Coronavirus and the markets

Hello, dear traders, it’s Petko Aleksandrov from Forex Academy, today is 9th of March, 2020. I will do a quick recap over the Coronavisrus and the markets at the beginning of the week, what we can expect and we have another sell-off. The markets are falling down since the coronavirus spread last month. We have more than 50% of the countries worldwide affected and there are a lot of talks going on.

As you know from my Stock market course + 10 Dow Jones EAs I normally trade the indexes with EAs, but these days there are some great short opportunities that I wish to share.

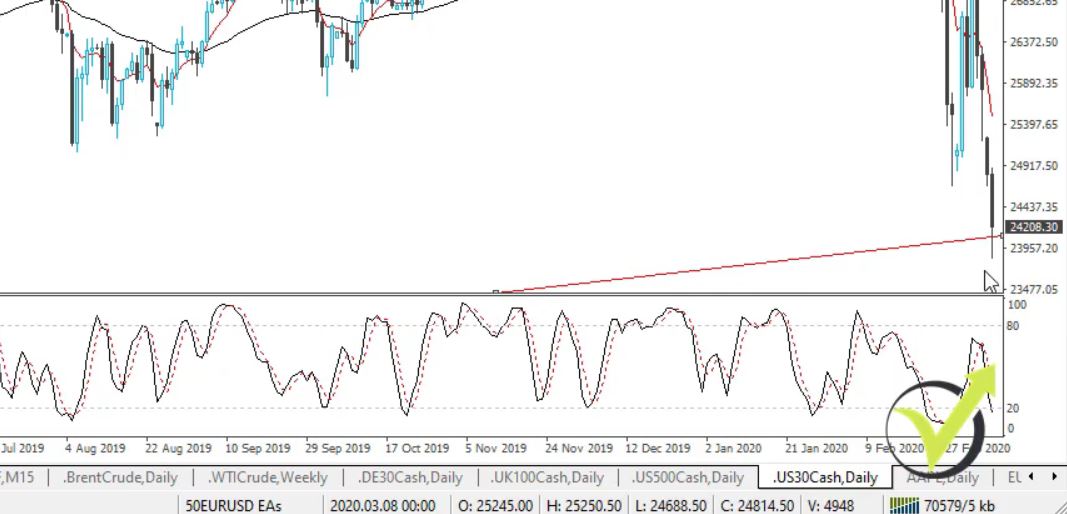

Is this going to be the beginning of the next crisis? I think it is already, it looks like it. But let’s have a look at what we have today and what we can expect during the next days, and, of course, what trading setups I’m looking at. Dow Jones down below 24,000, another 6.5% today early US morning.

