The Reactor made EA Studio an Automated Trading Software

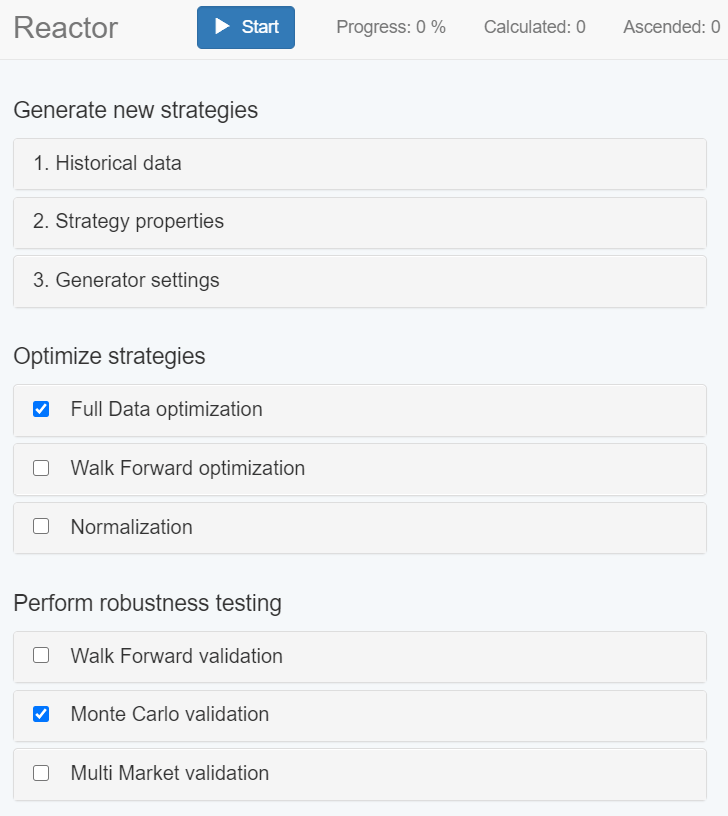

The Reactor is a Trading Software Automated tool, that the traders can use to generate, optimize, and validate strategies automatically. This is also called an “Automated Workflow” for creating trading strategies.

What is it included in the Reactor? It has a Generator and extra tools for optimizing and validating the created strategies.

For instance, each strategy that the Reactor generates will go through several Monte Carlo validation tests. When the strategy passes them, it goes to the Collection section.

If you set any other validation tools, it has to pass them successfully, too.

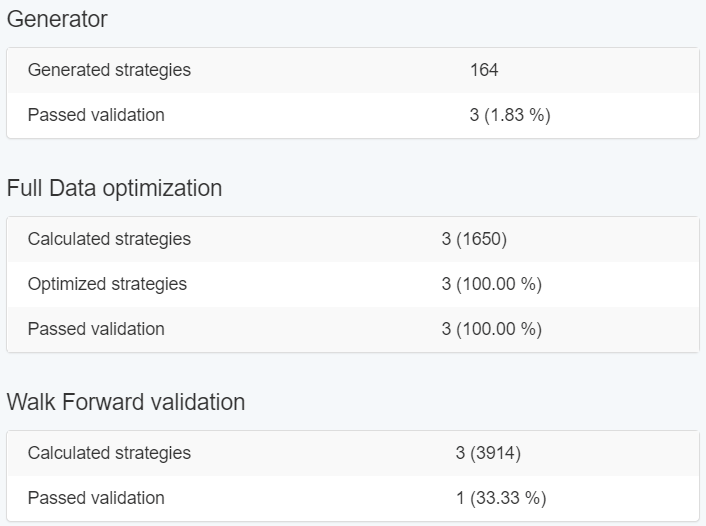

After you enable or disable any of the listed options, you will see their respective stats on the right side of the Reactor page. There are plenty of ways to utilize this amazingly powerful tool.

Let us have a closer look at how the Trading Software Atuomated Reactor operates:

- you set a goal, specific criteria and OOS, and after this, it generates strategies for you

- if you wish you can use different settings for the Generator to optimize the strategies

- in addition to this, the Reactor can validate the strategies using the Monte Carlo and the Multi-Market tools.

- only if the strategies go through the validations without any exception, then they appear in the Collection.

The most important task of the Reactor is to provide you with stable strategies that have passed all the tests.

You can leave the Reactor to run overnight and on the next day, the strategies will be waiting for you.

This is why we call the EA Studio to be a Trading Software Automated. It does the complete process from the beginning until the end.

