Home › Forums › EA Studio › EA Studio Tools and Settings › What Acceptence Criteria do you guys use?

Tagged: #acceptance criteria

- This topic has 191 replies, 45 voices, and was last updated 2 years, 1 month ago by

Petko Aleksandrov.

Petko Aleksandrov.

-

AuthorPosts

-

-

January 5, 2019 at 15:36 #8221

dommech

ParticipantI use 🙂

Maximum equity drawdown %: 10-15% (Depends on FX 10% or Crypto 15%)

Minumum Trades: 50

and Sometimes:

Maximum stagnation %: 30%

Minimum return / drawdown: 3

-

January 5, 2019 at 17:27 #8222

jacpin2002

Participant@dommech-Hey there! Good question. My acceptance criteria is:

Min count of trades: 10

Max equity drawdown%: 20

Min net profit: 10

Min backtest quality: 98

Min win/loss ratio: 70

Max stagnation%: 30

and sometimes Min profit per day: 1 *Of course this depends on the lot size being used for generation of strategies.

If I can’t get the generator to produce strategies with all of these requirements, then I just run it without acceptance criteria and use these as the performance filters. I use the criteria for all assets that I’m trading. After the the strategies are all created, I then do some additional analyzing to pick out the best strategies to use such as using the optimizer, turning on the stop loss or take profit, etc.

-

January 5, 2019 at 21:09 #8224

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Dommech,

something important from me here:

Min count of trades:50 is too small number. Specially in Forex you should go with min 300-400 count of trades.

Basically when the generator/reactor works it looks for combinations between different entry and exit conditions, indicators with different parameters etc., so when you have strategy with only 50 count of trades this might be not a stable strategy. We want to see bigger count of trades so we know that this combination of indicators, parameters, SL, TP and so on, works on more trades(longer period of time).

-

January 5, 2019 at 21:27 #8228

HaliffaParticipant

HaliffaParticipantI really like the win/loss ratio, but it is hard for me to get results on all pairs when I keep it on 70.

In the acceptance criteria for min count of trades, Petko is right, I even try to keep it above 600 trades.

-

January 5, 2019 at 21:52 #8232

dommech

ParticipantThx for the answers guys!

Some strategies with especially extremely low DD (0.5-2%) I’ve found that they are extremely rare.

My Backtesting data is over 3 years, always when using FX I’m thinking of adding it to 5 years, my thoughts are that market behavior changes and 3-5 years is enough? Or how do you guys think?

Usually I get 200 trades/strategy but if I set it higher I might miss the rare ones with the low DD

I understand that this affects the robustness of the strategy if it’s only 50 trades but the low DD makes me want to take the risk

Off Topic, but:

How far back do you guys go with FX, how many years or bars do you use to get enough statistic data?

-

-

January 5, 2019 at 21:37 #8231

jacpin2002

Participant@Petko and @Haliffa-Does the chart timeframe that we are using affect the count of trades? For instance, I can generate a lot more count of trades on the M15 chart vs. the H1 chart. But then again, I get into the issue of wanting that 70% winning performance and only getting a smaller count of trades. I wonder if this is the trade-off (higher winning percentage=smaller count of trades vs. lower winning percentage=larger count of trades).

Since I don’t want to give up on that winning percentage, I may be working with short-term strategies for quite a while.

-

January 6, 2019 at 1:37 #8236

jacpin2002

Participant@dommech-Yeah, I leave the generator more wide open and once it’s done or as I filter is when I get really picky about the strategies, just so I don’t miss those nice and very low DD strategies.

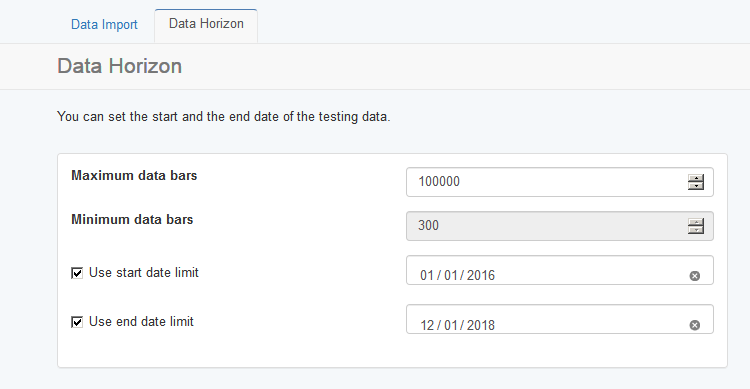

For FX, I am going back 5 years. Now that we are in 2019, I changed my data horizon to start at 1/1/2014. I do this because it gives me enough bars as I am trading H1 and M15 charts. For the lower timeframes, 200k bars should be good enough to get some good strategies.

-

January 6, 2019 at 12:02 #8244

dommech

Participant@jacpin thx sounds good, I go usually for M15 H1 and sometimes H4 but not lower

Will change to 5 years as well 🙂

I recently heard in one of Petko’s courses that instead of demo testing the files you could (optional!) Change the data horizon and leave 1 month out of the generator and later recalculate. this gives me even more confidence that the strategy is robust. I still put many EA’s on demo so exchange the bad ones

-

-

January 6, 2019 at 14:20 #8248

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Jacpin,

You are getting more count of trades on M15 probably because you have more data on it ( I guess you have the max for EA Stduo 200k there?).

So basically the more bars we have the more count of trades we can expect to see. Of course it depends how you set the generator/reactor, acceptance criteria, etc.

Just be careful if you use small count of trades and higher win/loss ratio, not to go in over-optimized strategies. Make sure that you do the Monte Carlo test and Demo testing (I know that you do demo).

-

January 6, 2019 at 14:33 #8249

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Dommech,

Glad to see you are working in more details. Yes, this method of removing the last one month is really great.

This way we see if the strategy was going to be profitable if we really traded with it. It saves a lot of time, and as you said, it gives confidence.

Both strategies look fine.

-

January 6, 2019 at 14:59 #8251

jacpin2002

Participant@Petko and Dommech-Can you let me know which course has this method to leave off the last month in the Data Horizon? I want to understand the steps on how to do this and see if it will really save me some time or provide me with more confidence in the strategies that I generate.

-

January 6, 2019 at 17:32 #8252

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Jacpin,

Glad to hear from you. I show that in the The Ethereum trading in 2018 + 99 Robots every month course, but I have it in my “to do” list where I want to dedicate a whole course about it. I will show different methods on how to avoid the Demo trading.

-

January 6, 2019 at 17:34 #8253

jacpin2002

Participant@Petko-You are awesome! If you can please do that I would be so grateful. Sometimes, the waiting for my EAs to pass demo is frustrating to me. But I don’t want to take unnecessary risks. 🙂 As soon as you have anything that shows how to avoid demo trading, then sign me up!!!

-

January 6, 2019 at 18:00 #8254

dommech

ParticipantI will use Demo as well but I will not Demo test my strategies before going live, I will still continue to demo test “backup strategies” if I need to switch out some of the ones. Testing this way on “Out-Data” work as well as demo testing. Markets change anyway so it’s not a guarantee that the strategy will work live if it did on demo.

I go with enough history data to feel confident + 80-90% Monte Carlo + the last step is the one month of “Out data” I don’t feel that I need more confirmations than that, this way really saves Weeks or even months so I’m willing to take the risks.

Hey, I’m compounding profits so lets start to compound time 😉

-

January 7, 2019 at 12:51 #8265

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterJacpin,

this is my job to test, trade, and find new methods which are faster. It is great that there are such softwares nowadays which allows us to be innovative.

-

January 7, 2019 at 12:53 #8266

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Dommech,

your method is just fine I think, very similar to what I do. Also, you are right that there is no guarantee, and I think I make this clear in all of my courses. We never know if a profitable EA will continue trade well. It is just the same as to know where EURUSD will go tomorrow.

But the thing is we wan to put more things on our side before trading, anyway we would be gambling, and you will never see me in the casino 🙂 No way!

-

January 10, 2019 at 11:54 #8350

Chingi

ParticipantHello,

I want to ask a question.

In one course I saw that in the acceptance criteria Petko uses the ambiguous bars, and I do not see those in the acceptance criteria.

-

January 10, 2019 at 16:02 #8355

jacpin2002

Participant@Chingi-EA Studio went through about 2 updates from the time I have been using it in the last 4 months. Petko is probably going to be updating that course or making a note about the software changes between the time the course was created and now. Instead of ambiguous bars, I use Minimum Backtest Quality and leave it at the default of 98%. Here is the information from the Help tab on EA Studio about this criteria:

-

January 10, 2019 at 22:38 #8357

Chingi

ParticipantHello Jacpin,

thank you very much for making that clear.