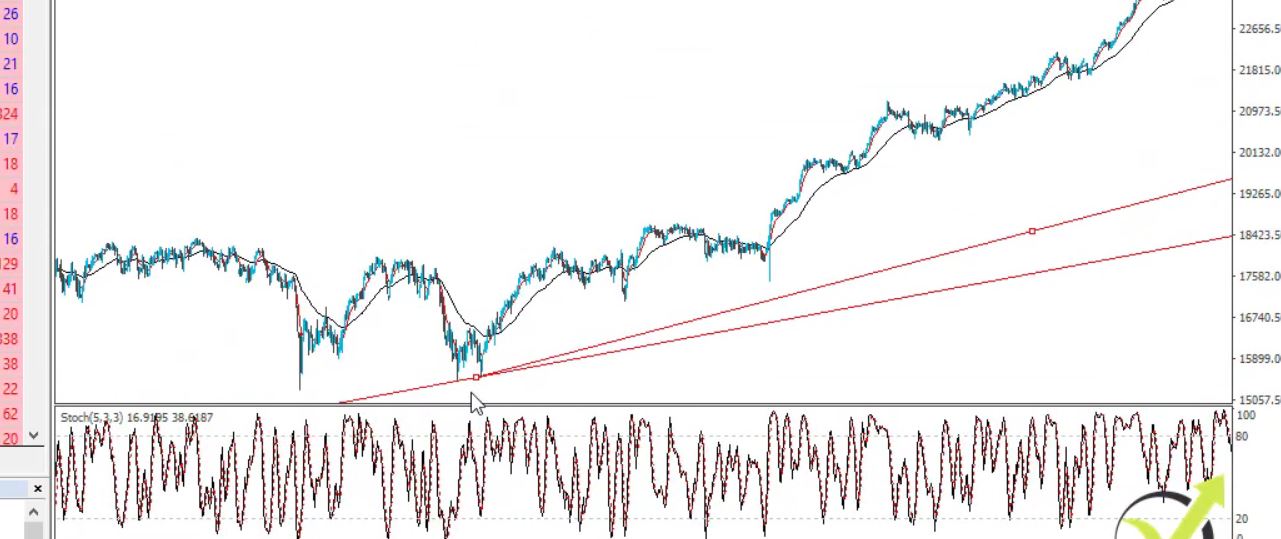

You can see it is just at my trend line, if I zoom it out, we have this trend line coming from below.

From the low, that I have in 2015 and the one we had in 2018, now the price is just at that trend line. However, I don’t think such a massive sell-off will be stopped by the trend line. But it might give us some short-term opportunities. The other trend line that I have from the low from 2008 is sell down at 21,500. That is more realistic support at the moment.

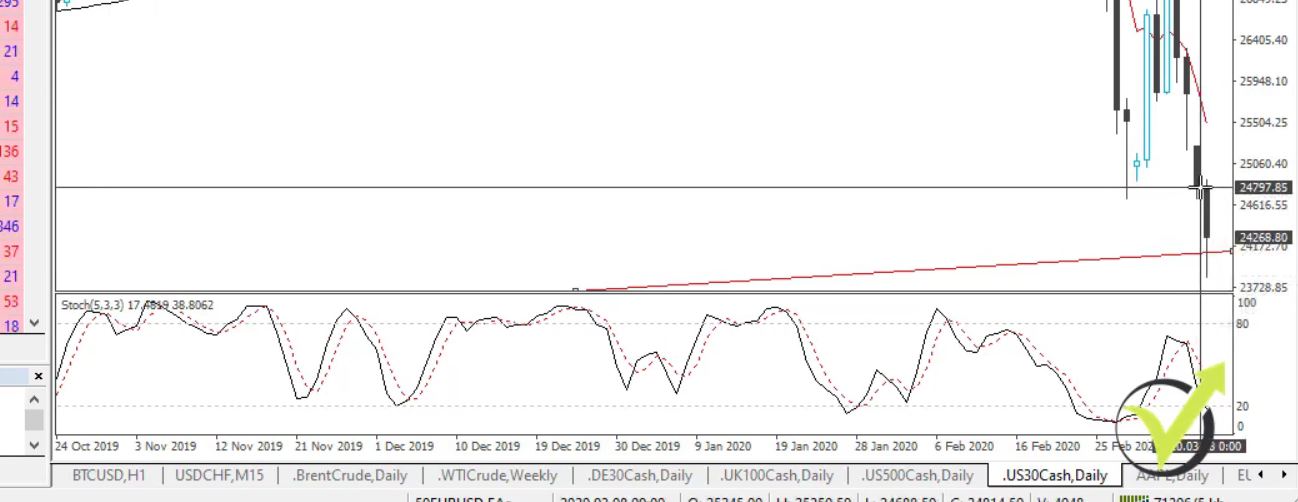

And today the market opened another $1000 lower. So on Friday, we had a close at about 25,785,

and today we had an opening at about 24,800, this is the trading from Sunday night.

Keep your Stop Loss higher

You can see what a massive gap we have over here. The coronavirus and the markets went crazy over the weekend. And normally, after such a gap we can see further sell-off. However, if you are looking to sell, I’ll suggest you keep your Stop Loss a little bit higher if you can afford it, either over the gap or either at the high that we have at 27,000.

