In this article, I will show you how to use the FX Blue Publisher for MT4 to identify which are the top-performing trading robots while trading with portfolio EAs. Moreover, I will make a brief review of the FX Blue website, which is a website where we can follow the statistics for our trading accounts.

Table of Contents:

Getting Started with FX Blue

The good thing is that once your MetaTrader account is linked, all the Forex statistics update automatically.

This is a free lecture from my Top 10 NZDUSD EAs course, And you will learn how I use the FX Blue website to analyze the trading results from the Experts I include in this course.

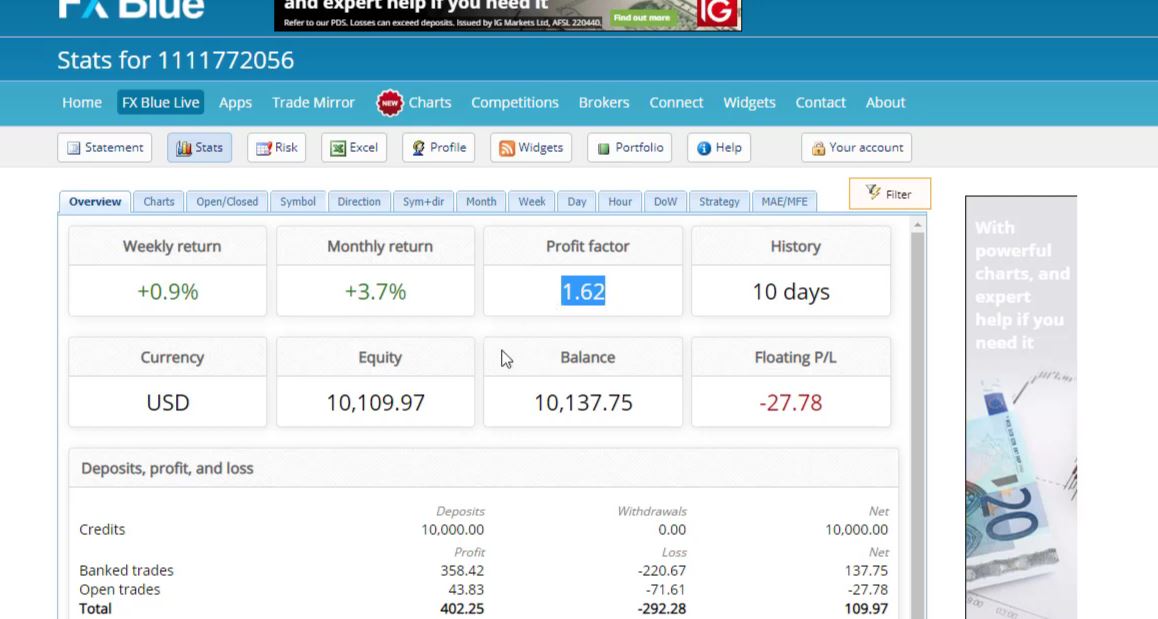

Below you can see an overview of the account and you can follow the performance. But keep in mind that this overview is based on the performance that we have so far. In our case, we have 10 days of trading.

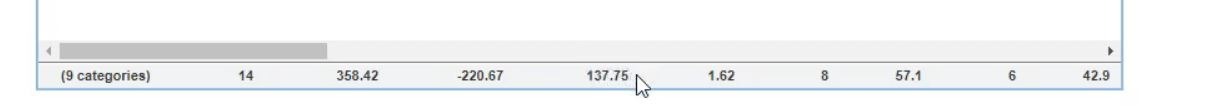

A true monthly return will be available when 1 month passes. Since the example below is just for 10 days, this is not enough to have a reliable monthly return. So the monthly return is based on the performance we have so far. And then we have the Profit factor which is 1.62 in this example.

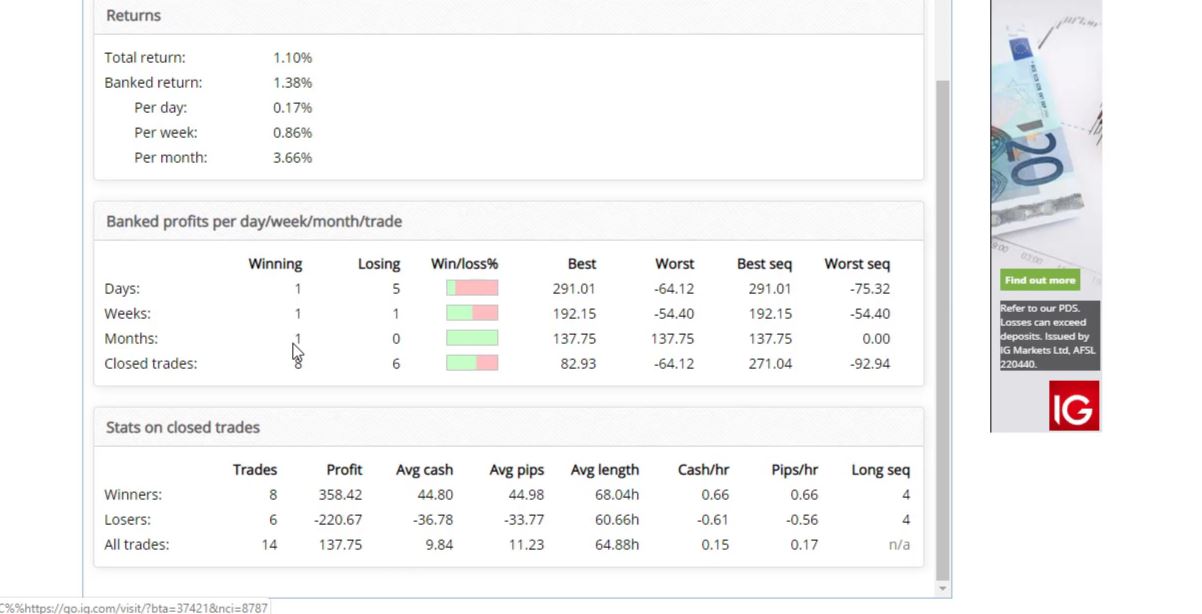

And what more we have on this FX Blue website is the balance and the equity. As well, we have the returns, total return per day, per week, per month.