Actually Petko explains the same in the course about the ambiguous bars, but I was just thinking that this option is no more available.

So it is good to know it is there, just with different name.

-

January 11, 2019 at 13:56 #8371

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterThanks for answering the question, Jacpin!

Yes, Chingi, it is the same filter.

Cheers

-

January 11, 2019 at 15:20 #8378

Bob Smith

ParticipantI like to use it too! And if one is developing the EA by coding, will never know this option exists 🙂

-

January 13, 2019 at 10:40 #8423

AndiMember

AndiMemberI am used to place the max consecutive losses in the acceptance criteria.

I think it is great filter because this way we know how many negative trades to expect during the trading.

also if there are more during the demo trading, than I know it is over optimized Expert Advisor

-

January 14, 2019 at 0:17 #8445

RomanParticipant

RomanParticipantI’m currently testing from 2005 on the H1 for a few of my pairs (roughly 90k bars). I’ve been looking into using 20% OOS and then keeping the last 6 months of data in my back pocket as a final test after Monte Carlo. Today I just threw some GBPJPY strats on the demo account for testing, will let you know how it goes!

P.S. only 2 made it onto my demo account after 20 hours of scanning. Only the strategies that passed the 20% OOS and the 6 months visual check.

-

January 14, 2019 at 14:27 #8462

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHi Roman,

It is good that you test with the OOS and 6 months at the end. However, you are using huge period, so you can afford it.

Keep in mind that the more Historical data you have, the profit per day becomes smaller. That is why to look for this “golden middle” that will bring you you robust strategies with a nice profit.

-

January 15, 2019 at 23:38 #8489

Chris Eliot

ParticipantHey guys,

do you know that now it is available to use up to 500k bars in the Data in EA Studio. That is only for the licensed traders by the way.

Have someone tried that?

-

January 16, 2019 at 2:27 #8493

jacpin2002

Participant@Chris-I did not know that. That is a lot of bars. For H1, I think going back 5 years hasn’t even hit 200k bars yet for me. So, 500k…. that is a lot of bars. I wonder if that is more for the lower timeframes like M1 and M5 where 200k bars will only let you go back a couple of months. 500k might be able to give a full year on M1 or M5…or at least close to it. I’m gonna check it out.

-

January 16, 2019 at 9:03 #8496

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello,

this increase of the Historical bars is still in test, and I am not sure if it will last.

Anyway, if you want to test it, you need to change the number from the Data Horizon.

There are many updates now in EA Studio, and more are coming up.

So what I will do is to open a new topic in the forum, where I will post videos with every update. This way everyone will keep it up with the updates, and I will explain them in details, because in the help of EA Studio they are written but not really explained.

-

February 9, 2019 at 10:31 #9513

Maria Leona

ParticipantHi all,

I wish to know if someone has a strict system when generating strategies with EA Studio or FSB pro about the acceptance criteria?

What I have learned from Petko is to reduce the acceptance criteria if I can not get any strategies and to increase it if I am generating too many.

The thing is that with every asset it is different. I mean if I found good acceptance criteria for EURUSD, this does not work on GBPJPY for example. So I had to lower the acceptance criteria there.

Any suggestions on that?

-

February 10, 2019 at 3:49 #9534

jacpin2002

Participant@Maria-Hi there! I know what you are talking about. I did have to change the acceptance criteria in order to generate strategies, but then I would use the performance filers in the collection with the same acceptance criteria I would have normally use to get the strategies I want. That was the only around that issue that I found.

-

February 10, 2019 at 14:35 #9544

AndiMember

AndiMemberHi Maria,

better to generate more strategies and than filter them in the Collection.

The generator shows different and unique strategies all the time, so you really can not predict what it will show in 100%.

That is why you better give it a little bit more space, and than you just filter the strategies you want to have using the filters in the collection.

-

February 11, 2019 at 23:31 #9582

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Maria,

one thing to keep in mind here is that the brokers offer a different number of Historical data bars with different assets.

Have a look at your data, and you will see that for EURUSD you will have more bars that for AUDUSD for example.

This difference could change the performance of the generator when using the same acceptance criteria which is logical.

Now when you get used with the EA Studio and you generate daily strategies you will know what acceptance criteria to place for any asset quickly.

Not a bad idea to make an excel table where you place the currency pairs with the acceptance criteria and the values that worked best the last time.

So when you run a generator for any asset you can have a quick look at it, and see the latest acceptance criteria that you used. It will save you time.

-

February 12, 2019 at 9:46 #9591

Maria Leona

ParticipantHello Jacpin,

I get your point. So you just generate strategies with fewer criteria and than you make it strict with the filter in Collections.

Now, I am concentrated a lot on the new feature R – squared and I think I am trying to make my strategies with too good equity lines which is not exactly what I should be doing 🙂

-

February 12, 2019 at 9:47 #9592

Maria Leona

ParticipantHey Andi,

this is exactly what I am planning to do. I think jacpin said the same. Just generate with not so much strict criteria and then make it strict from the filters in the collection.

Petko is doing the same in his courses, so I do not know why I lost a couple of days to struggle with that.

-

February 12, 2019 at 9:51 #9593

Maria Leona

ParticipantHey Petko,

Your idea is just great. I am getting on work to start building such a table.

You are right that it will save me time just because of generating strategies for the same currency pairs will be easier.

With the time I will just make the acceptance criteria stricter.

-

February 13, 2019 at 20:45 #9621

HaliffaParticipant

HaliffaParticipantHello traders,

I think it will be great if in this topic everyone shares what acceptance criteria one uses. This was we will have an idea what to test as acceptance criteria because obviously running a generator without good strategies at the end is what we do not want to have.

So here I will start:

Currently, I use:

Profit Factor 1.2

R – squared – 70

Min count of trades 500

Stagnation in % – 15%

-

February 14, 2019 at 23:59 #9647

DesitaParticipant

DesitaParticipantHere are my Acceptance criteria at the moment for the Forex pairs:

R – squared – 80

Min count of trades 450

Max consecutive losses 10

Backtest quality – 98

-

February 17, 2019 at 10:45 #9721

Viktor Isaak

ParticipantHere is what I use in the acceptance criteria:

Minimum bars in trade – 30%

Min profit factor – 1.2

Min months on profit – 80%

May I ask what is the R – squared? I see that you both use it?

-

February 17, 2019 at 23:41 #9741

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Viktor,

The R-squared is an update we have with EA Studio. It helps us generate strategies with better equity lines.

I have opened a topic in the Forum called EA Studio Updates – have a look at it, there is video and more details about R-squared.

-

February 18, 2019 at 22:47 #9755

DesitaParticipant

DesitaParticipantR – squared is great improvement, I think it improved a lot the generator because it chooses more stable strategies

-

February 20, 2019 at 3:51 #9779

RomanParticipant

RomanParticipantMin Trades:200

R-Squared:75

OOS Stability:70% -

February 20, 2019 at 9:28 #9784

AndiMember

AndiMemberAfter the video of Petko, I am planning to start using the OOS. It seems like really nice and useful. SImply, we do not use the whole period that we have but we use chosen % of Historical data. After that, we see the results that would have happened in the last months. And with the update int he acceptance criteria, we get only the good strategies.

-

February 20, 2019 at 9:30 #9785

AndiMember

AndiMemberAnyway here is what I use:

Min count of trades 450

Profit factor 1.2

Max consecutive losses 7

Backtesting quality 99%

-

February 20, 2019 at 10:02 #9790

Petko AleksandrovParticipant

Petko AleksandrovParticipantHey Andi, you go it right, with the update of EA Studio acceptance criteria we can filter the separate sectors as In Sample and Out of Sample. That allows us to generate strategies that perform robustness tests as Multi Market and Monte Carlo in the In Sample part and in the same time those that pass the validation criteria in Out Of Sample part.

-

February 20, 2019 at 21:04 #9811

RomanParticipant

RomanParticipantHola Andi! I’ve always used OOS, I was testing another software at the same time as FSB in 2017. With the search style they use OOS is very important. With it I still keep some of my data in my back pocket (about 3-6 months) just to really simulate and confirm simulated trading. This ensures at least for me the strategy has some strength I can depend on. Doing my method I may only find 1-5 strategies a day, but it helps me feel more secure with them. Even though we are testing on demo first, this keeps my demo free of clutter. Saves me time, space, and emotional excitement lol.

-

February 21, 2019 at 17:42 #9832

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Roman,

you are very right here, OOS is very important, but once again the update now changed it a lot. We have the chance to choose acceptance criteria for the In Sample and for the Out Of Sample. Before it was for the complete backtest.