Tools for Optimizing Strategies with the Trading Software Automated

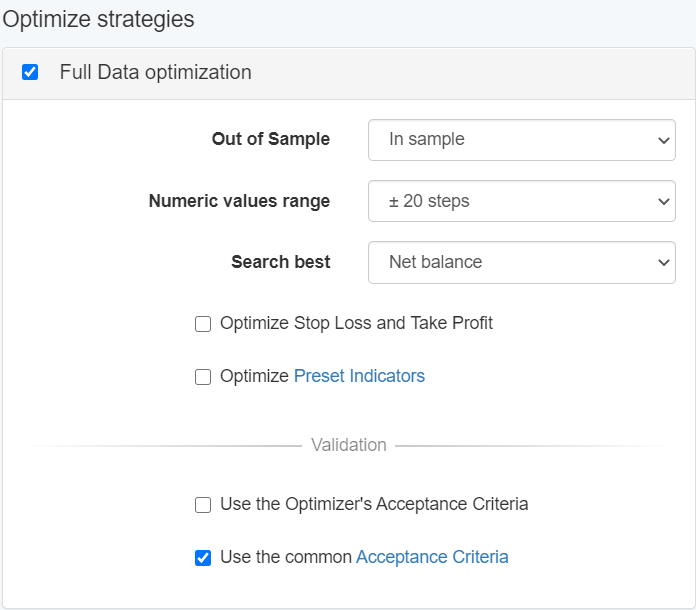

1. Full Data Optimization

By selecting the “Full Data Optimization”, every strategy of the Generator will be optimized by the Automated Workflow. This kind of optimization has separate settings and they differ from the main settings of the Generator.

When the optimization is completed, the best strategies are checked if they fulfill the Acceptance Criteria. In case all is well, the EA Studio will proceed with the next workflow tool.

If you haven’t set any additional tools, the strategy will go to the Collection and the Generator will start running. It will be more effective to leave the Generator to work for a longer time. The Trading Software Automated process gives us a chance to limit manual work.

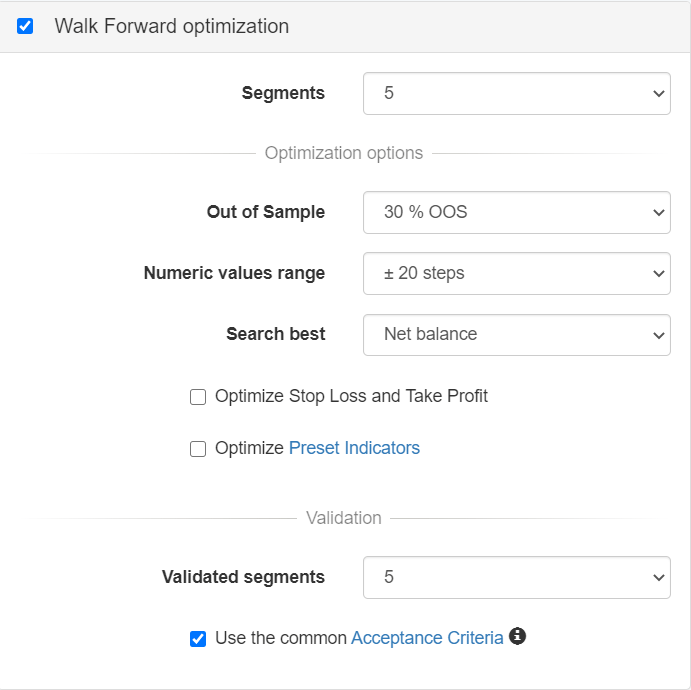

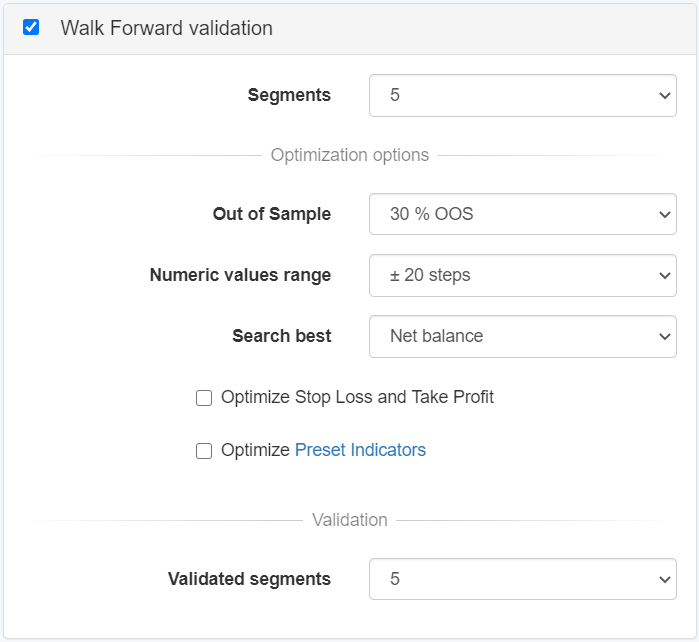

2. Walk Forward Optimization

Walk Forward represents a sequential optimization of the strategies. We use the following terms for it: Walk Forward Analysis (WFA) and Walk Forward Optimization (WFO).

