Forex Algo Software – the new tool in 21 century for algorithmic trading.

Forex Algo software allows the traders to test the robustness of the strategies before actual trading. The problem with Meta Trader is that you can test the robustness of a strategy after you have it. After you have bought the Expert Advisor, after you have paid the developer to do it or after you have spent a couple of weeks to code it by yourself.

And just then you can do the backtest and to check the robustness. Now when we have Forex Algo software, we test the robustness before we have the Expert Advisor, just when we have the strategy, the idea of the strategy. And we can see if it is worth to do it as an Expert Advisor.

And actually, with the Forex Algo Software, it is very easy to have it as an Expert Advisor because we don’t need to have any programming skills or any trading experience even. With one click we can export it as an Expert Advisor and I will show you how to do that. Alright? Now when we have Forex Algo Sofware, we have different robustness tools that we will use.

What are the robustness tools in Forex Algo Software?

- Walk Forward

- Monte Carlo

- Multi Markets.

These 3 are different tools to validate your strategies and to check if they are over optimized or not. Now on our website, we have 2 pieces of Forex Algo Software: one is EA studio or Expert Advisor Studio, the other one is Forex Strategy Builder.

Now, Forex Strategy Builder needs to be installed on the computer. It’s a little bit of a heavier program, takes a little bit longer time to get used with it. I can say these two are just different software.

I get the question all the time, “What is the difference between these two?” They simply create different Expert Advisors and they have some different features inside. But the idea is one and the same with both.

The Algo trading software Expert Advisor Studio offers 15 days free trial.

We are building strategies, Expert Advisors, we export the strategies as Expert Advisors with one click so no programming skills are needed and no trading experience is needed. You can generate strategies based on the historical data, which I will show you how to place in the Forex Algo Software. Now Expert Advisor Studio comes with 15 days free trial which you can use and during this time you can export or generate as many Expert Advisors as you wish.

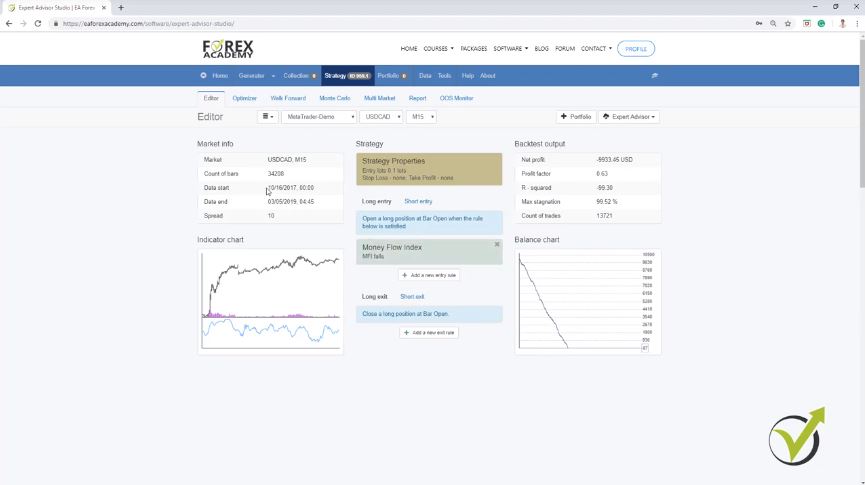

There are no limitations here. I will click on “Login” just to use it and I will just demonstrate to you how I will use this Forex Algo Software to test the robustness for the strategies. So if I click on “strategy,” you can see that I have the possibility to put entry conditions and to put exit conditions.

So if you have a manual strategy that you are trading and you want to use it with Expert Advisor, you can build your strategy here. Now I will demonstrate it to you very quickly. Let me take randomly some indicators, for example, I have many indicators here but let’s pick some random money flow index.

For example, there are different conditions, money flow index rises, falls, is higher than the level line, is lower than the level line. Let’s take money flow index falls. And I will click on “accept” and you will see that immediately I have a dramatic loss.

You see the backtest result immediately you add an indicator to the strategy.

So basically here is the backtest. OK? For this period that we have, from October 2017 till today the 5th of March, 2019? So whatever indicator I place or add to the strategy, I will see immediately the backtest result or the balance chart.

Now let me place some exit condition as well and I will take, for example here, some of the indicators that I like the most. I will take the envelopes and here is the rule we have the bar opens above the upper band, the bar opens below the lower band, the bar opens below upper band after opening above it…let’s click on some of it randomly.