Personally, before the update, I did not use a lot the OOS. Simply because we were choosing the acceptance criteria for the complete backtest. So no matter what was OOS showing we were able to decide which strategy to use based on the whole test. Now we have it separately. This way we can choose what criteria to have in the generated part(In Sample), and what Training part(Out of Sample) to choose.

With simple words, now we really have the chance to simulate Demo trading with OOS.

-

March 8, 2019 at 0:01 #10390

AndiMember

AndiMemberAs said I tested the OOS, and it worked just really great for me. The strategies are stable, they pass the robustness tests, and now I am on a nice profit on the Demo account, so I am sure that most of the EAs will go to my live trading portfolio.

Thanks, Petko! You really improve the systems and share with us! You are the man!

-

March 9, 2019 at 12:02 #10424

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Andi,

I am glad to hear that my videos improved your Experts trading.

I follow along all updated with EA Studio and test them when I find the method that works the best for me, I will always share it.

Anyway, OOS is great to be combined with the acceptance criteria.

-

March 13, 2019 at 8:09 #10518

Stephen

ParticipantIs there any correlation between the Minimum count of trades and Monte Carlo?

-

March 14, 2019 at 9:21 #10545

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Stephen, I can say there is. The more count of trades a strategy has, the more chances you have to pass the Monte Carlo.

Simply, if you have a small count of trades, you are getting closer to over-optimized strategy. The more trades a strategy has, the more robust it is. The strategy was tested more times in the past, and there is a higher chance to continue profit.

-

March 16, 2019 at 22:09 #10613

Stephen

ParticipantHey,Pekto!

Thanks for the answer. I was guessing that the more count of trades we have, the better.

I saw that the strategies having more count of trades pass the Monte Carlo.

However, I think that EA Studio is capable to find great strategies, and especially if we succeed to filter them well.

Thanks for your help as always!

-

March 16, 2019 at 23:05 #10614

RomanParticipant

RomanParticipant@Petko – Sorry for the delayed response. Yes I really do treasure the OOS, especially the acceptance criteria control of both in and out of sample is extremely useful! Finally got my new computer yesterday which is why I’ve been radio silent. Looking forward to cranking out more strats!

-

March 17, 2019 at 9:38 #10618

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Roman,

Glad to hear from you again. Yes, the new acceptance criteria really changed the usage of OOS. Before that, I was not using it…

-

March 20, 2019 at 10:55 #10656

Thapelo

ParticipantGuys, when you use the win/loss ration what value are you looking for in the acceptance criteria as a minimum?

-

March 20, 2019 at 15:08 #10662

jacpin2002

Participant@Thapelo-I’m using 0.70 as my minimum in the acceptance criteria and only under the complete test part.

-

March 22, 2019 at 22:51 #10712

DesitaParticipant

DesitaParticipantHey Jacpin,

you do not use the OOS at all? How is the win loss ratio calculaed? Isn’t it the profit divided by loss?

-

March 23, 2019 at 21:37 #10723

Bart Meijrink

ParticipantI think it is calculated when you sum the Winner trades and the losers trades, and then divide by the winners…not 100% actually.

-

March 25, 2019 at 16:56 #10790

AndiMember

AndiMemberHey guys, it does not really mean how it is calculated. I know that it is a ratio between winning trades and losing trades 🙂

But if your SL and TP are different(and they are) this will mean that these criteria could be misleading.

For example, if you have SL 2 times bigger then the TP, it will mean that one negative trade will equal to 2 positive trades. And it will be different for any strategy…

-

March 25, 2019 at 18:48 #10798

Ossaio

ParticipantGood point Andi, I observed that my win/loss ratio is only high (>0.75) when SL is very close to or bigger than TP. Sometimes, those strategies with SL 2 times bigger than TP can give very nice equity line but it will require a lot of wins to recover one negative trade.

-

March 25, 2019 at 19:46 #10802

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey guys, that is why I use more the profit factor. It is not connected to the number of profitable trades and losing trades but to the results itself. At the end of the day, the important is the results, not the number of trades.

-

March 28, 2019 at 7:08 #10847

AndiMember

AndiMemberHey Ossaio,

yes, this is true as Petko confirms. It is nice to use the win/loss ratio but it is better if you combine it with some other criteria.

-

March 29, 2019 at 6:57 #10861

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterFor sure, Andi. We always need to combine different criteria.

Now, when trading on the live account, you can use one strict rule/criteria to follow the trading on the live.

I think Jacpin was using exactly the Win/loss to monitor the EAs on the live which makes a lot of sense.

-

March 29, 2019 at 15:23 #10896

jacpin2002

Participant@Desita-Sorry, it took so long for me to reply. I was having issues logging in and for some reason, the forum wasn’t allowing me to respond. But now I can. I use the win/loss ratio as 0.70 (meaning 7 out of 10 trades are winners) I only will accept 3 losses out of 10 trades. This is just my conservative way of trading. But after watching Petko’s courses on the updates, I now use the win/loss ratio of 0.70 for the complete backtest as well as a minimum count of trades. I use the OOS just the way Petko shows us as well as the R-squared for optimization. After doing this, my strategies have become so much better.

@Petko-You’re absolutely right. I still do. It is a lot easier for me to analyze an EA results in FX Blue Live with just monitoring the win/loss vs, anything else.

Hope everyone else is doing well and happy trading! My commodities are on a roll lately and my forex pairs with GBP and JPY are doing fantastic this month!

-

March 29, 2019 at 19:27 #10905

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Jacpin,

Glad to hear that the recent videos that I recorded improved your strategies with the OOS and the R-Squared.

I think your system to manage the live account with win/loss ratio of 0.70 is just great. Keep up the good work!

-

March 31, 2019 at 10:38 #10952

DesitaParticipant

DesitaParticipantHey Jacpin,

thank you very much for the replay. Your system is really nice. I will give it a try during the next month. It makes a lot of sense really.

And what is your system to test the EAs on Demo, or you do not? Do you only use the system of Petko for OOS?

-

March 31, 2019 at 18:18 #10959

jacpin2002

Participant@Desita-Hey there! I honestly tried to get out testing on Demo and only using Petko’s system of the OOS, but I just couldn’t confidently let it go. I guess this may be considered overly cautious, but I really don’t like waste time or money. So I do a combination of both.

I generate the strategies using my broker’s live historical data and include the updated criteria that Petko showed using the R-squared and 30% OOS. I then take these strategies and run them through the MT strategy tester (since I am using MT5, it might be a bit different for those on MT4). I analyze the last 10 trades to see if the win/loss is still at 70% or above.

For example..strategy generated and ran through tester shows a total count of trades to be 125. I go back to trade 110 (not 115) to analyze and see if 70% win/loss performance is maintained. From there I check the win/loss performance of trades 120-125. Lets say it is 4-1 in winning trades at this time. I then put this EA in demo for the next 5 trades to complete another 10 trade analysis. If it maintains losing more than 2 trades out of the next 5 trades, then this has maintained the 70% winning performance and passed demo testing. Potentially this is an EA that I could start live trading. There are other factors I look at as well before immediately putting them on, like profit factor, # of pips moved, etc.

Let’s take this same scenario and have it start off as a losing strategy, for instance it is sitting at 2-3 in winning trades. This means that it cannot have any more losses out of the next 5 trades to pass my demo criteria. Sometimes they pass and sometimes they don’t. But I have found that being this strict has helped me to avoid some major catastrophes.

Hope this helps.

-

April 3, 2019 at 12:35 #10996

DesitaParticipant

DesitaParticipantHello Desita!

Thank you so much for making this so clear. I see that you are very strict in your testing which is absolutely respectful.

I like that you look at the recent trades. I also do. I avoid placing EAs which equity line goes down at the end after the generation. But it is not really strict and precise to look at the chart. Probably the number of trades is the better solution.

Anyway, I watched many times the OOS update from Petko and it is just great. I am sorry that I did not use it so far.

-

April 6, 2019 at 12:22 #11062

HaliffaParticipant

HaliffaParticipantJacpin, so nice of you to share your experience here!

My acceptance criteria on live account are 1.2 profit factor, but I see that you are doing deeper analysis which is more professional.

-

April 6, 2019 at 21:50 #11072

jacpin2002

Participant@Desita-I did the same thing..not looking at strategies where the equity line is going down after generation. But since I am generating fewer strategies, I start to look at these and keep them in mind because it may be just going into its losing phase and will come back in winning later on. I agree, I am really mad at myself for not using OOS sooner.

@Haliffa-Thanks for the compliment! I would say that this is me being very conservative, but not overly cautious. If I became overly cautious as well, then none of my EAs would ever go live! LOL.