We name this type of analysis “walk forward” because there is a moving window that gradually goes over the entire period of the data history with a pre-set step. Also, this process is done by the Trading Software Automated in 100%.

The Walk Forward tool that the traders use to minimize any over-optimized parameters in the strategies.

It is not important for the strategies to look perfect when we backtest them, but it is highly advisable to create systems that will work well in the live trading environment.

Over-optimized strategies can easily fail and this is not what traders want when they put their money on the table.

In case that the WFO results outperform the Full Data backtest results, then the strategy will obtain the better parameters for its optimization.

3. Normalization in the Trading Software Automated process.

The Normalizer is the most recent feature added to the EA Studio Trading Software Automated.

It allows the traders to simplify the trading strategies. It reduces the SL and pushes the parameters of all indicators closer to the default values.

Any changes are accepted, only if the results are better. The Normalizer doesn’t change the strategy, it just make it faster and easier.

Perform Robustness Testing

All the Robustness tolls do not change anything in the strategies. Even a single parameter.

1. Walk Forward Validation

The WFO tool will provide you with the strategies which have passed the validated segments without changing their initial parameters.

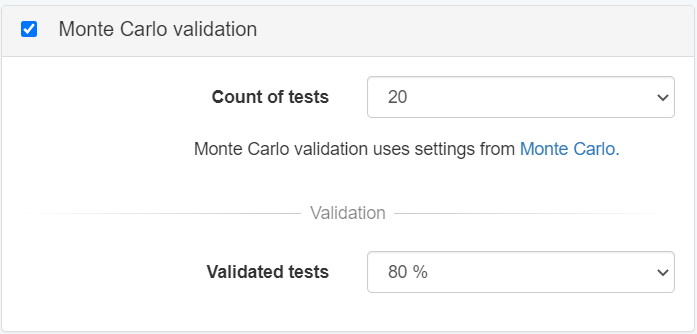

2. Monte Carlo Validation

The Monte Carlo tool executes a random test of the strategy and validates the output.

You can choose what percent rate to set for the tests on profit. As you can see from the provided example, the strategies have to be on a profit so that the app moves on to the next tool.

Monte Carlo is a must in the Trading Software Automated process. It is capable of testing the strategies with different indicator paramters, which proоves to us if the strategy is over optimized or not.

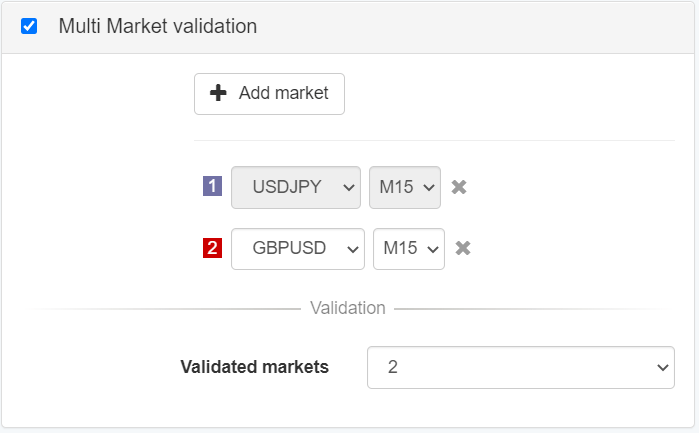

3. Multi-Market Validation

The purpose of the Multi-Market tool is to test the strategies against various markets. As validation criteria, you need to define the minimum count of tests that need to finish on a profit.

In this example, there are two markets, and the validation threshold is two. Therefore, if at least two tests finish on a profit, then strategies will be sent to the Collection section.

Tip for the Reactor/Validator

It is preferably to use just one of these tools:

- Full Data optimization

- Walk Forward optimization

- Walk Forward validation

If you choose all of them, this will make the criteria too strict and you might not see any strategies as a result of the complete Trading Software Automated process.