One more time, this Forex statistics is based on the performance so far. Other statistics that are available are results in days, weeks, months, which is too early to look at that.

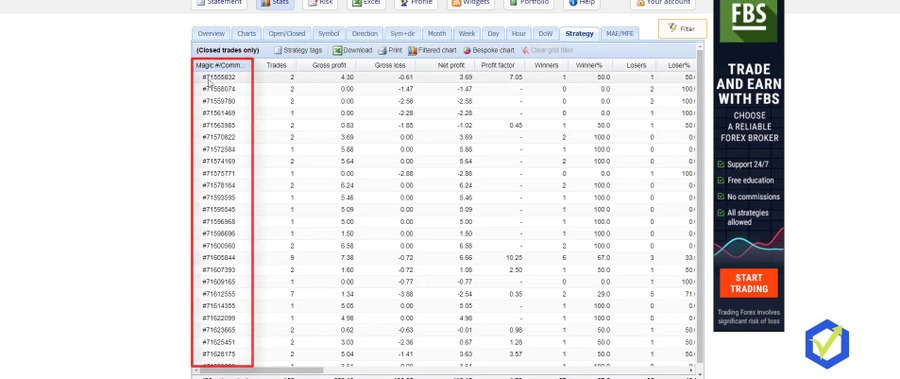

And as well the winners, the losers, all trades and so on. Now, what I look at the most is the strategy.

