Many traders, beginners, or even a little bit advanced people, fail on the market because they don’t have a Forex money management system to follow. That’s crucially important. This is the base. And that’s exactly what we will be talking about in this lecture.

Forex Money Management

Hello everyone, I’m very happy to welcome you to our Trading Academy channel. We share a lot of our strategies, ideas, systems for the Forex market, Cryptocurrencies, Stocks, algorithm trading. Basically, everything that we do for years.

We’ve decided to create a vlog as well where we will be sharing more thoughts, tips, and suggestions to beginner traders who are just starting out and have no idea from where to go. And especially the people who already lost money because I can assure you that the mass of people around lose money initially because they didn’t take solid education. They didn’t follow strict Forex money management.

The Profit Factor

Even if you have the perfect strategy (there is no such strategy, but let’s say you have a very good strategy), no matter if it is manual, it is algorithmic trading using Robots, just a strategy that has a bigger Profit factor.

So for the beginners, the Profit factor is the total profits divided by the total losses in the account.

So let’s say I use one strategy and I buy, sell, I follow the strategy strictly. At the end of the month, if I have $1,000 profits from closed trades and I have $500 losses, my Profit factor would be 2. 1,000 divided by 500. And anything above, Profit factor above 1, that’s OK. So even if I have $501 and I have a profit and I have a $500 loss, that’s OK because I have $1 profit.

My Profit factor is above 1, so it’s not a point to be above 0, the point is to be above 1. And why I’m talking about the Profit factor and the money management you will understand just in a second. So every strategy that has a positive Profit factor, and not just positive but a Profit factor above 1 is a good strategy. It brings you more money than losses.

Forex Money Management Strategy

Now the thing is, even if you have such a strategy with a good Profit factor like 2, 2 is a great Profit factor because you will be making simply more profits, double more profits than losses. The thing is, even if you have such a strategy but you have bad Forex money management, then you might still blow your account.

Now every strategy out there, no matter which strategy you’re using, guys, every strategy has losses. That’s why the Profit factor is important, so we can compare the profits and the losses and we can see how profitable the strategy is, especially when we do backtests with Expert Advisors.

So when you start trading, you will see sooner or later that there will be losing trades and sometimes these trades are consecutive. For example, I would be making, let’s say a $100 profit, then I will drop to 50, then I will go up to 120, then I can drop to 30. These are drawdowns. Where our equity goes down and of course if the strategy is robust and if it’s profitable in the longer term, then our equity should continue higher.

Increasing the Lots

But thing is, what happens when you have a few consecutive losing trades? This is where you can blow your account if you don’t have a good Forex money management system. Because what happens with the beginners is they start seeing profits and the feelings start to play. Especially, when you have a few consecutive days, you will be so confident in your strategy.

You will say, OK, I know how to do it now, I know how to trade, and you did just $100. And you say, OK, now if I was trading with double size, I’ll be making 200. And you start to increase the lots, you start to increase the quantity you trade, because you’re so confident in your strategy. You did profits.

But what happens is, it is very likely that when you increase your lots, the lot is the trading quantity in trading, when you increase the lots, what happens, there is a huge possibility that at this time you will hit the losing period. But you increased a lot and then you will have just double more losses into your account and you will go on 0 or even below that.

Losing Trades

And then you’re still very confident in your system. You say, OK, I know this system is very profitable, I did profits, I just hit the losing trades. And after the losing trades obviously, I will have the profitable trades. Then you might increase more the lot. And then if there are other losing trades, you can easily blow your account.

Simply one day, you will not have enough margin in your account. The broker will close the existing trades because they cannot handle negative losses and you will lose everything. Using a profitable strategy. And many people don’t even realize what the issue is, they think it’s the strategy.

But most of the time, especially if you use a backtested strategy with Expert Advisor which proves to be robust. The reason of losing or failing and trading is because of the feelings. This is because of bad money management. And one thing, so what’s the solution?

Algorithmic Trading

That’s the purpose of this lecture. I’m just explaining first the problem so you can understand where it comes from. And then you will understand what is the solution. Now the solution is algorithmic trading, Expert Advisors. These are Robots that execute the trades automatically.

The Expert Advisors will follow your strategy strictly 100%, even when you are sleeping, even when you are driving like me.

This is what I do guys, I trade with Expert Advisors all the time. The EAs are trading on my computer. And that’s what I love the most with the Expert Advisors. But regarding the Forex money management, the Expert Advisors, these are codes. This is a code for the strategy, doesn’t have feelings.