When I click on “accept” and actually here you see I have a profitable strategy. I took these indicators really randomly. Just from my experience, I know which indicators are good entry and exit condition.

Any indicator change you make will be seen immediately on the balance sheet.

I didn’t place even a Stop Loss and Take Profit and you can see this strategy is on profit. Even if there was a huge Drawdown, still this strategy is on profit. And now what is the thing here guys, that whatever change I make in the indicators, I will see the effect immediately on the balance chart.

This way the Forex Algo Software saves a lot of time for Demo testing on Meta Trader with the different parameters.

So let me, for example, change the rule, the bar opens above the upper band and I will click on “accept.” And here I have a much better strategy. Even recently losing, you can see the equity line is much smoother but for the recent period, it’s losing. OK?

And let me change some of the periods. So, for example, from 14 I will go up to 15 and I will click on “accept” and you see there is a small change. And I will go up to 20 and I will click on “accept” and you see it’s getting actually worse. Alright?

Now I can add as well a Stop Loss and Take Profit. For example, let’s add Stop Loss of 50 pips and Take Profit of 100 pips and I click on “accept” and you see there was a small change. So this thing really saves us time.

With a manual strategy, you don’t need to test on a Demo account for long.

If you have a manual strategy, you really don’t need to test it a long time on a Demo account. What you can do is simply to build your strategy here and see what was the performance for the last months, for the last year or even more, if you load more historical data. And now talking about data, I will show you how to place the data over here.

I click on “data” and you see here is a drop zone, drop the files here or click to upload. So let me get the files. I go to file open, data folder, go to MQL 4 and here are the files.

This is the historical data that I have exported earlier. OK? What I will do, I will drop it in this window right over here. I will just drag it and drop it and you see the data is imported and uploaded.

Do not take the brokers on my trading courses as recommendations.

Now whatever broker you see on my trading courses, guys, please don’t take it as a recommendation. We are not connected to any of the brokers. But, of course, I have to choose one to record the courses and I’m always looking for the regulated brokers.

I dedicated many lectures in my courses how to choose the broker and basically how to avoid the scam brokers because this is the most important thing nowadays since there are really many scam brokers around. You can read more about it in our Forum, it’s free. There is such a topic called “how to recognize the scam brokers” which will help you to identify them. Alright?

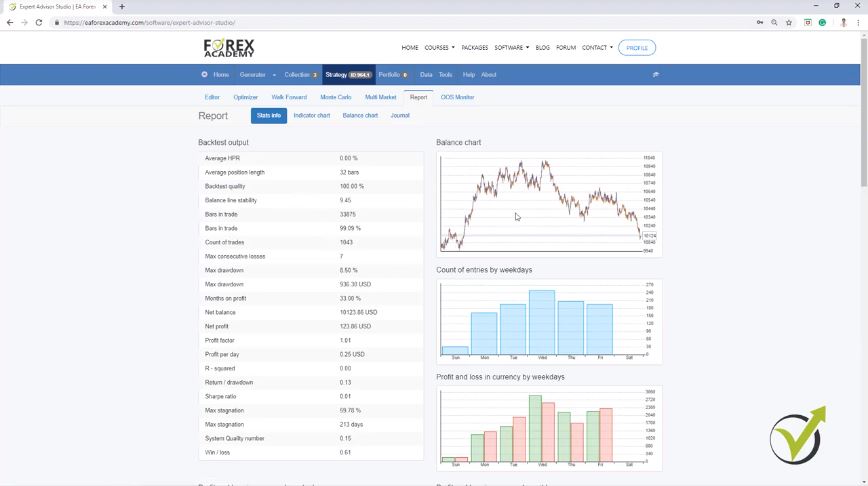

Now going back to the strategy, we said that here we can build a strategy and immediately we can see the balance chart or the backtest. OK? We have “report” where we see detailed statistics about the strategy, the backtest output such as balance line stability, maximum Drawdown, months on profit, net balance and actually let’s get back to this better strategy that I took randomly. It was actually using the envelopes, the bar opens above the upper band and I will remove the Stop Loss and the Take Profit.

You can see all opened and closed trades in the journal.

So in the report, you can see that you have some statistics such as count of entries by weekdays, profit and loss in currency by weekdays, here you have it by hour, entry and exit hour. We have count of entries, profits and losses by entry hour and monthly performance are below which is very interesting as well. Now we have the journal, same as with Meta Trader, where we can see all the trades that were opened and closed.