Coronavirus and the markets and the Indexes

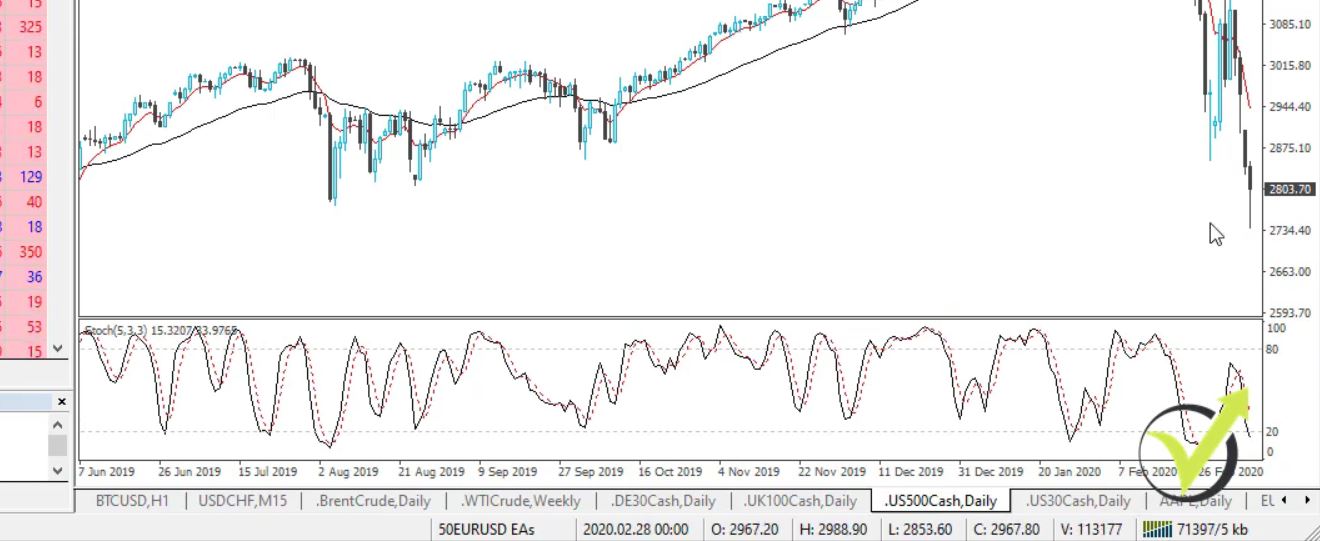

S&P 500, a very similar thing. Now it’s trading below 3,000.

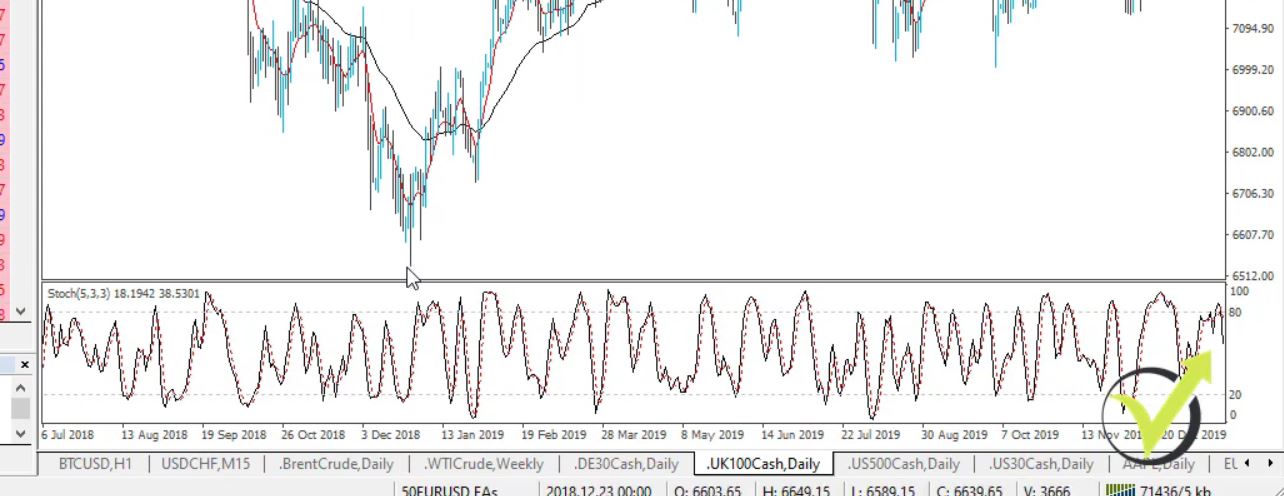

The UK Index is below 6,000 reaching the low that we have from 2018.