Reasons for using a fixed quantity

So even if it does a few consecutive trades, profitable ones. It will not get greedy to increase the lot. It follows the same amount. And now all the Robots that we use in the Academy and that I attach to our courses are always with a fixed entry.

For example, you set it to 0.01 which is the minimum quantity or you set it to 0.1 or 1 lot if you have bigger capital, then that’s it. It will always trade with 0.1. And the time you decide your account is growing, you can start increasing the lot accordingly.

I will give you some examples at the end of the lecture to let you know what I follow as a Forex money management when it comes to the account and the quantity I trade with. But that’s the reason, that’s why we use always a fixed quantity in the Robots and not what most people want to have. They want to have a percentage as an entry.

Setting the Robot to open trades

So of course, that’s possible to be done with the Expert Advisors. But we do it by purpose this way exactly to lower the emotions into people. Because what’s most popular when trading with Robot, is you set it to open trades, for example, to 5% from your account. It will open every time 5% from your account and it calculates it.

The problem is, when your account starts to grow, your opening entry or your opening percentage for the Robot will grow as well. And again if you hit a losing period or if your strategy has a huge Stop Loss, what will happen is, you can have a much bigger loss than the previous profits the Robot did.

So that’s why it’s better to have 0.1 and that’s it. You follow entry with 0.1 lot. I hope I have succeeded to make that clear and I said I will give you a few examples. So when you are trading, for example, with $1,000, a good Forex money management would be to open trades with maximum 0.5 lots.

Forex Money Management – The Leverage

Then it’s up to you if you want to be trading with 1 strategy using 0.5 if you want to be using 5 strategies using a 0.1. So basically, what happens is all the time, no matter how many trades you have, you will not have more than 0.5 lots. And of course, it depends on the leverage, that’s very important, just mentioning for the beginners. The leverage allows us to borrow money from the broker.

So if you have $1,000 into your account and you use leverage 1 to 30 which is quite popular recently, then you will be able to open trades for up to $30,000. And you need to make sure that you’re using a small portion of this money.

And another thing that many of the beginners don’t understand is that the risk actually is not how much from your account you have opened or you have used. Did you use 5, 10, 20, 50% from your account? But the risk is your Stop Loss. So if you use for your strategy Stop Loss of, let’s say $50 or 50 pips, trading with 0.1 is approximately $50, then this is your risk.

The Stop Loss

No matter what is your account, how much you’re risking out of it, the real risk is the Stop Loss. Because if you have, for example, small Stop Loss, let’s say 20 pips, 50 pips. I’m not a fan of small Stop Losses, but you use 5 or 10 Expert Advisors for different strategies, and if you open trades with all of them, what will happen is that you and all of them go to a loss.

Which is also possible to happen. What will happen then is you will have a solid loss. So always calculate your Stop Loss. And this is what matters, even if you use all the money of your account. But you use a small Stop Loss, that’s still fine. You have a good Forex money management because you’re not risking a lot.

So following the money management strictly, is very important. And no matter what happens, don’t fall into emotions. Don’t fall into the greed that after profitable trades you will take bigger risks. Don’t fall into the fear that if you see a few losses, you will blow your account and you close for no reason trades. You need to accept that there will be losing trades.

Beware of scammers

The moment you accept that is the moment you will understand how everything works. And many beginners always aim to find a strategy that has no losses. I understand that because many of the brokers promise that. That’s a lot of scammers, YouTubers, people who will drive you to affiliate links for some scam companies.

They will promise you Robots without any losses and it’s like accepted. The general mass of beginners thinks that there is such a thing. But the fact is, there is no such thing, guys. There will be always a loss in your strategy. There will be a week, maybe a month even without doing any profits.

But next month will be OK. Next 2, 3 will be all right and you will be on the profitable side, if you use your strategy strictly and if you have good Forex money management. Don’t look for a strategy that will bring you no losses.

Good Forex Money Management

I’m telling you this because I have been through that. And the only solution for having no losses is the never losing formula that I have calculated for the Cryptos where I take hedging trades and I open trades against the initial trade to cover the losses. It’s mathematics that I’ve been using. And then every losing trade just exits with 0 loss.

That’s the maximum you can achieve out there, nothing more. So be realistic, don’t fall into emotions. Follow your strategy strictly and precise Forex money management that will feel comfortable for you. So anything where you’re not risking more than 2% to 5% of your account, is good Forex money management.

And anything that you are not blowing your account in a few trades still works fine.