-

April 7, 2019 at 9:25 #11077

DesitaParticipant

DesitaParticipantHello Jacpin, yes Petko mentions that at one of the recent courses that it is important to place the EA on live when it is on its winning phase. It makes so much sense.

I always feel like: “OK, that’s it! I know what I have to do now!” and then something new comes up, something I did not think about or I missed 🙂

-

April 8, 2019 at 21:29 #11101

Rose

ParticipantHey Jacpin,

Nice to see you writing in the Forum, it is great to learn from your experience. I have built a similar system to yours but I want to test well before I share. 🙂

-

April 10, 2019 at 8:12 #11122

HaliffaParticipant

HaliffaParticipantHello Jacpin, you are right! If we go too cautious, we better stop trading Forex. 🙂

But as Petko says, we should be confident and not brave in trading.

-

April 14, 2019 at 10:16 #11246

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello guys,

Quite interesting topic here. The thing is that really everyone is different. Different risk tolerance, different capital to trade, and different targets.

The best is to test it all on a Demo, and see where you will feel comfortable.

-

April 23, 2019 at 0:06 #11423

trade1234321

ParticipantHello,

I am Laila, a new trader to the forum. I want to ask if someone succeeded to get strategies from the generator if using all Acceptance criteria?

-

April 23, 2019 at 14:25 #11437

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Laila,

Welcome to the Forum! If you mean using all Acceptance Criteria at the same time, you won’t probably get any strategies. Normally we use 2 to 5 different criteria and it is already too strict.

Also, it is important to have good Historical data.

-

April 26, 2019 at 4:00 #11585

RomanParticipant

RomanParticipantHi Laila,

I use only 2 acceptance criteria at the moment in “training” and OOS. My reactor settings are pretty strict though, i like to see a very strong Monte Carlo. This test for me is the most important. But again this is my personal style. You’ll find what you like to see with time. It’s taken me 4 months of live trading to gain 30% in my account. September of last year is when i finally got serious about developing my strategies the way i’m comfortable. If you see Jac’s criteria he likes to see 70% win ratio, this for me means large stops with tight TP in my experience so far. Not something I’m comfortable with. I’d rather see at least 1-1 ratio between SL and TP, and as long as the win rate is above 40% I’m happy. Give it time, and patience. You’ll want to throw your computer from time to time when you get back to the generators and see nothing in the collection. If I knew what i know now in December 2017, I would have focused on learning my reactor style sooner.

-

April 28, 2019 at 19:27 #11648

trade1234321

ParticipantHello Petko,

After a couple of your courses, I realized that it’s not the idea to use all of them but few. Also, it depends on what value we will set.

I spend reading the forum(great and very positive), watching the courses and practicing. I have a much better idea of how to use the two software.

-

April 28, 2019 at 19:33 #11649

trade1234321

ParticipantHello Roman,

thank you very much for the information and for sharing your experience. I am sure it will take me time, and I am quite serious in trading for the last few years so I hope I will be in tune with the software in the next 1-2 months.

I am just exploring the OOS function(Petko’s videos about it are awesome). It is very hard for me to twist my trading style but I see that this is the right path and I am confidents I am in the right place.

It is very motivating to hear you made this profit. It is a very good profit for 4 months!!! Some professional traders I know, fellows of mine, aim at 20% per year. Of course, they trade with huge accounts.

As soon as I see what works for me, I will share it in details.

Regards,

Laila

-

April 30, 2019 at 4:33 #11669

RomanParticipant

RomanParticipantHi Laila,

I began as a manual trader as well, but as Popov once said in a post on the main forum for FSB “This is a different way to trade”. When I first started using the software I rushed into throwing EA’s live without really testing them on demo first. Now i know what to look for in order to do that, but when i started i blew an account just as fast as i funded it. OOS is something I pay Very close attention to, and I keep a little bit of data in my back pocket to truly verify the OOS in EA Studio. I’m currently working on learning FSB so you’ll see me asking a lot of questions in the FSB thread as well. To make that profit I’ve also had to endure two major drawdowns with my errors (i started a thread on this). I rushed strategies onto the live account at full demo size and a single loss on two occasions (the last one was a legit accident due to me being half asleep) put me in a 50% dd the first time, and the second was about 3 weeks ago and it took out all my previous gains and then some. Luckily last week was a REALLY good trading week and i made it all back with some EA’s i had put live on GJ and EU.

-

April 30, 2019 at 4:40 #11670

RomanParticipant

RomanParticipantIn thinking about it, my account would be up around 60% since the beginning of 2019 if not for my last error. Was about to hit the 30% mark before coming home from a 12 hour day and putting a strategy full blast on the account. It’s still a profitable strat, but now it’s at about 3% account risk instead of the “Full Nelly” that took out my previous profits. I’m enjoying algo trading much more than i did as a discretionary trader. I still stalk the markets on the daily like i’m used to, but enjoying my trades getting triggered while chasing people around for my day job lol

-

April 30, 2019 at 10:01 #11681

AndiMember

AndiMemberHey Roman, may I ask what was your error you did, because I did not understand, sorry fr that. Just knowing each other mistakes would be so useful. Thanks!

-

May 1, 2019 at 1:03 #11694

RomanParticipant

RomanParticipantHola Andi,

I’ve been trading using a smaller live account to really get a grasp on how to track the demo EA’s (and practice doing this consistently every day) then make sure the live account continues to grow. What I ended up doing twice is putting my full demo size on my live account dragging myself into a 50% drawdown the first time. And the second time I had come home from a long day of driving (I’m a territory sales rep) and placed an EA live without adjusting the position size. Erasing all my previous gains of about 32% bringing be back down to break even. This was about a month ago so I’ve just recently recovered it due to having more EA’s on the live account now than I did at that time.

Silly mistakes, but cost a lot of time and aggravation. So had to remind myself to slowdown again.

-

May 1, 2019 at 10:53 #11697

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Roman, you should be very careful when placing new EAs in the account. Make sure when you generate them in EA Studio or FSB pro to use the lots that you are planning to trade with. This way you will not need to change or adjust when placing on the live or demo account.

-

May 1, 2019 at 18:53 #11719

jacpin2002

ParticipantHey everyone! Just wanted to post an update of the Acceptance Criteria that I am using after having implemented the OOS from watching Petko’s videos:

Complete backtest-Minimum win/loss ratio-0.7In Sample (training) part-Minimum net profit-100 and Minimum r-squared-65

Out of Sample (trading) part-Same as In Sample

Doing well with this. 🙂

-

May 1, 2019 at 21:52 #11728

Stephen

ParticipantHey Jacpin, the Minimum net profit is if you trade with 0.1 or? It depends on the lots…

-

May 1, 2019 at 23:21 #11738

jacpin2002

Participant@Stephen-Yes, this is with trading at 0.1 lots. I always generate my strategies with trading at 0.1 lots. I will then just increase the lot size during live trading when I feel my account balance is high enough to handle the risk.

-

May 2, 2019 at 1:56 #11752

RomanParticipant

RomanParticipantJacpin thanks for the update, are you using 30% OOS? I’ve been mainly using 20%.

-

May 2, 2019 at 2:11 #11755

jacpin2002

Participant@Roman-Yup, I’m using the 30% and it has made such a great, huge difference in the strategies that I am generating for the better. I just copied what Petko had in his videos and went with that. Thank goodness for Petko.

-

May 2, 2019 at 8:20 #11760

HaliffaParticipant

HaliffaParticipantI stay with 20% OOS, I am not sure if there is a huge difference between 20% and 30%…maybe if the data is smaller it is good to use 20%. Anyway, we would have too small data to generate the EAs.

-

May 2, 2019 at 8:28 #11761

HaliffaParticipant

HaliffaParticipantAnd yes, good we have Petko! He changes my trading it total. First I realized from the Forum that I was scammed last year, then I learned how to trade by myself and not to depend on anyone, and now he keeps improving my trading with all updates and new courses.

-

May 2, 2019 at 13:54 #11791

RomanParticipant

RomanParticipant@Haliffa – Agreed, Petko is a huge asset!

I personally like the 20% OOS, it simulates the most recent market conditions (I mainly trade H1) so for me 20% is about a year and a half worth of data. Then i verify the OOS with the most current 6 months of data that I’ve kept with Data Horizon. It’s all about personal preference 🙂

-

May 3, 2019 at 11:45 #11831

HaliffaParticipant

HaliffaParticipantHello Roman,

yes indeed it is a personal choice but the great thing with OOS is exactly that we are able to test the EAs on the recent months. And it happens automatically with the Reactor which is really awesome!

-

May 10, 2019 at 0:31 #12218

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello, guys, recently we had an update with the EA Studio which combines the OOS and the Walk forward. I will do my best to record a video about it until the end of the week.