And actually from here if I go to strategy one more time and I just uploaded the historical data, if you upload your historical data you will see it somewhere over here. So this is the one that I uploaded, you can see a very small difference right in my balance chart. Now if you upload historical data from the different brokers and you see a huge difference when you change the server, this means simply that the brokers provide different quotes.

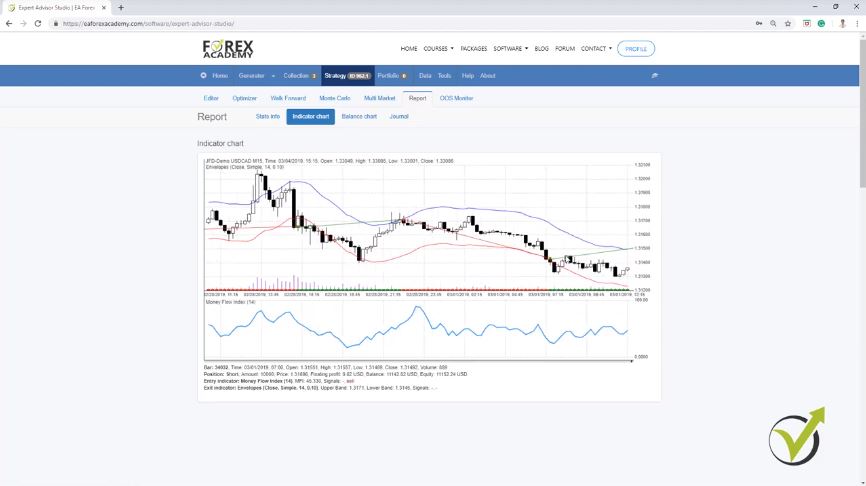

Different prices, which forms different historical data but the strategy is the same. On the left side, we have the indicator chart which is something very interesting to me. Here we have where the trade was opened, where it was closed, so if we have the green line this is a long trade, if we have the red line this is the short trade.

So you see here we have a buy position until here, then here we have the entry condition for short and then here we

have it for long. You can see when the price touches these envelopes. Actually, to be precise, we set the bar opens above the upper band, this is the exit condition for the long trade. The money flow index falls.

In this case, we with the Forex Algo Software when we have a long trade and a bar opens above the upper band, it closes the trade.

And our entry condition is with the money flow index. In this case, we say the money flow index falls. Alright, guys?

So this is how you can build a strategy over here and the best thing with the Forex Algo Software, that I always say, is that with one click we can export this strategy as an Expert Advisor. You can see if I open it, you will have the code for the Expert Advisor already without mistakes and you can compile it. Alright? So we have the Expert Advisor ready to use and if you want to do it for Meta Trader 5 you can export it as well for Meta Trader 5. Alright?

So let’s make a quick check with the Meta Trader. I will copy that, I will minimize it and I will paste the Expert Advisor. So I go to “open data folder” and I go to MQL 4 experts and here I will paste it. So this is the one with 343 ending magic number, I will open it. OK?

Zero errors and warnings indicate the code is fine. This means the strategies from the Forex Algo Software are reliable.

Let me compile it first. I click on “compile,” you can see there are zero errors, zero warnings which means that the code is just fine. And now I will see it right over here if I click on refresh, it is this one right here. OK?

Now I am on USDCAD, I will drag the Expert Advisor over the chart, I will click on “OK” and let me backtest it. I will go to Expert Advisors, strategy tester, open prices. We have the date for the last 1 year and 15 current spread and I click on “start” and let’s see what is the result.

Over here it’s 11,137, the graph you can see, it’s the very same graph recently losing in this zone. The very same thing what we had here, but here it’s just in a small window while in Meta Trader it’s quite bigger. And if you compare the results with the open and close trades, you will see that these are the very same trades that were open and closed.

Could be a small difference because of the spread. Because here I entered the current spread and when we export the historical data, I use 10 points because I rounded it to the high number. But anyway guys, this is the way that you can check if the Expert Advisors created with the Forex Algo Software are real, are showing the very same backtest as what we have in Meta Trader.

Forex Algo Software and Meta Trader differences?

- the spread might cause a difference in the report

- date range should match to see the same trades

- Meta Trader starts the backtest from the 100 bar

- the Forex Algo Software takes negative ambiguous bars

- the Forex Algo Software is faster

This is is how to test the reliability of a Forex Algo Software.

And this way you can see if a Forex Algo Software is actually reliable or not. Of course, I have tested that many times and there are thousands of traders who use these Strategy Builders. So it’s tested, all bugs were fixed a long time ago and actually, it works really nice.