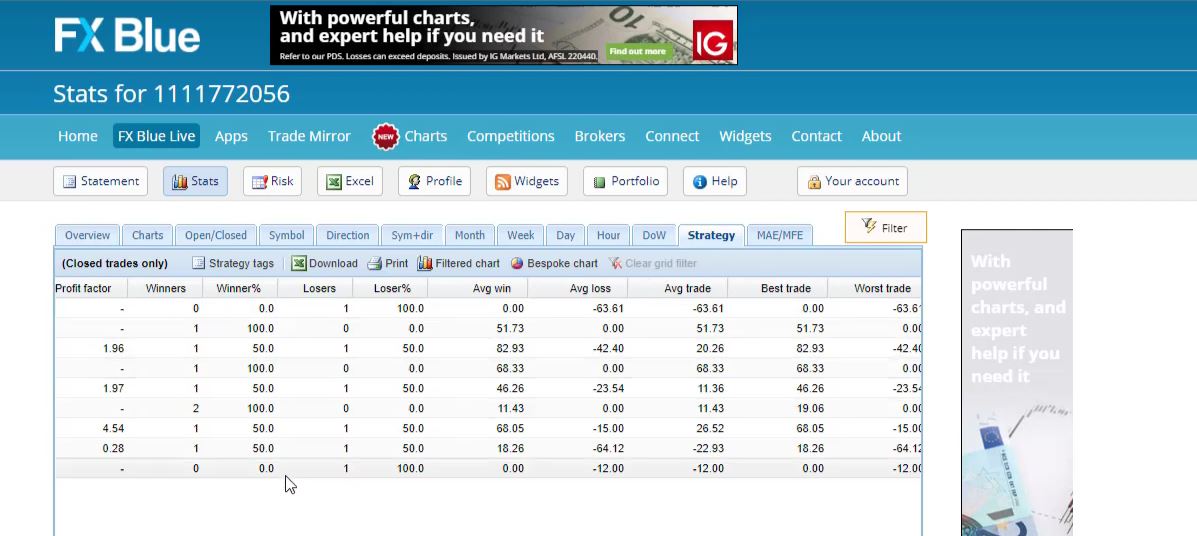

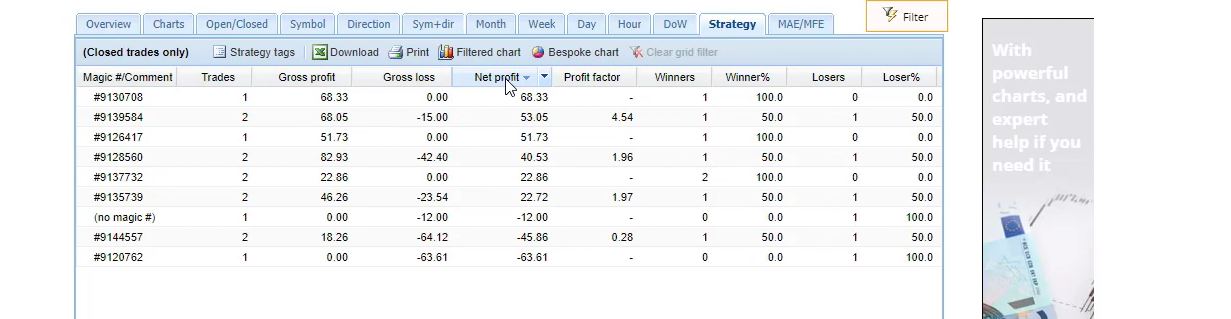

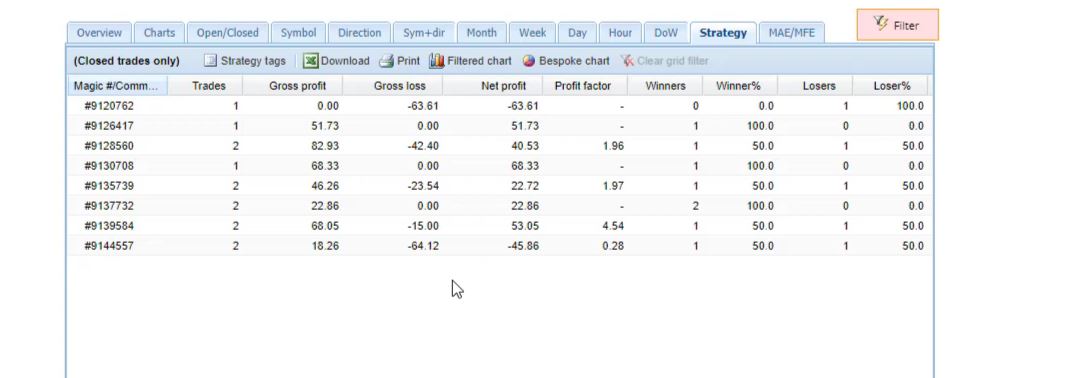

This is where I see which strategies made profits so far, which strategies made losses. On the left side, we have the magic numbers and then we have the number of trades, the gross profit, the gross loss, the Net profit.

Profit factor is my favorite among all Forex statistics.

The Profit Factor is the ratio of the Net profit versus the Net losses. Or in other words, the profit divided by the loss. And this is one of the things I am looking at.

We have the winners, the losers. So we can see how many winning trades, how many losing trades we have for each strategy.

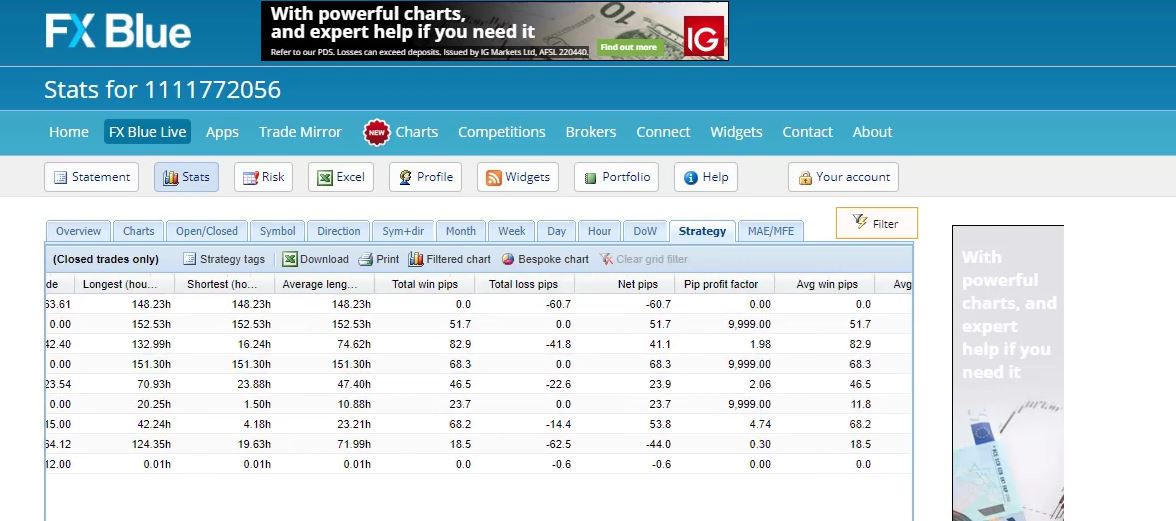

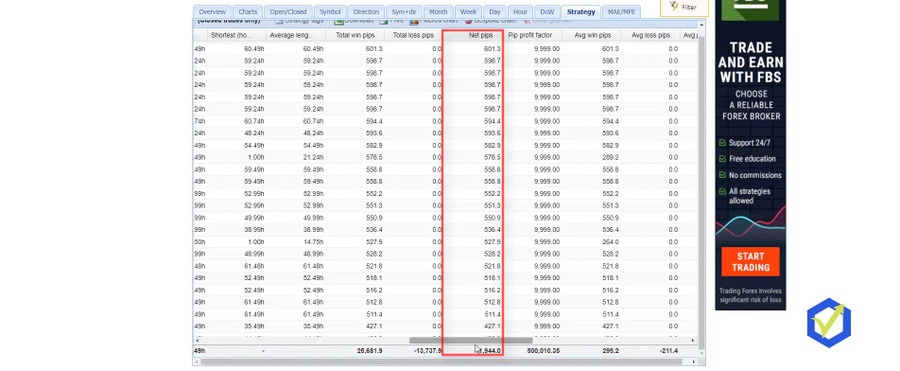

If I scroll more you will see average win, average loss, average trade, best trade, worst trade, longest, shortest trade.

So we can see how many hours these strategies keep the trades open, like the average length for the trades in hours. And then we have the pips.