-

May 10, 2019 at 3:24 #12221

jacpin2002

Participant@Petko-I can’t wait. Another way to make better strategies generate??? I’m here for it!!!

-

May 10, 2019 at 9:31 #12223

Tina

ParticipantMe too, every time I am excited to see updates and new videos.

-

May 11, 2019 at 10:20 #12276

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Jacpin,

yes, today I will record the video and launch it till Sunday.

Kind regards,

-

May 12, 2019 at 9:27 #12342

Violet

ParticipantHello Jacpin, what else do you use when you generate the EAs or just win/loss 0.7?

-

May 13, 2019 at 4:02 #12351

jacpin2002

Participant@Violet-Hi there! Here is the updated Acceptance Criteria that I use based on Petko’s latest video:

Complete Backtest:

Min. profit factor-1.1

Minimum r-squared-70In Sample (training) part:

Minimum r-squared-50

Out of Sample (trading) part:

Minimum r-squared-50

After the strategies are generated, I then filter their performance based on the win/loss, # of trades, etc.

I hope this helps. Happy trading!

-

May 13, 2019 at 10:18 #12353

Violet

ParticipantHello Jacpin,

thank you very much for sharing. Yes, I saw that videos but I tried generating with the win/loss of 0.7 and I did not get any strategies. Now it makes sense to me.

I saw that you follow the results, and you keep the EA if it makes 7 of 10 profitable, right? What is the SL is higher than the TP. If we have 7 profitable with small TP and 3 negative with bigger SL, isn’t that going to be a losing EA?

-

May 13, 2019 at 18:05 #12362

jacpin2002

Participant@Violet-Yes, I keep the EA if it makes 7 out of 10 trades. I follow the performance using FX Blue Live and it has helped tremendously. I usually do a check twice a day on the performance of the robots-once in the morning and once in the evening.

Yes, you’re right. It would be a losing EA with a higher SL than TP. Those EAs that I have that are like that are trading at over 90% accuracy. So, I am usually a good 15-20 wins in before a SL occurs. But as soon as it does look like it is just wiping profits, then it is time to take them off.

-

May 14, 2019 at 7:43 #12369

Violet

Participant@jacpin2002 – thanks for sharing all of that. It sounds you already know your system and you know what you are doing and what you need to do. That is lovely. One last question 🙂 How long time normally one EA stays on a live account with this management of 7 out of 10?

-

May 14, 2019 at 17:51 #12388

jacpin2002

Participant@Violet-I only started live trading in October 2018, so I am just 6 months in. However, I can say that my current EAs are lasting about 3-4 months staying in profit for right now. But I am constantly running EA Studio as with updates and Petko’s videos, I am generating better EAs all the time that are lasting longer and with tighter performance, meaning the SL is closer to the TP.

-

May 15, 2019 at 2:35 #12389

RomanParticipant

RomanParticipant@Jacpin – I’m very happy to hear your results! You always give me hope LOL. Trying to get my stats to improve, so far the best strategy i have is one Petko released in one of his courses back in September last year :/. Very curious though, with such performance you’ve been getting what’s kind of tp and sl range are you using in the generators?

-

May 15, 2019 at 3:50 #12391

jacpin2002

Participant@Roman-Hey there! I’m glad my experience is helping you out. I wanted to make sure I share both my ups and downs, so that other traders know that they are not alone in what they experience. I keep the TP and SL range for the generator as follows: Forex (SL 10-100 pips Fixed or Trailing and TP 10-100-both are set to Always use) Commodities (SL 1-10 pips Fixed or Trailing and TP 1-10 pips-both are set to Always use). Hope this helps.

*The only thing I am struggling with is to have a range of SL and TP for the cryptocurrencies. I want to be able to keep it to Always use, but I’m having trouble finding the range. @Petko-Could you please help me with this? Maybe you can provide some guidance on what range could work for Bitcoin, Ethereum, and Ripple? I did notice that range may differ amongst these three as they all move differently in the relative amount of pips.

-

May 15, 2019 at 17:15 #12396

Violet

ParticipantHello Jacpin,

I succeed to create EAs so far that last for no more than 5 weeks. So I guess this is the thing we need to look for – longer successful performance. This way the longer the EAs last, the less work we will do. At the end of the day, this is why we are at Expert Advisors 🙂 And what do you mean by tighter performance? Why are you looking for SL closer to the TP?

-

May 15, 2019 at 17:48 #12397

jacpin2002

Participant@Violet-Having the SL closer to the TP is what I mean by tighter performance. I like the SL being close to the TP because with a 70% winning performance, my EA will only take 1 or 2 trades to make up the loss instead of 4 or 5. And yes, always be on the lookout for longer successful performance. My two EAs that have been the most successful and longest running performance are for GBPUSD and gold. 🙂 Hope this helps.

-

May 15, 2019 at 19:25 #12399

Violet

ParticipantJacpin, you are so kind to share all of that. Thanks a lot! I am sure you are in help to many that read but afraid to ask 🙂

I have started using gold too and I am happy with the results so far 🙂

-

May 15, 2019 at 20:07 #12400

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Jacpin,

It is indeed hard to set the range for the cryptocurrencies. This is because the recent months the Bitcoin and the others were staying in a range without huge volatility. During this time when I was generating EAs, I was looking for smaller TP because if I place a huge range, the generator will look at the whole Historical Data. This will include the data from 2017 and 2018 when the bigger TP worked better and Take Profit of 200$ was taken a few times during the day. This was the time when I recorded the two courses for the Bitcoin Never Losing Forumala.

Anyway, now there is some volatility again, so I have increased again the ranges. Also, I am testing now the cryptocurrencies with the update with the Walk Forward Optimization. I have described it in the recent update called EA Studio updates: Walk Forward optimization.

This way we take the last parameters which are best for the recent period of data. And this is very suitable for the cryptocurrencies which have different volatility all the time.

Hope that helps.

-

June 5, 2019 at 23:58 #13061

leon.reddy

ParticipantHey Petko,

Thank you for the video, I have missed it somehow. I am on the halfway now but it looks like a really interesting one.

-

June 8, 2019 at 10:37 #13223

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Leon, just keep an eye on the EA Studio Updates topic. Whenever there is a major update in EA Studio I record a video about it.

Actually, there are updates in EA Studio all the time but most are inside the code of the software which improves the speed of the generator and other features.

-

June 24, 2019 at 17:36 #14572

Deniza

ParticipantAlright, so there are updates all the time as far as I get it. But not on the interface. And I guess, you make updates only on the things that we see, or some extra features? Thanks for your work, Petko! I really enjoy watching the courses and using the EA Studio and FSB Pro.

-

July 1, 2019 at 8:30 #14943

Sharapova Sisi

ParticipantHello all, do you use different acceptance criteria for the different time frames or not? At least with the different time frames, we have a different number of bars, right? Does this mean that we need to require a different count of trades?

-

July 1, 2019 at 15:34 #14963

centcelParticipant

centcelParticipantHello guys, it also happens to you that the Acceptance Criteria is not accepted by the Reactor all the time until it has led you to despair? Everyone is responsible for generating their own EAs. I wanted to know how you behave. Do you have an example of Exel tables where you have the whole in overview? Can you take a few screenshots to show your Acceptance Criteria values? This would make it easier for me and for many of you who are still at the start.

-

July 2, 2019 at 9:27 #15030

AndiMember

AndiMemberHello Centcel,

the best thing to do is to start with small criteria, not strict. With the time when you collect more bars, you will be able to increase it. For example, try to make stricter the criteria every new month. Increase the Number of Trades from 300 to 320, 340..every new month. Because with every new month you will have more bars. It worked for me before…

What I do now is to create many EAs, and after that filter them in the collection. Not looking so much to make it strict.

-

July 6, 2019 at 22:06 #15485

Sharapova Sisi

ParticipantHello Centcel,

I think you have bad Historical data. I had this issue at the beginning. You won’t get any decent strategies before you collect many bars. Focus on the small time frames because there the data collect faster.

-

July 9, 2019 at 16:12 #15717

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Centcel,

the guys have you good answers. The problem is with the data obviously.

What you can do is to use the MetaTrader-Demo data that is in EA Studio. It has many bars. You will be able to create good strategies. As you see in most of my courses I use exactly this data. Also, it updates automatically.

-

July 22, 2019 at 8:28 #16618

AndiMember

AndiMemberPetko, do you use the same criteria in the Acceptance criteria when you generate the EA and the additional filter in the collection? Does it make sense to filter the EAs in the collection with different criteria or better use the same?

Thanks!