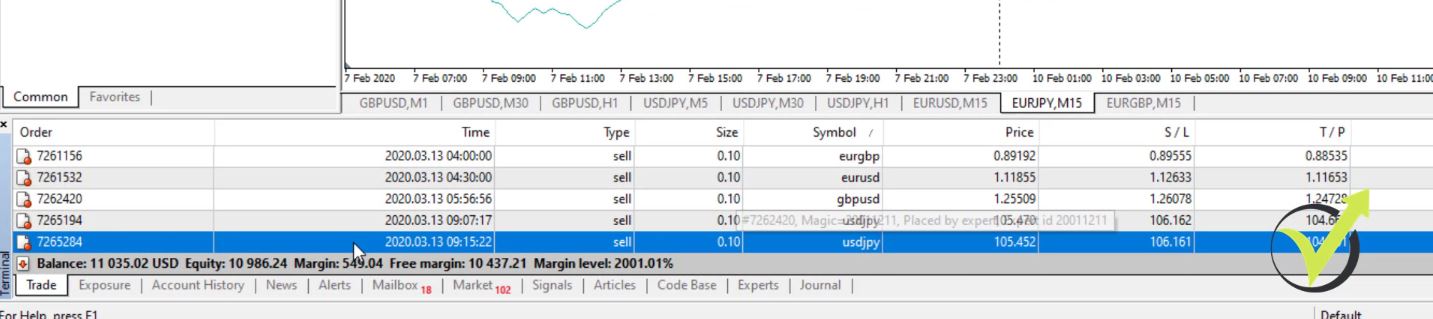

For the purpose of this article, I will show you an example of an account. I started with 10,000 and now I am at 11,000.

This is a free lecture from the Forex Trading Strategies from a Professional Trader + Top 5 Professional EA.

This means that for 1 week or just a little bit longer, I have 10% of the account which is a very good result. And I don’t say it will happen to you when you start trading, that you will have the 10%. Maybe it will be less, maybe you will end up the week losing, it really depends on the market. That’s the one thing you should remember as well, that the results are not always the same. But the better FX training you have, the better results you will achieve.

So we don’t have 1 week similar to the next week or to the previous week. Sometimes we have a good week, sometimes we have a bad week, that’s the market. But the most important thing is that we maintain good money management. In a $10,000 account, what I wanted to show you as an example in this course, I’m trading the Expert Advisors with 0.1 lot. This means that in my account I am blocking about $100 for each trade, 100 and something, like 110.