Also very interesting, we have how many pips we have won and how many pips we have lost. And here are the net pips and totally we have 157.2 pips. And here we have the Pip Profit Factor.

So it’s like the same thing as the Profit Factor we have with the Net profit but here we are in pips.

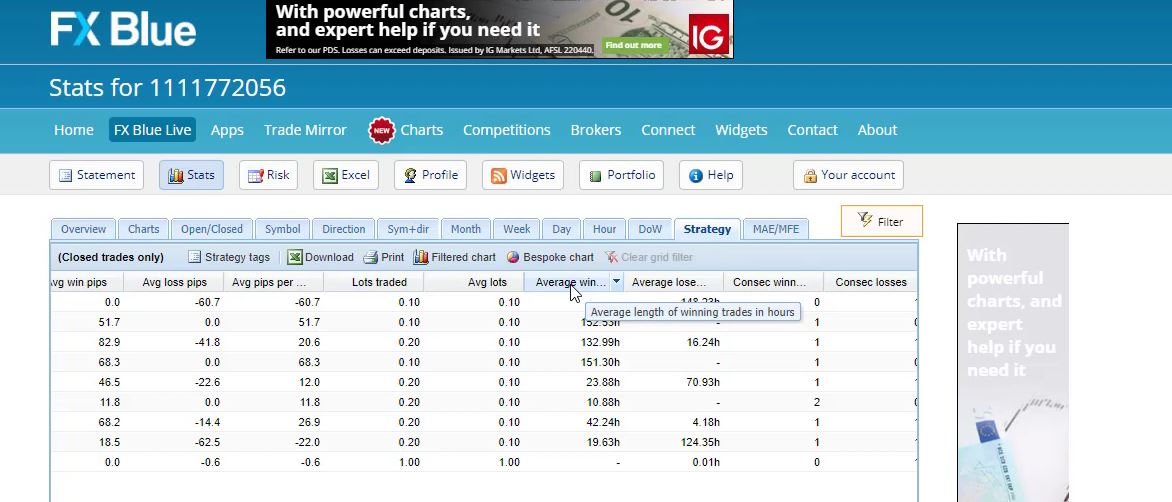

And if I scroll more you will see how many lots were traded totally.

And in the end, we have an average length of winning trades in hours and an average length of losing trades in hours.

We have the consecutive profit and the consecutive losses, consecutive pips is over here, maximum consecutive winning pips, and maximum consecutive losing pips.

The FX Blue statistics

So it’s really a lot of statistics that you cannot understand from MetaTrader if you’re looking at the account history.

We have as well the days, the months, the weeks, and many more that I really don’t look at. I mean I look at them just to have an idea but I concentrate on the strategy.

So if I use these Forex statistics and arrange the strategies according to the Net profit, I just click on Net profit 2 times and on the top, I will have the strategies that made the most profit.

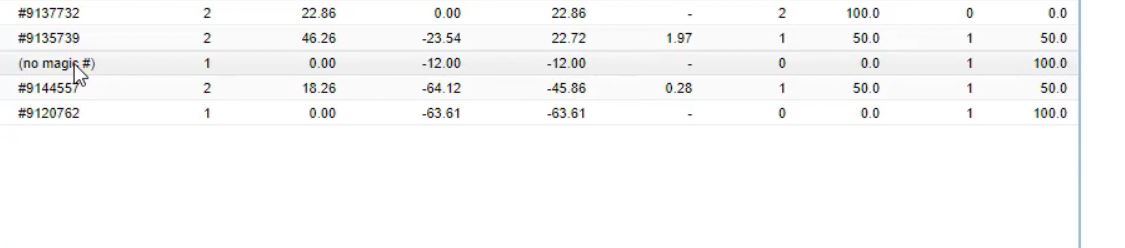

And in the end, we have these 3 strategies making losses. Actually, this is not a strategy. It says no magic number.

And if you remember at the beginning of the course I opened 1 lot trade to show you how you can check if you have a commission for your broker or not. So I closed it on -6 and I had a commission of 6, totally -12.

So this means that actually the profit from the strategies for these 10 days, it’s not 137.75 but it’s actually 149.75.

Because I have this -12 from that open trade there. And actually, I can remove it if I filter the statistics. Let me try to do that.