-

August 16, 2019 at 0:10 #18093

riuzk

ParticipantHello friends,

Are there any Risk/reward ratio in the Acceptance criteria on Ea Studio

Thanks

-

August 16, 2019 at 7:04 #18109

HaliffaParticipant

HaliffaParticipantAs far as I know, there are the Win/loss and Return/drawdown.

How should be risk/reward calculated? How much you are risking vs how much you profit. This means the loss (this is what we risk) vs the profit (this is what we benefit). If this is the case this is the win/loss or the profit factor which is the gross loss/gross profit.

-

August 16, 2019 at 10:58 #18125

riuzk

ParticipantHello Haliffa,

Reason why i was asking about risk/reward ratio is because many of the strategys i get, often has bigger SL than TP but has great Profit Factor according to EA studio. But i wanted to aim more for example: risk 10$ to make 20$, which criteria should i focus on then?

-

August 19, 2019 at 11:57 #18341

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Riuzk,

I understand your question. EA Studio taught me not to look for a smaller SL than the TP. This is an old trading rule that was never proved to me.

Anyway. if you want to have that, just put in the range for SL and TP when you are generating the EAs.

For example, place a range for the SL 10-15 and for TP 30-45.

Kind regards,

-

August 19, 2019 at 15:43 #18349

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterOne of the old trading rules says that your Take Profit should be 3 times bigger than the Stop Loss. After I tested 100s and even 1000s of strategies with EAs I realized that this is not the reality. I have so many profitable EAs where the SL is bigger than the TP.

Also, with EA Studio and the Experts, we test with precise statistics, something not available at manual trading at all.

Of course, there are strategies that work with SL smaller than the TP but not the majority.

And as I mentioned in some of the courses, if you ignore everything but think just about the price. When you open a trade and you place a SL smaller than the TP, you have a bigger chance of hitting the SL first. Higher possibility.

-

August 19, 2019 at 15:44 #18350

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterAnd I just did not see prove along the years that the SL should be 3 times smaller than the TP… 🙂

-

August 21, 2019 at 17:05 #18463

riuzk

ParticipantThanks Petko for you explanation, im guessing you focus more on profit factor with counts of trades.

Many of my running EA’s has bigger SL than TP, but i see sometimes my EA studio find a strategy that have SL on 150 pip and TP 10 pip, these are some strategy i tend to ignore. Because sometimes i have 15 winning trades in a row and 1 loss that takes you back to breakeven. What kind of experience do you have with these strategy Pekto?

-

August 22, 2019 at 21:59 #18525

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterI normally avoid those as well. There were traders sharing in the forum that they profit with such strategies. I think it was for the Gold…

Anyway, if the strategy passes the Monte Carlo and it is not over-optimized for such SL or TP I think it worths trying it.

Ye, recently I use a bit more the profit factor, but give it a try, use different things, experiment. This is the way that you will find your trading style.

-

September 7, 2019 at 8:24 #20695

AndiMember

AndiMemberJust an update to this topic: I started using more the consecutive losses acceptance criteria. I went down to 5 and the strategies I get are really awesome. I use it as well to remove the EAs from my live account. If they make more than 5 consecutive losses, I remove them.

And it makes a lot of sense because if we create an EA following one thing when this thing is broken or comes not true, it means the strategy was over-optimized for that criteria. Correct me if I am wrong Petko.

-

September 14, 2019 at 17:37 #21598

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Andi,

Glad to hear from you. I would not correct you because I use the very same thing with some of my accounts.

Let’s make it clearer to the beginner traders what is consecutive losses in Forex trading. This is how many losing trades in a row we have when generating a strategy or backtesting one.

Now, when Andi says that he uses 5 consecutive losses, it means that he aims at strategies that have no more than 5 trades losing in a row.

So yes, it makes sense to keep the same rules when generating strategies and when trading on a Demo to filter the EAs for live. The consecutive losses in Forex strategies are quite interesting and easy to follow when trading as well.

-

September 17, 2019 at 9:56 #21745

Meryjonestexas

ParticipantHow to follow the consecutive losses in Forex trading with the EAs? I am not sure if I see that in FX Blue?

-

September 18, 2019 at 11:16 #21800

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Mery,

yes, you can not see exactly the consecutive losses in FX Blue, you can see the winner and the losers there. So one of the things you can do is to keep an eye when you have 10 trades and see how many of those were the losers. Let’s say you want to have win/loss ration of 0.7, this will mean that you can allow just 3 losers. After that, you can restart it when the strategy goes to 10-20 trades. Or you can restart at every 5 trades.

The other thing you can do is to bring back the strategy in EA Studio and from Data horizon you can set as a start the date when you started trading with the EA. And you will have a detailed statistic for the strategy. Basically, you can import 10 EAs, update the Historical data and see how they go, what stats you have, but just make sure to set the start date.

The consecutive losses in Forex are just an example for that, you can do it with the profit factor, the r-squared, max stagnation and so on…

-

September 25, 2019 at 11:53 #22322

Meryjonestexas

ParticipantHey Petko,

thanks for making this clearer. I got it now. I am surprised that in FX blue there are no so many statistics as within EA Studio. It’s a statistical website and EA Studio shows you more about the strategies… 🙂

Anyway, I wish there was such a feature in EA Studio where we can track the performance of the Experts and we would not need to use the external website.

-

September 26, 2019 at 7:03 #22394

traderaw19Participant

traderaw19ParticipantHi Meryjonestexas,

I see some columns in FX Blue about consecutive losses and winners. They’re all the way to the right on the stats page, so they’re kind of hidden.

Is this what you’re looking for?

-

September 27, 2019 at 11:04 #22474

Meryjonestexas

ParticipantHey Traderaw,

thanks indeed! Yes, I see now that there are consecutive losses and profits.

I am thinking of a new system to place the EAs trading on the live account. If I generate EAs with consecutive losses 7, for example, I would then keep the EAs in the live account until there are 7 consecutive losses. If this happens I would remove the EAs from the live account.

How does this sound?

-

September 28, 2019 at 11:39 #22542

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterVery good point here! In my mind was that Mary was asking about the win/loss ratio! Thanks for the clarification traderaw19!

Mary, I am not really sure about that system…

let’s say you have selected to use 7 consecutive losses. In your real trading you might have the case to hit on 4-5 consecutive losses than 1 winner, and then again 4-5 consecutive losses and 1 winner. And this could continue for some time and it will be within your criteria but you will have losses…

-

October 1, 2019 at 10:19 #22942

Jay-r Yuzon

ParticipantHi everyone. I’m new to algo trading and to this forum. Just wanted to know your thoughts regarding this subject. Thanks

Since the common acceptance criteria can be found under the generator (generator settings), and also under optimization (whether full data, walk forward, and normalization), what is the best way to make use of the common acceptance criteria?

Should we use it while generating strategies, or during optimization? Or both?

What are the advantages or disadvantages in using one method over the other?

-

October 3, 2019 at 9:47 #23050

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Jay-R,

Very good question here, but it is from those questions that have no precise answers.

However, I will explain to you what is the logic.

If you use the common acceptance criteria in the generator, all the strategies will be filtered there(this is what I do).

If you want to use the optimizer, it is recommendable to use the common acceptance criteria again. Because the strategies that will come from the generator fitting the acceptance criteria but the optimizer can change that. Normally it should change them in a better way and improve Profit Factor, Consecutive losses and so on, but might lower the number of trades.

Anyway using the Monte Carlo is a must after the generator.

Have a look at the Normalizer, it is quite interesting. I will upload an update video about it.

Cheers,

-

October 7, 2019 at 15:57 #23417

Jay-r Yuzon

ParticipantThanks for elaborating on the logic Petko.

For the Monte Carlo, I did notice in your courses that you use it frequently.

And yes, I’m looking forward to your updates on the Normalizer.

Cheers

-

-

October 7, 2019 at 16:47 #23425

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Jay-R,

I will do my best to record those updates tomorrow.

And yes, I use the Monte Carlo all the time. It is the strongest robustness tool for me.

-

October 19, 2019 at 23:56 #24158

Stephen

ParticipantHi Petko,

I’ve been using Monte Carlo and I also think it’s a very nice robustness tool. Are the updates you spoke about ready yet?

-

October 21, 2019 at 12:16 #24240

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Stephen,

Glad to hear from you. Yes, it is recorded, just the team is editing it.

Tomorrow it will be uploaded on YouTube, and I will inform you in the EA Studio Updates topic.

-

October 26, 2019 at 15:58 #24947

johnbrown7

ParticipantHi everyone. I see the term Acceptance criteria is a vast combination of features. When choosing the Acceptance criteria, how do you know what and what not to combine for you to get the expected outcome?

-

December 24, 2019 at 10:31 #32199

Thapelo

ParticipantHey John,

The best practice is to start with wide acceptance criteria. For example, use just Min count of trades 300 and a profit factor of 1.2.