5 open trades are normal for an account

Because you see I have 5 trades opened at the moment,

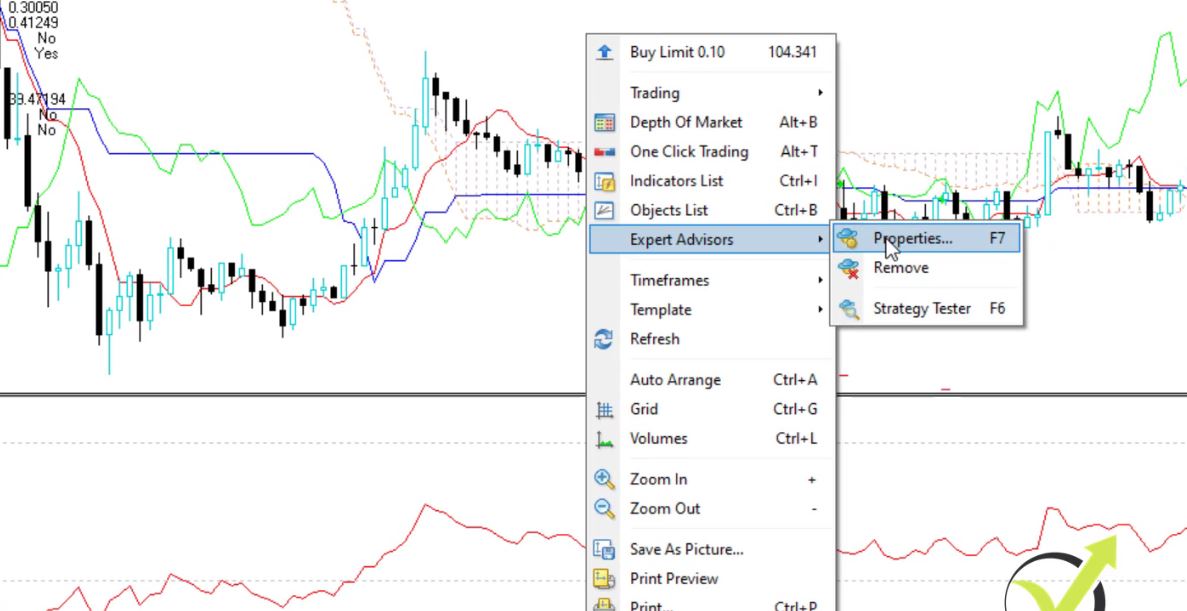

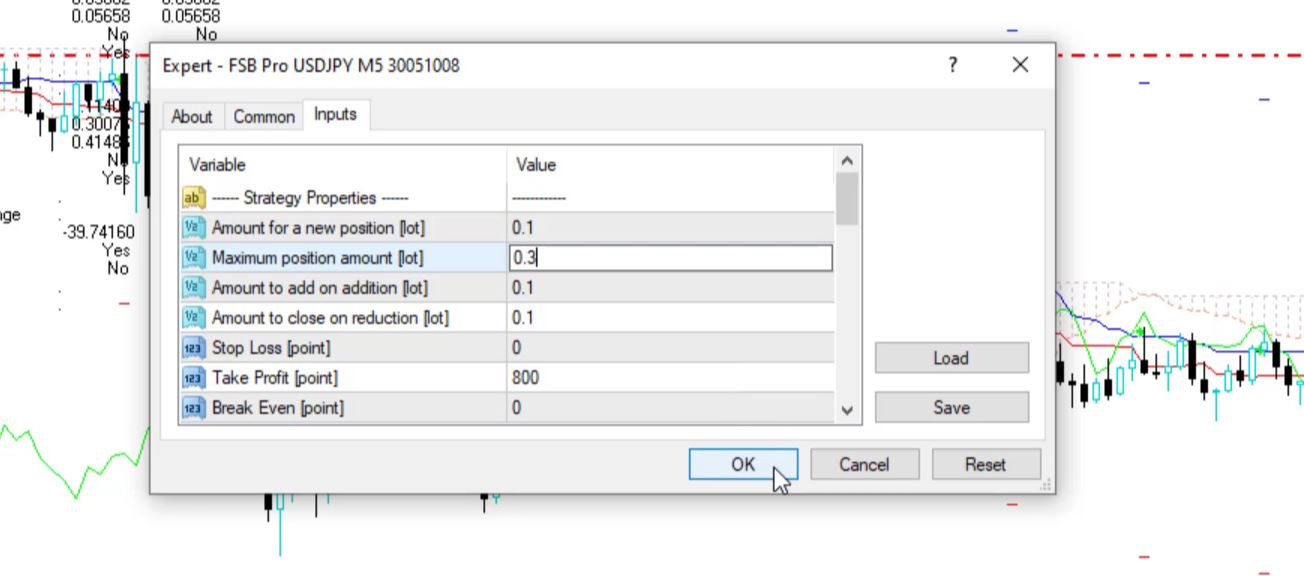

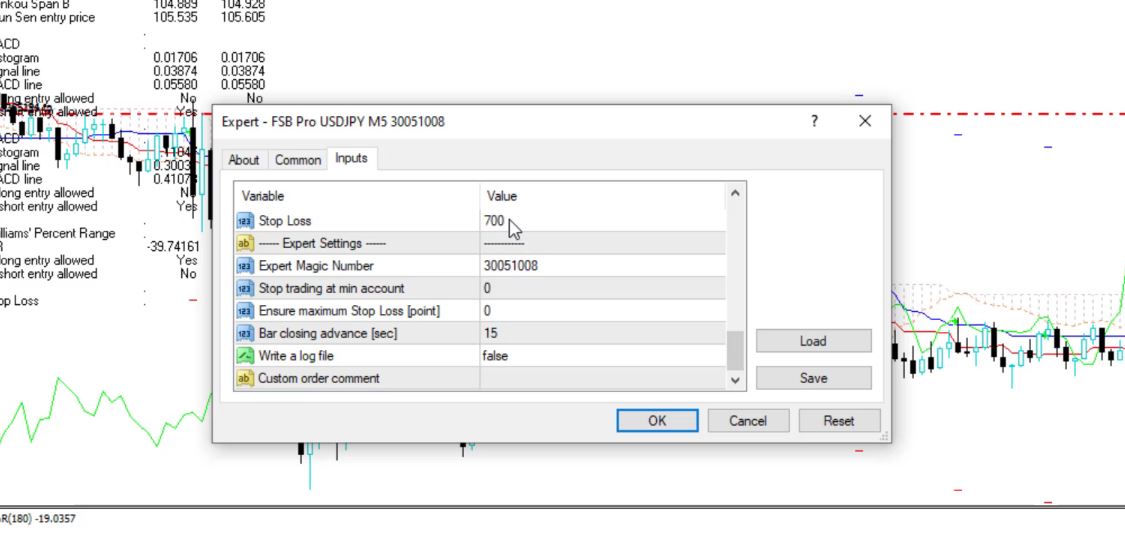

with 0.1 and the margin I am using is 549 which is about $110 for each trade. And this is 1% of my account. Or when I started with 10,110 is just 1.1%. And if all the Expert Advisors open trades, which are 5 Expert Advisors but 2 of them, the GBPUSD and the USDJPY, you can add to the position if you want to. From the Expert Advisors, Properties, you can select if you want to add.