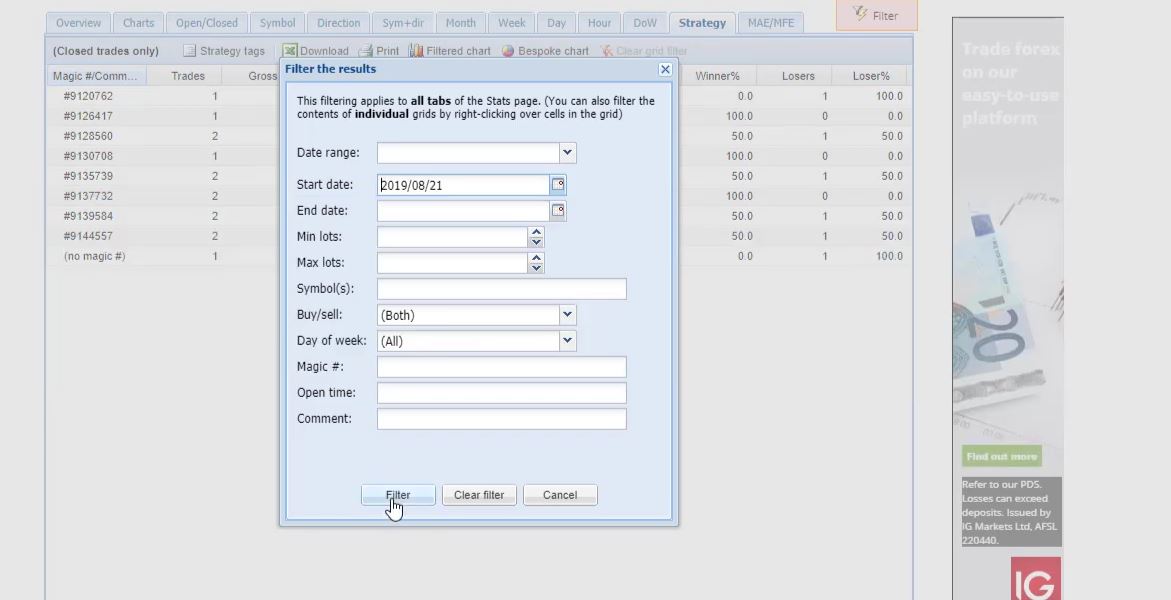

So if I filter the start date let me see when that was today’s the 29th of August, 10 days ago should be right about here on the 19th.

Following the results.

Let me try 21st, I click on filter.

It is removed.

So just the result from this trade is gone and exactly I have 149.75.

So what happened, I was placing the Expert Advisor somewhere on the 19th or on the 20th. I think actually it was on the 20th and then the first trades started to open from 21st. So I will leave it this way in order to remove this trade which is not from our statistics. It’s not what I am looking at.

Analyzing the FX Blue statistics from the Forex strategies.

So in the Top 10 NZDUSD EAs course, I will show you how I follow the results over here, what I’m looking for. And I will give you some ideas about how you can select which strategies to use from these 10 Expert Advisors. Because it really doesn’t mean you have to use all of them.

Of course, you can if you want. But what I normally do when I test Expert Advisors on a Demo account, is I look at their performance and I choose which ones I want to put on my live trading account.

And the best way to do that is to test these on a Demo account and to see which strategies are currently profiting.

Because as we said, every strategy has a profitable phase, a losing phase, which is very normal. But the thing is I want to trade the strategies only in their profitable phase.

How to install FX Blue Publisher EA

I continue now from the 99 Bitcoin EAs account where I have already some results. And as I said, it is very hard to follow the results from the account history. When we have many different Expert Advisors. And I said that you have 2 options to manage the 99 EAs. You can keep it this way, trading in 1 account.

And at the moment you decide you want to go for a Live, you put the 99 EAs and you go for the Live Account. The 2nd option is to keep the 99 EAs on your Demo Account. move the top performers or the EAs that are currently profiting to your Live Account. The reason is every strategy has a profitable period. Every strategy has a losing period.

Amongst these strategies that are trading, some are in the profitable phase, others are in the losing phase.

What I will show you, is how to extract the EAs that are in their profitable phase. And from there, you can move these EAs to your Live Account. For that purpose, I will use one statistical website called FX Blue.

I am not doing a promotion

It is free to use, its service is about adhering to results. The website is fxblue.com. Don’t take it as a recommendation or something. I’m not connected to the website, not promoting it or anything. Just it has this FX Blue Live feature which allows the traders to follow the results on their accounts.

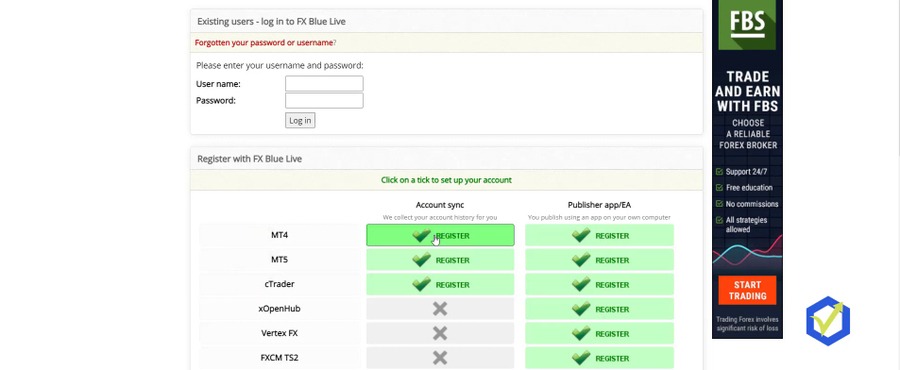

Actually, we have a lot more statistics and we can see exactly which are the EAs that profit the most. Now, according to accounts synchronization, it depends on what you are using. If you are using MetaTrader 5, 4, cTrader, there is the Publisher EA/app, etcetera. What I will go for is MT4 account synchronization.

I click on register and now I will select the broker server.

Here we have hundreds, maybe thousands. I don’t know how many they are, we have a lot of servers and brokers. Let me look for HFMarkets. It is SA Demo Server, the one that I have, yet I will need to write down the account number. It is 40669106. Read-only password – here you have 2 options. 1 is if you receive the Read-Only password from your broker or recently actually not all brokers provide the Read-Only password. This is known as similar to the investor password.

A different method of registering

I will show you a different method. I will write down my own password, and put down my email as well, which is petko.alexandrov, this is my personal one. I’ll just type it in and click on Register.