Now what we have here, more with the Strategy Builder, we have the generator. The generator is the smart thing or I can say the intelligence that stands behind this Forex Algo Software. Because with the generator over the historical data that we use and that we imported from our broker, we select the symbol, the period and we can select what range to have for our Stop Loss, for Take Profit, if we want to use it or not, if we want to use trailing Stop Loss or not.

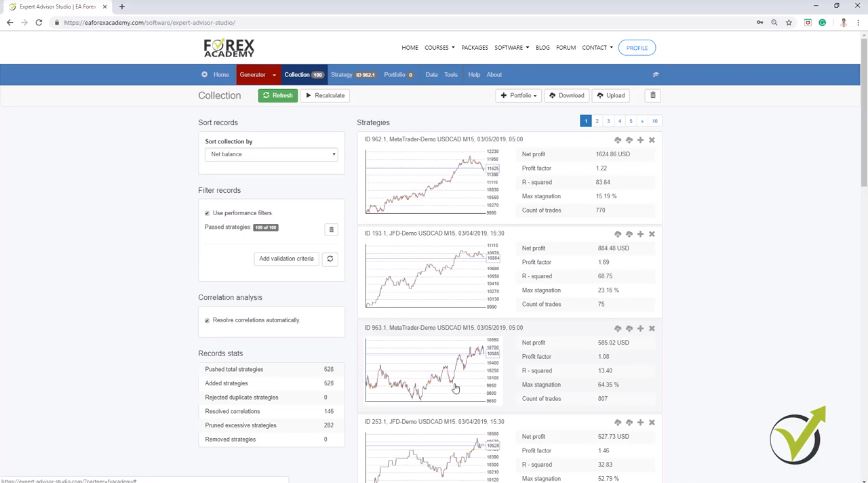

And we have some generator settings and when we click on “start,” I will just click on start randomly without making any setup here. You can see that there are strategies generated. You can see what is the speed of the Forex Algo Software. It calculates really fast strategies and all of the strategies calculated, you will see them in the collection.

So even if you don’t have any strategies profitable, you can generate your strategies over here. And these are the very same realistic strategies. If I click on any of those, you will see the entry and exit conditions. Also, the balance chart, the indicator chart and everything else.

We can create our own Expert Advisors with the generator of Forex Algo Software.

So this way, with the generator we can create our own Expert Advisors. You can see this strategy has a really nice profit line. Balance line. We have the Force Index, the Average True Tange for entry conditions. As well, the average true range for exit condition and we have Stop Loss and Take Profit with the strategy.

So this is how you can generate strategies. Of course, you need to set up some limitations because you can see it calculated thousands of strategies. And already we have hundreds of strategies into the collection. Actually, in the collection, we see the best 100 strategies.

But here in the generator settings is where we set working minutes. So for example, you can run it for 10 hours like I normally do before I go to sleep. I run it and then in the morning I have already strategies to work on. And then I download them, I download the complete collection and I run it again for another 10 hours.

We have the Acceptance criteria in the generator settings.

So this way, I make it work all the time for me. Let me stop it. So here in the generator settings, we have these common Acceptance criteria.

So here we place limitations. OK? We place criteria for this strategy. So we don’t want to see hundreds of strategies that are just randomly generated. We want to see strategies that perform well, that have a good Profit Factor, R-squared or they don’t have a huge stagnation.

We want to see many count of trades because this is very important. The more trades we have, the more robust the strategy will be. Because we don’t want to base our trading on strategies that were showing backtest only with 100 count of trades, for example, or 200.

The more the number of trades the more the chances of success in the future.

We want to see at least 300 – 350. If it is more, of course, it’s better. When we have more count of trades, it means that this strategy was executed more times in the past. OK? So if it was executed only 100 times, obviously the chance to fail in the future is bigger. This is because it was tested, we can say, just 100 times.

The word test is not even the right word. Or we can say the strategy was executed only 100 times. And if it was executed like 400 times, 500 even, 700 times. Obviously, this will give us a sign that probably this strategy will continue working profitably in the future. And what else we have are these robustness tools – the Monte Carlo, the Multi Market, and the Walk Forward Validation.

These are different robustness tools that I will cover in the next lectures. I will show you how I’m using them in order to filter the strategies and to test the strategies even before I am exporting them as Expert Advisor. OK? I’m testing them and if I see that they perform well with these criteria, just then I will give them a try trading. Alright?

Thank you guys for reading the lecture, and I will continue with the next one. If you have any question feel free to drop it in our Forum and I will answer you.

Cheers.