If you don’t want to add, you just leave it as it is. So it will not add to the position because the maximum position amount will be 0.1. I keep it 0.3 so I add 2 more times.

So if all the Expert Advisors, the 5 of them open trades, and if the USDJPY and the GBPUSD add to the position, I will have a total of 9 trades opened. And each one is 0.10, I will be at 0.9 lot which will block me about $1,000 from the account. That is the maximum I can have and that is what you need to calculate in your FX training before you open a real account.

Each 110, 9 times, it will be about 990. So about 1 complete lot in a $10,000 account which is 10%. But keep in mind something, I’m not risking 10%. I will have the margin at 10% or at $1,000. This is how much it will be blocked from my account to open the trades. The rest will be a free margin like what we see at the moment.

FX Training: Stop Loss is the real risk

So if at the moment all the Expert Advisors open trades, I will have a blocked margin about $1,000 and the free margin will be about $10,000. So this is how much I use from the account to open the trades, but I’m not risking that much. I am not risking 10%, I’m risking a much lower amount. Because the risk is how much you are able to lose. How much the Stop Loss is.

And if you go through the Expert Advisors when you are learning them and doing your fx training, you will see that each Expert Advisor has a Stop Loss lower than 100 pips. In this case, for the USDJPY, for example, we have 70 pips.

And actually, looking at my account history, I don’t have a loss bigger than $100. All of them are less.

So what I wanted to say is that if you have all Expert Advisors opening trades and they all hit the Stop Loss, this is like the worst-case scenario, you will have a loss lower than 10%. That is something that every FX training education must teach you.

Because it will be 10% if all of them have $100 of a loss with 0.1. With 0.1, if you have 100 pips of a Stop Loss, this will be approximately $100. But, one more time, because all of the strategies have Stop Loss smaller than 100 pips, it is less than $100, and it’s much less than 10% if you combine them all. I will leave that to you.

The worst-case scenario matters

And this is like the worst-case scenario, one more time, if all the Expert Advisors open trades and if all of them hit the Stop Loss. Now, from my experience, this will happen very rarely. It’s not something that happens every day, every week or even every month.

But, one more time, I wanted to say that this is smart money management because I’m never risking more than 10% of my account. So I will just summarize it one more time. If I trade with a $10,000 account, I would be trading with 0.1. So if you are trading with $1,000 of account you can trade with 0.01. And if all of the trades open positions, I will use 10% from the account which will be about $1,000 in this case.

But the worst-case scenario when all the trades hit the Stop Loss which, one more time, is very rare or it might never happen to you, not while fx training and not while real trading.

It will be even lower than 10% because all the Stop Loss are below 100 pips. I hope that’s clear now. And I don’t want to show you how much is the total Stop Loss now because it will change when you’re taking the course.

Test on a Demo account while you are doing your FX Training

So I really hope that makes it clear about the money management, about how much is blocked from the account, and what is the worst-case scenario.

This is something you need to know at all times when you are trading. And the best thing to do is to test it first on a virtual account. Just practice on a virtual account. If you’re planning to open a real account with $1,000 then open a Demo account with $1,000, test the Expert Advisors for a week to 1 month, 2 months, 3 months, depends on how much time you need to test the Expert Advisors for yourself just to be confident with the results.

And don’t hurry to risk real money until you are confident with the strategies. Spend more time on FX training until you are ready. It doesn’t matter if you are trading manually with the strategies, it doesn’t matter if you’re trading automatically,

With the Expert Advisors, the most important thing is to be comfortable trading with them, to be convenient in the strategies. And this is the only time when you should be risking real money.

And, one more time, don’t hurry with that. I know a lot of people want to make profits quickly but it doesn’t really work this way. You need to test for a longer time, practice, and see how it goes.

Conclusion

Alright, traders, in this lecture, I wanted to talk about money management because this is very important especially if you are a beginner trader. And when taking your FX training you need to pay attention to that.

Because having smart money management will keep you longer on the market and most of the beginner traders blow their accounts because exactly of not having good money management. And this is what I want you to remember from this lecture.

Let me know if you have any questions. Share with me in the comments below what are your thoughts about Forex money management. What you’re using at the moment, so we can discuss it and see if that is the right one for you or you can improve it more. I will see you in another lecture, guys. Take care.