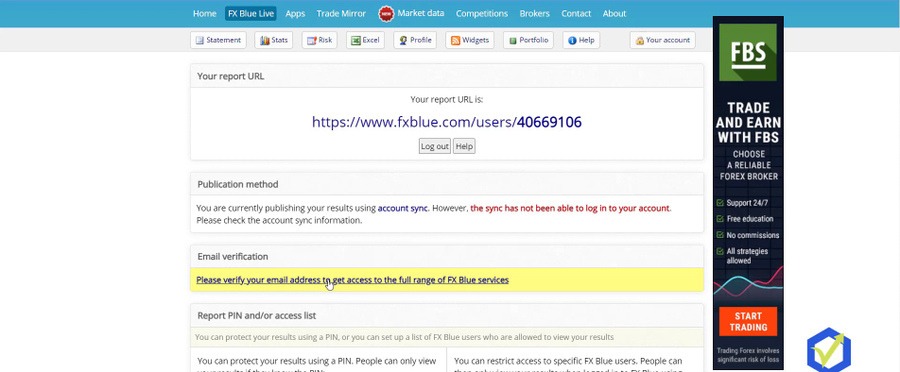

Now this will bring me to a page that it says, Please verify your email address to get access to the full range of FX Blue services and you’re currently publishing your results using account synchronization. Click on Please verify your email address,

a small window will pop up where I need to put my name and address and I will click on Send SMS.

What happens is I will receive an email on the phone and I need to reply to that email from my email saying anything as a subject line. Hello. Thank you. And this will verify your email. I just did it from my phone. Got the SMS, I sent email to the email they sent me, which is confirmation. I click on continue.

Software installation

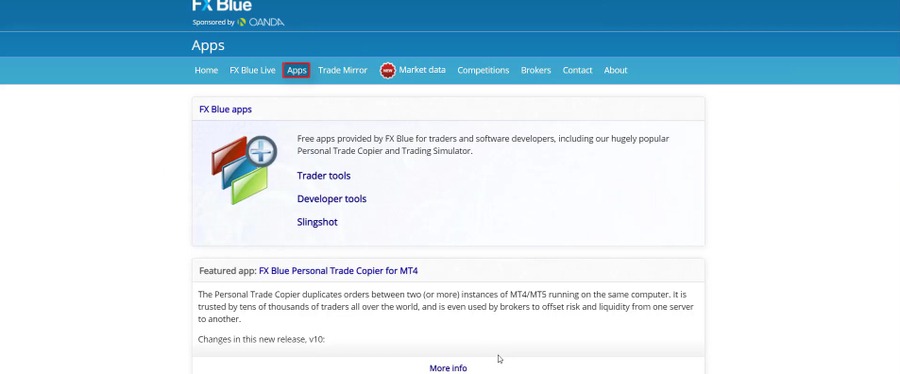

What I will need to do is click on Apps,

and I will click on more apps at the bottom.

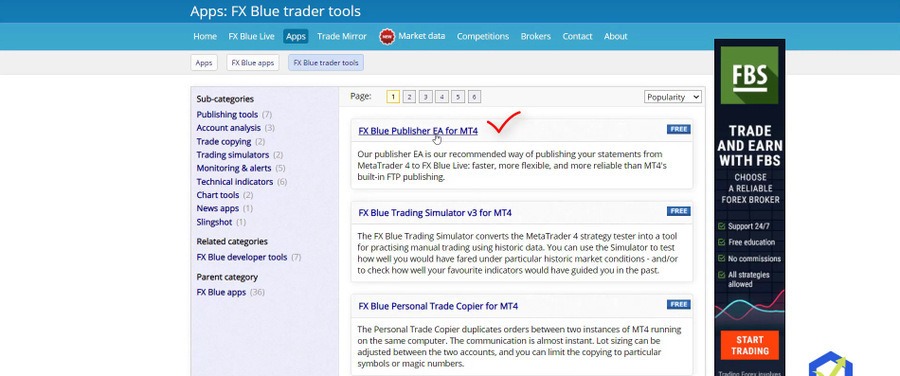

This is the one that I need, FX Blue Publisher EA for MT4.

I will click on that one. It is free.That’s an Expert Advisor that will publish my results. Click on it, it’s just downloading in my downloads folder, double click on it again.

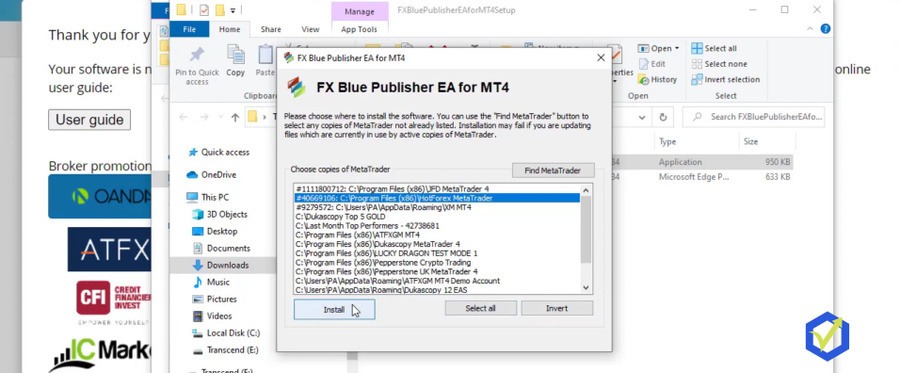

It’s very easy actually to install it and to use it. Just if you follow the steps one by one, you will see that it’s nothing hard. And it asks me for which account I want to install. I have quite many accounts and MetaTrader platforms installed. The one that I’m showing right now is the one with Hot Forex.

