters.

And I want to see that 80% out of the 20 tests, so this is 16 out of the 20 tests to be validated. And as well, I want to have a randomized backtest starting bar which will show us backtests with different backtest starting bar. Because we want to make sure that whenever we place this Expert Advisor, this strategy on the market it will still perform well and it’s not over-optimized exactly for the trading period.

And later when I have strategies in the generator, I will show you what exactly is the Monte Carlo. Below we have Multi Market validation which is pretty interesting as well. You can select how many markets you want this strategy to be profitable.

Multi Market validation test one and the same strategy on different markets

For example, if I add a few more, let me remove the APPL because it’s not a currency pair but if you have 1. 2, 3, 4, 5, 6, 7, for example, you can select that you want this strategy to be profitable at least on 4 markets out of the 7. OK? Or you can select 5 out of the 7 or 6 out of the 7, and you can add some more markets over here.

Now having the Multi Market validation is really great, but when we are generating strategies for 1 asset, in this case for GBPUSD, I concentrate on the GBPUSD. OK? Even if this strategy fails on some of the other markets, it doesn’t mean that this will be a losing strategy for the GBPUSD because every currency pair is a different market. OK?

So, for example, you can use this one if you want to trade some of the other markets as well or just as proof if this strategy will work on the other markets. And this time I will use only the Monte Carlo validation. So pretty much this is how I set up the reactor.

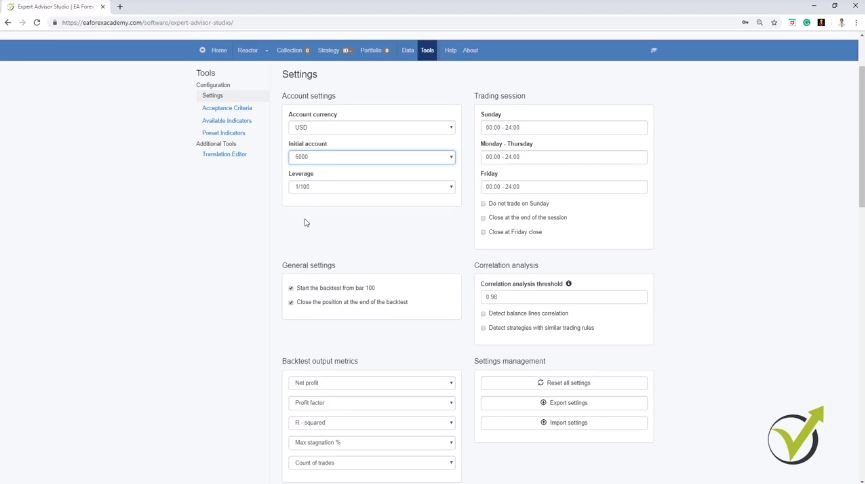

Setting your trading account.

Of course, I am testing all the time different Acceptance criteria to make it better and better. As well, after that when I update all of my courses I do my best to improve the performance and the backtests of all strategies. And the last thing before I run the reactor, I will go to Tools and I will go to Settings.

And here, you can set your trading account. You can change the account currency, the initial account. For example, I will make it 5000 as I selected the Demo account.

You can change the leverage if it’s different. It is good to make it the same as your trading account but even if you miss to do that it’s not really important. You will still get strategies into the collection.

Correlation analysis filters similar strategies

And you have some additional tools about the trading session when you want to trade. If you want to close at the end of the session, or to close the trades on Friday. Then you have the General settings, start the backtest from the 100 bar.

This is how Meta trader works. So you can see the very same backtest on Meta Trader and close the position at the end of the backtest. OK? Correlation analysis is pretty interesting. It detects balance lines correlation and it detects strategies with similar trading rules.

So, for example, if you have as an entry rule RSI 9, for example, rises or crosses the level line and then you have another strategy with RSI 10 with different parameter, OK? It will remove the second strategy that comes to the collection because it’s a strategy with similar trading rules. Alright? Now going to the reactor I will press on start.

How to do Forex trading with many strategies: Use the Reactor.

And again you can see how fast the calculator is and how many strategies are being calculated. And those of them that pass the Acceptance criteria will show over here and then they will go to the Monte Carlo validation. If they are validated with these simulations that I was talking about in the Monte Carlo, I will see the strategy into the collection.

Now you can see what is the difference when I run the reactor with Acceptance criteria, not like before when there were hundreds of strategies. And actually, in the collection, we always see the top 100 strategies that are being generated. OK? Now I will leave the reactor working for 600 minutes which is 10 hours.

And yes you might see this note here. The generator cannot find strategies. Possible reasons, too strict Acceptance criteria, cannot make enough profit, improper range of Stop Loss or improper arrange of Take Profit.

Separate EA Studio in a different browser to work faster.

And this is normal because my Acceptance criteria are strict but it’s not too strict because I have tested it already of course and it will show me strategies with the time. You might see a warning from the software that you might have made your Acceptance criteria too strict. Alright? So I will leave it now to run till tomorrow morning and what I will do at the same time, I will run another reactor on Experts Advisor Studio on M30 and H1 charts. OK?

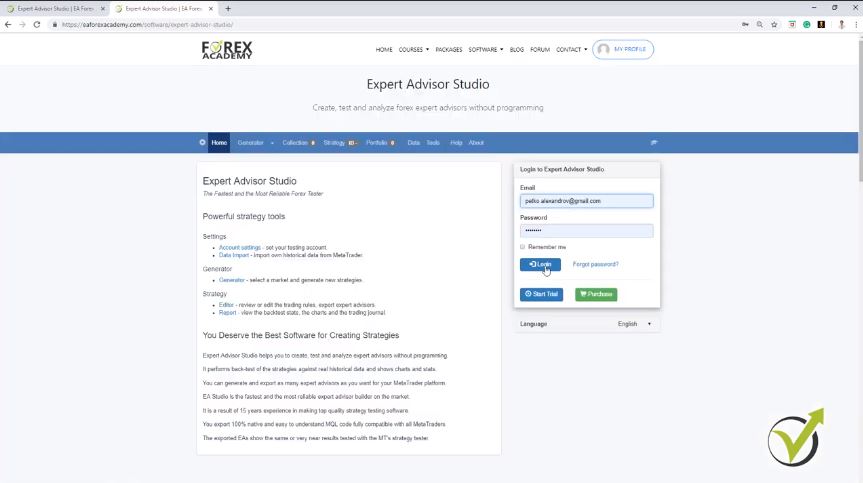

You can log in to your account and use it in a couple of browsers at the same time. You can register for 15 days free trial. So I will go to the reactor and the very same thing. I will just change M30 and I will have a quick look at the other settings. Normally they are saved so everything should be the same.

Yes, it is. And we have the Monte Carlo 80%, 20 test so it is just fine. OK? And in order to work faster, I just separate it in a different browser.

How to Forex trading with many strategies: use the Reactor on different browsers

And I press on start and you can see it is still working very fast. And I will do the very same thing one more time. But this time, I will do it for H1 chart. So here I will just log in and I will go to the reactor and I will switch to H1 chart. OK?

Same settings are there, 20% Out of Sample, the Acceptance criteria is the same. Just every time I would check if everything is fine and I click on Start and I will separate it actually in a different browser as well. So the 3 are working simultaneously. And after 10 hours I will have the first results.

Thank you very much for reading. I will continue tomorrow morning with the results that I will have from the three reactors.

If you want to get the 10 GBPUSD EAS you can enroll in the complete Forex Algorithmic trading course – Top 10 GBPUSD Expert Advisors.

Cheers.