Or you can use just consecutive losses in Forex which means that the strategies you want to trade must not have more than 7 consecutive losses, for example.

When you get many strategies in the collection, like over 100, you can add some more criteria

-

February 5, 2020 at 17:10 #36771

AndiMember

AndiMemberSomething I wanted to share. Actually Petko said that long ago but I did not realize it. Now I see it is 100% true.

The more count of trades the strategy has, the Monte Carlo passes with more validated tests. This means that we have more robust strategies.

So basically the most important Acceptance criteria is a profitable strategy with many count of trades. With some currencies and time frames I get over 1000 without a problem, and with other 500 is the level. But at the end of the day, I get better strategies for any asset.

-

February 8, 2020 at 10:24 #36968

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterYes, Andi!

Simply with the strategies with more count of trades the entry conditions happened many times in the past. This is what makes them robust.

-

February 14, 2020 at 17:04 #38092

Augustine

ParticipantMy Acceptance Criteria

Balance line Stability 85 and minimum count of trades

It always gives me R-squared greater than 90 and very good profit factor.

It is a new update I believe, you should all give it a try.

By the way, this is my first post, you all have been helpful here. I will try to share one of my results.

-

February 14, 2020 at 17:10 #38093

jenialyinvest

Participantsodekeaugustine3 do you use out of sample…and any robustness tests?

-

February 14, 2020 at 17:21 #38094

Augustine

ParticipantI use full data optimization and Monte Carlo validation(robustness test) in the reactor.

I use OOS Monitor for the Out of sample.

Balance Stability is a performance metric develop to be as a combination of R-Squared, correlation and better scaling for a strategy

Eastudio guide, under acceptable criteria

-

February 14, 2020 at 17:35 #38096

jenialyinvest

ParticipantIs the oos monitor truly out of sample? Or us it just showing in sample?? Not sure how it works?

-

February 14, 2020 at 19:11 #38102

Augustine

ParticipantYes jenialyinvest

I do use 30% OOS for my full data optimization but the green part won’t show in the collection, so I have to check OOS Monitor for the OOS.

This way it is the same out of sample you are talking about.

-

February 14, 2020 at 19:28 #38104

Augustine

ParticipantOh,

I just check well,it isn’t the same thing, that is why I used 30% OOS in my full data optimization settings.

What the OOS MOnitor does is that ,it divides the result into 3parts: in sample,out sample and complete backtest in respective of whether you use OOS in your reactor or not.

-

February 19, 2020 at 11:13 #38795

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterGreat discussion here, guys. Keep up the good work!

-

March 10, 2020 at 10:03 #41200

AndiMember

AndiMemberHello guys,

something that I figured out recently and I wanted to share.

I use the OOS when generating the strategies with the reactor, and after that, I filter the strategies with the min count of trades.

This way, when generating strategies, I am already testing the EAs for the last 20% of the data(simulating the Demo account) and when I filter them with the min count of trades basically I get the robust strategies.

Plus the Monte Carlo is there of course. This way I feel much more comfortable…but it took me nearly 2 years to realize what should I be using for my self.

Yes, I know Petko showed that in some of the courses, but maybe I was not ready to accept it 🙂

-

March 17, 2020 at 0:56 #41967

Luis Getino

ParticipantHello,

I’ve been using EA Studio since the beginning of the year, and I took most of the courses. The reactor here works most of the time daily and I have tested many combinations of acceptance criteria and timeframes and I played a lot with data horizons to simulate trading after the out of sample period.

I am not using normalization, it doesn’t seem to have much impact on the robustness of the strategies,

I am not using walk forward too, because 20% OOS with the minimum profit factor 1.2 or 1.1 seems to work better to generate robust strategies. Also this way I have the chance to delete strategies that have 1.1 OOS profit factor but are loosing recently or have huge stagnation.

I like to use minimum R Squared 70 and maximum consecutive losses 10, but what Andi said is really really important. There is a huge difference in miminum 300 trades or minimum 500 trades. The strategies with 300 to 500 trades are much less robust even if they passed Monte Carlo test.

-

March 17, 2020 at 23:02 #41985

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Luis,

You are doing an excellent job! It is all about testing and trading with the EAs.

EA Studio, in the beginning, was much simpler without Walk Forward, Normalizer, and other tools. With time, many were added, which makes it a bit more confusing and time-consuming for the traders to find their method of generating strategies.

About the number of trades, that is absolutely correct.

-

May 9, 2020 at 15:27 #47476

ivonemisters

ParticipantHello guys,

I am new in the Forum and trading, so I want to ask you what acceptance criteria is?

Sorry if this question is stupid, but it is hard for me because I am a beginner trader!

Have a great day!

-

May 12, 2020 at 23:31 #47710

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Ivone,

the Acceptance criteria are the rules that we want our strategies to fulfill.

For example, when we run the generator to show us new strategies, we can set acceptance criteria with Profit Factor 1.2.

This means that we will see strategies that have higher PF.

Cheers.

-

May 16, 2020 at 15:13 #47809

ivonemisters

ParticipantThank you for the answer, Petko!

Cheers!

-

May 30, 2020 at 22:35 #49592

Van

ParticipantHey guys,

A quite interesting topic that should not fall down in the Forum.

I see that using the right Acceptance criteria is what gives us the start.

Recently I started to use the Min Count of Trades + R-squared. I think robustness and a nice balance line works great because it just makes sense…

-

June 6, 2020 at 20:39 #50401

Faraz Fazlet

MemberHi Guys,

I have used a very lenient acceptance criteria such as 90% backtest quality, minimum trades 100 and profit factor 1.1 (also for in-sample and OOS).

I realised once the strategy count in the collection area reached 100, the rest of the strategies are getting moved to “Pruned Excessive Strategies”. It looks like there is a limit of a maximum of 100 strategies per portfolio. Not sure though.

Is there anyway I can get these Pruned Strategies back to my collection so I can filter them manually?

Please advise. Thank you.

-

June 7, 2020 at 14:30 #50412

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Faraz,

yes, in the collection you will always the top 100 strategies. You can not see the rest. Anyway, you can set on the side additional acceptance criteria, and while the Reactor is working you can filter the EAs so it won’t reach 100 by using your extra criteria.

If you want to have just more strategies than 100, you will need to download the collection when it reaches 100, and delete the strategies so you will collect the new ones.

By the way, you use a very small value for count of trades. Go for 300 as a minimum.

Cheers,

-

June 7, 2020 at 20:13 #50444

Faraz Fazlet

MemberHi Petko,

Thank you for the advice. I will follow the same accordingly.

Have a nice weekend.

-

June 8, 2020 at 16:02 #50497

Faraz Fazlet

MemberHi Petko,

As shown in your courses, I tried to open 2-4 windows of EA Studio to calculate many strategies at once. However, the speed significantly reduces, which you have told as well.

Is this speed something relating to my computer, internet connection speed or is it related to the server of EA Studio?

I have a VPS connection with Contabo with 60GB Ram, 1Tb SSD and 1000mb/s Bandwith. Yesterday I ran just one strategy window for 600 mins and it was able to calculate more than 5 Million strategies within this time period compared to 4 windows which was able to calculate only around 250,000 strategies within a 600 min timeframe.

However, I did another one strategy window today and it was only able to calculate around 350,000 strategies within the 600 min timeframe.

I am starting to think that the speed is not related to my Computer or Internet Connection, it maybe the EA Studio server.

Please correct me if I am wrong and do you have any other suggestion to increase the speed of the calculations, as I feel the specifications of my VPS mentioned above is pretty good.

Any of the group members who can contribute to this? Please do.

Thank you very much.

-

June 9, 2020 at 14:49 #50514

Meryjonestexas

ParticipantHey Faraz,

It looks like you have a very powerful VPS!!! Are you using it just for trading?

If you have something else in there which uses the RAM(even you have a lot) this might slow down the process.

EA Studio runs on a server and on the browser at the same time. Make sure you use Chrome.

-

June 9, 2020 at 16:09 #50516

Faraz Fazlet

MemberHi Mery,

I have a separate VPS setup for trading only. This one I use it solely for EA Studio only. So yes as you mentioned, it is a powerful VPS and I’m only running 01 EA Studio session at the moment and nothing else. The speed is still very low. For a 10 hour session, its generating only around 250k-300k strategies and yes I’m using Chrome as well.

Initially it was generating around 5 million strategies every 10 hours, thats why I’m a bit confused on what happened now.

I’ve checked the RAM as well, this is the only program thats running. Feeling that its the EA Studio server that is slow.

Generally how many strategies does your EA Studio generate in a 10 hours timeframe?