I click on Install,

and it says the software has been successfully installed. I will go back to the MetaTrader platform. I right-click and refresh.

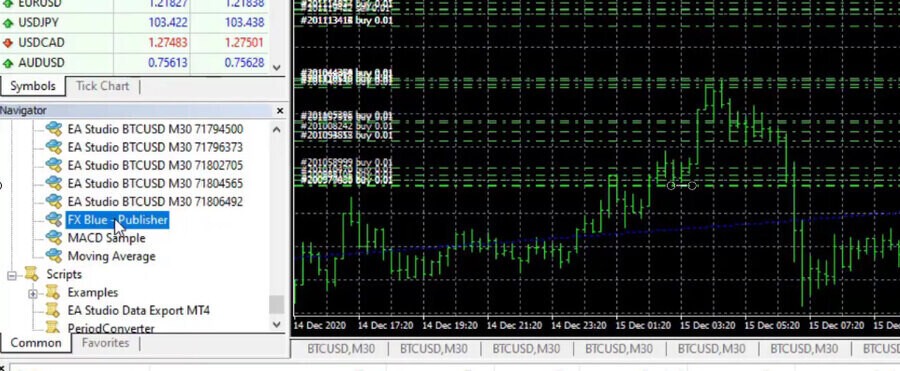

FX Blue Publisher EA

The same thing as installing Expert Advisors on the platform. Here it is – FX Blue Publisher.

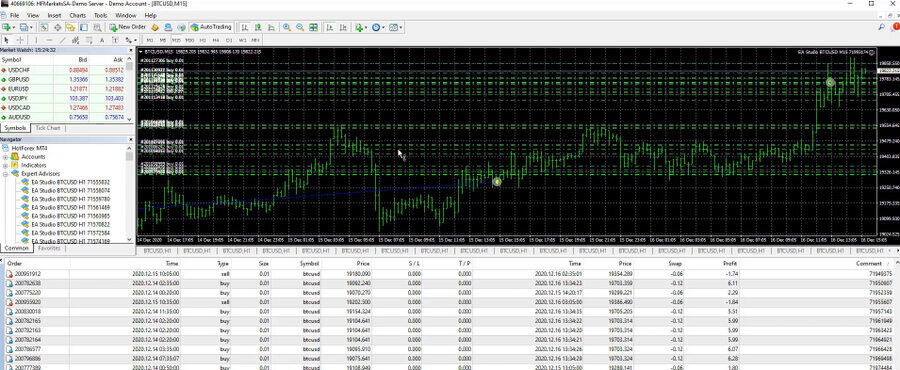

It is ready to use. Usually, need one more chart to use the FX Blue Publisher EA. I already opened 99 charts, that’s the maximum with MetaTrader. Clicking on the Chart Window. Undoubtedly, nothing happens, it won’t open another chart.

It’s 99 is the maximum. That’s why I’m using 99 EAs to get the maximum out of it. The FX Blue Publisher needs a chart. Now what that means, is that I will look for one Expert Advisor that has no trades opened at the moment. And how do I recognize it? There was a trade that was opened and now it was closed.

All the rest, they had open trades.

There are trades opened and actually, that could be a historical moment that I’m recording right now. We can see something, $20 000 for the Bitcoin was just hit and everyone was waiting for that moment for years. Now it happens whilst I record this lecture.

Trading with Expert Advisors

That’s the great thing when trading with Expert Advisors. It doesn’t really matter what happens on the market, I am trading with Expert Advisors and no matter what I’m doing, I have many Experts trading on my other accounts right now.

I see very nice profits with this demonstrational account and its very similar to what I have in my other accounts. Reas why I love trading with Expert Advisors. I don’t need to do anything manually.

Bitcoin is already above the $20 000, something I was waiting for, as I knew that there will be more volatility and nice profits in my accounts. Let me continue what I was explaining. The FX Blue Publisher EA needs to have a chart and I will just use 1 chart with 1 Expert Advisor that has no trades opened at the moment. And this is the 1 with 737, ending on 737.

How the FX Blue Publisher EA works

When I run the FX Blue Publisher, I disable this one for a while. And then after that, I put it back. I just want to show you how it works. Double click on the FX Blue Publisher and it asks me if I want to stop the 737 Expert Advisor and execute the FX Blue Publisher, click on Yes.

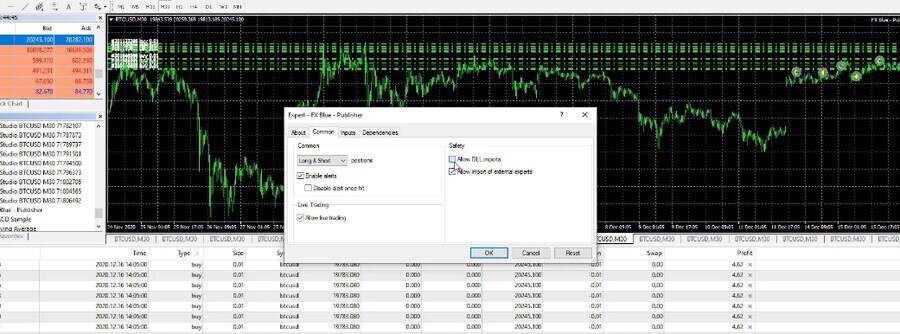

Importantly, I will click on Common and I need to allow the DLL imports.

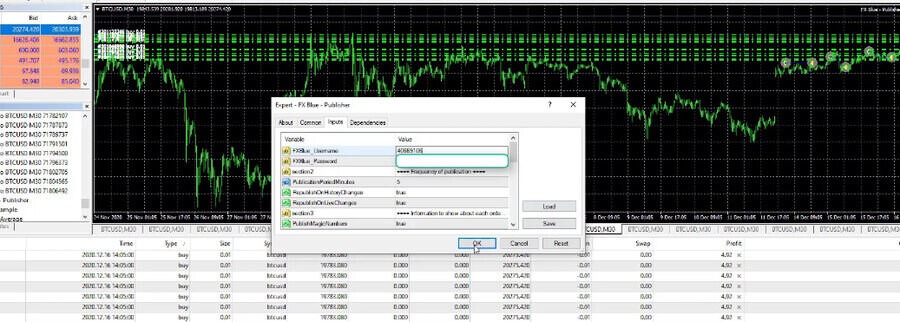

And in Inputs, I need to put my FX Blue username and the password. I enter the password and on the top, there is the account number 40669106, and pretty much that’s it. click on OK.

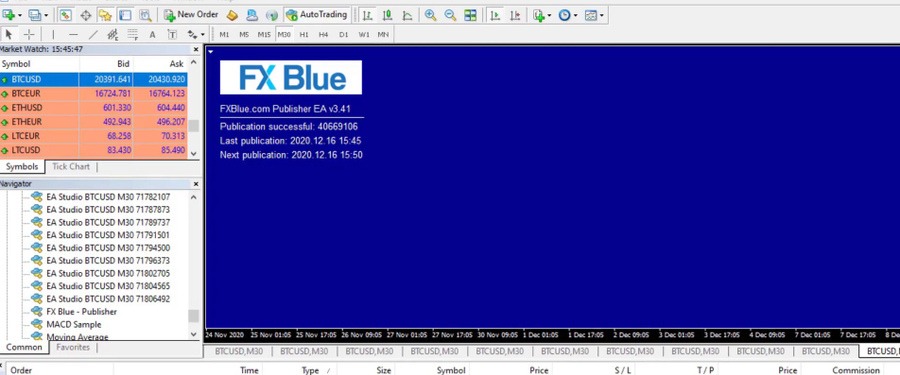

And it says sending data to FX Blue Live, last publication, successful. It just took a few seconds.

Now after we are ready, what I will do is simply go back to the FX Blue and I will click on FX Blue Live and view accounts and I will click on statistics.

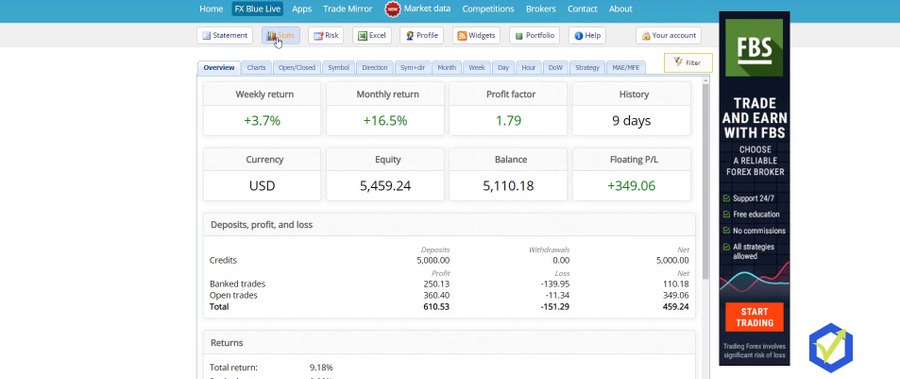

These are the statistics that I have from the account. I can see a few stats that are useful. Weekly return, monthly return. This is based on just 2 days of data that I have.

FX Blue Statistics

It says 9 days because the account was opened previously, I started with the Experts just 2 days ago and to see the floating profit loss, the balance, the equity rising right now because it is the Bitcoin time breaking the $20 000. The thing is, if I click on Strategy, I can see all of the trades.

I can see all the strategies arranged by the Magic Numbers.

And the result is combined.I know for each Expert Advisor, how many trades were opened, what was the profit, what was the loss. I know the net profit as well. I have many more statistics like profit factor, winners, losers. If I scroll to the right, I see a lot of statistics. Pips, we have average wins, average losses. It’s a lot.

I’m not going to talk about all of the statistics just in the next lecture I will share with you some more of what are the systems that I have been using. I will give you a few different options and you will know how you can select which strategies to extract for your Live Account.

Conclusion

You could be testing the 99 EAs on a Demo Account and extract just the top ones. If I click on the net profit twice on the top, I will see the Expert Advisors that brought the most profits. The first one is great. It already did 9 trades and it did most net profit, which is just $6.

This is why we trade with 0.01. If you are trading with 0.1, that would be $66. If you trade with a complete lot, that would be $666 of a profit. And if I scroll down, you will see the total net profit, which is 110. And if I scroll to the right one more time, where were the pips. You can see that we already have nearly 12 000 pips.

Finally one more time in Bitcoin.

I’m definitely going to check what’s going on in my other accounts. Maybe I will take some quick profits. That’s a great time for the Bitcoin breaking the 20,000, definitely. And I will bring back the Expert to this chart and I will see you in the next lecture.

If you found the lecture about Forex statistics and FX Blue Publisher EA useful, share your thoughts below. Thanks for reading.