-

June 9, 2020 at 19:24 #50518

JordyTr971Participant

JordyTr971ParticipantIts strange, EA Studio is more slower than before and it use many CPU like FSB .

Im sure its wasn’t like that few month ago .

-

June 10, 2020 at 11:02 #50523

JordyTr971Participant

JordyTr971ParticipantIt work good now, was a problem of my PC I think .

When do you consider you’re acceptance criteria as too tight ?

More than 10000 strategy calculated without any of them passed validation ?

-

June 13, 2020 at 0:10 #50900

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey guys,

I have been using EA Studio every single day, and I don’t see any issues with the speed.

Faraz, keep in mind that when EA Studio is loaded, it does not have anything to do with the server. It works just on the browser.

It works as it is on your computer.

It might calculate fewer strategies on the lower time frames because you have more bars. On the higher time frames, it will calculate millions. Of course, it depends on the acceptance criteria which will pass.

The logic is simple – the more bars you have the more calculations it does. It is a lot of mathematical formulas behind the generator… The more values there are (bars) the fewer strategies will be calculated.

-

June 14, 2020 at 8:06 #50907

Faraz Fazlet

MemberHi Petko,

Yes, you’re absolutely right. I just opened 2 browsers and ran an M1 and a D1 reactor for 24 hours. At the end of the day, the M1 reactor had calculated around 500,000 strategies and the D1 had calculated more than 11 million.

So yes, now it makes sense. Thanks for clearing it up Petko.

-

June 14, 2020 at 12:37 #50909

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterSure, let me know if there is anything else.

Cheers,

-

June 14, 2020 at 19:14 #50913

pebenitodm

MemberHello,

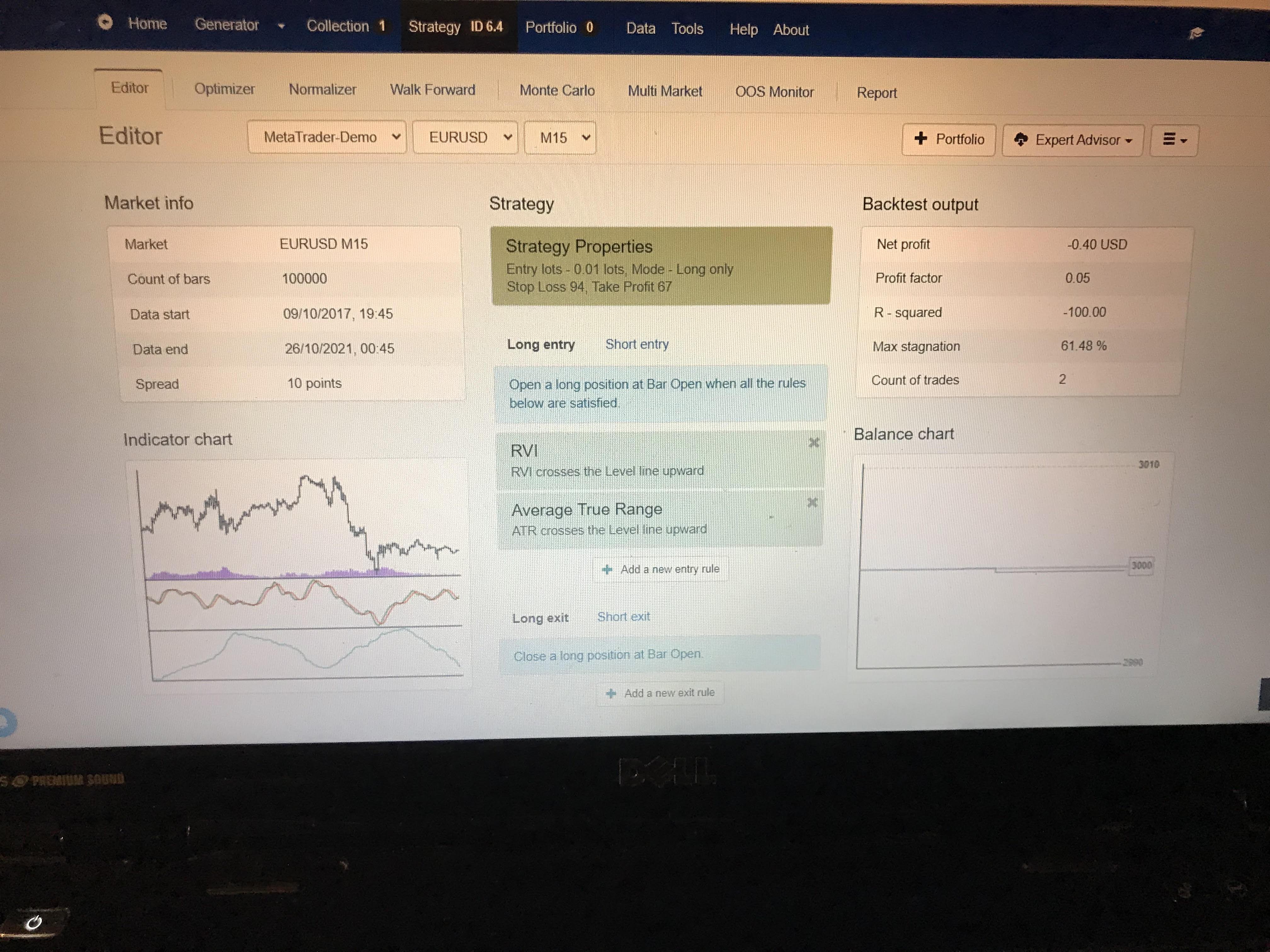

This is my acceptance criteria. But I am looking forward for some feedback. I’m pretty new to EA studio (4months).

COMPLETE BACKTEST:

min back test quality: 98

min r-squared: 60

min count of trades: 200

min stag %: 30

min equity dd %: 20

min prof factor: 1.2

IN-SAMPLE:

min prof fact: 1.2

min r-squared: 60

min backtest qual: 98

OOS

min prof fact: 1.2

min r-squared: 60

min backtest qual: 98

I been focusing on GBPUSD: 15M AND H1.

This are my settings on my acceptance criteria and validation and looking for some feed backs:

Running on Reactor:

Data Horizon – 02/01/2018 to 06/11/2020 (14,706 bars) data source from FS DUKAS

S/L: 50-100(ALWAYS USE/FIXED)

TP: 10-50(ALWAYS USE)

GENERATOR SETTINGS:

OOS: 30% ( GEN STRATS W/ PRESETS and USE COMMON ACCPT CRIT)

WFO SETTINGS:

SEGMENTS: 5

OOS 30%

+- 10 STEPS

OPT PRESET IND

VALID SEG 5

MONTE-CARLO SETTING:

20 @80%

default settings for validation (im looking to change this, but i just cant think of a good setting for validation)

I hope this info help some people build a basic..

lately I have been messing around min count trades on acceptance criteria and sometimes I use it to filter and or sometime use a lower min count trade.

Im really looking forward for some feedback to improve my validations/acceptance criteria for reactors/wfo

-

June 15, 2020 at 22:56 #51134

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello, and welcome to the Forum!

I think you are doing a pretty good job and you realize what you are doing.

However, the min count of trades are small, you need to keep at least 300 as a min.

If you tried and you fail to get any strategies it is because you have a small number of bars?

If you use the Free Forex Historical Data app, there are more bars, why would you use less than 15k?

Also, you may want to try generating EAs not just for the GBPUSD because this will bring you more diversification.

Cheers,

-

July 12, 2020 at 11:36 #53584

johnbrown7

ParticipantWhat I recently use for my acceptance criteria is:

PF > 1.4

A number of trades 700.

I noticed that if I use Walk Forward Optimization in the Reactor it finds more strategies with bigger Count of Trades.

Did anyone notice that? It works great by the way!

-

August 15, 2020 at 10:22 #57050

Bart Meijrink

ParticipantI have noticed the same. I guess because it divides the backtest period into zones, and in each one, it requires min count of trades.

However, what I wanted to share recently is that I use more and more the R-squared and the tests show that if I generate EAs with above 80 as a value, the strategies perform pretty well after that.

-

August 15, 2020 at 22:45 #57266

jbcdk

ParticipantHi johnbrown7,

When you use number of trades 700, how many bars do you then have in your data set?

-

August 19, 2020 at 13:55 #57528

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterRecently I noticed that we don’t need to have too many bars to get more count of bars. With the default 50 000, you can still get 300 to 500 count of trades.

And this way we get more active strategies. That is what I Explain in the upcoming trading course.

-

September 29, 2020 at 22:14 #61736

AndiMember

AndiMemberHello Petko!

I realized what you said in this last post after watching the course 🙂 Amazing!