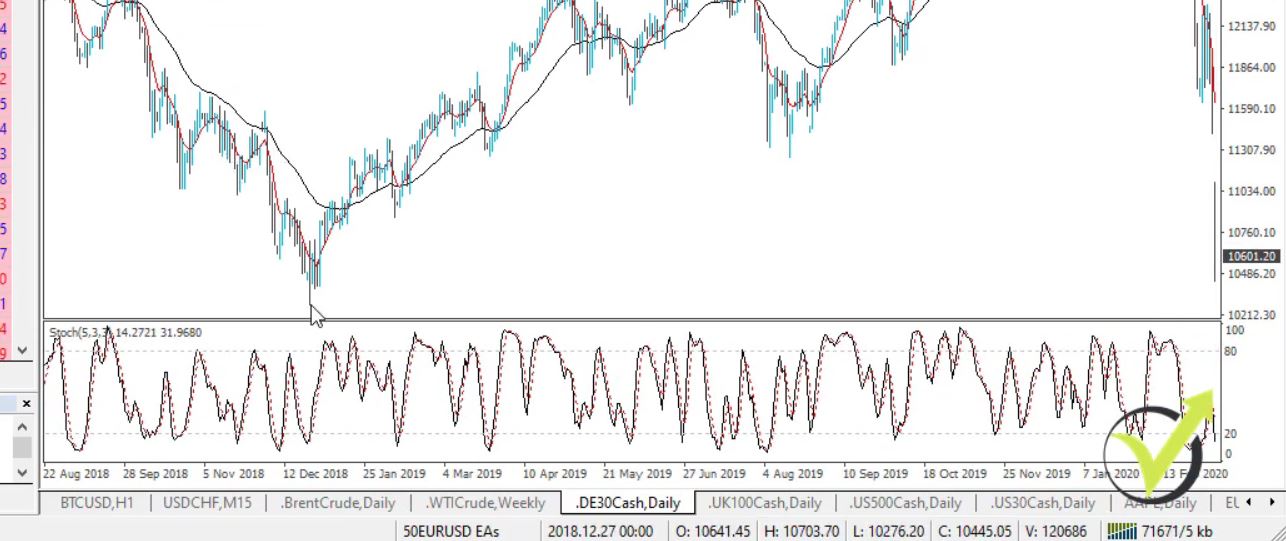

It already passed the low that we have from 2018. So below 6,000, we have the next low at 5,400 and something. This is the low we have from 2016. We have the same thing with the German DAX, at the moment it’s testing the 10,000 round number, keep in mind it’s a round number.

And then we have the support from December 2018 which is at 10,270, strong support for me from that number and from the round number of 10,000.

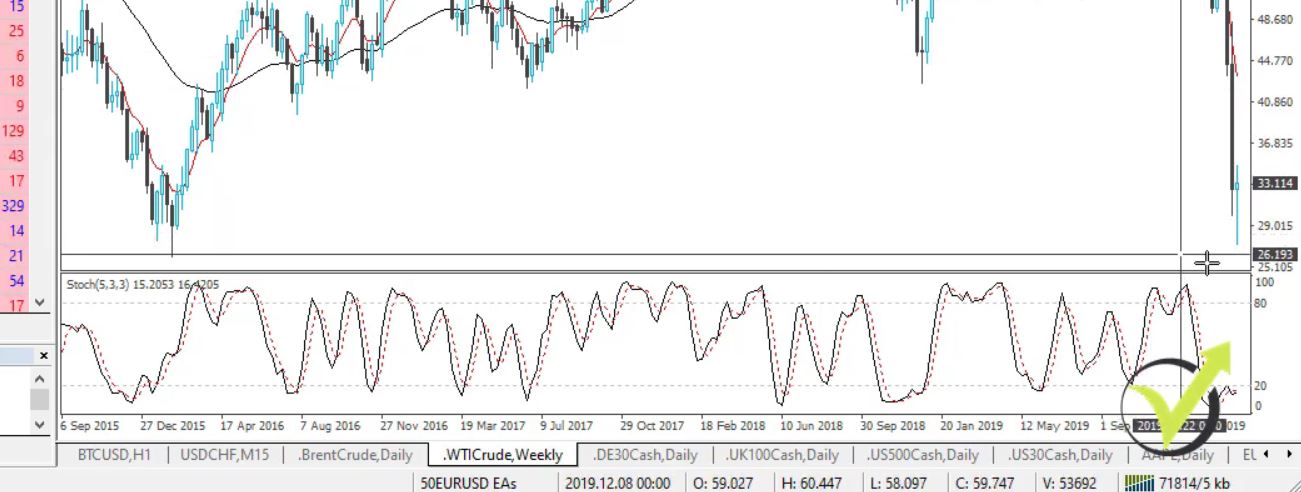

The move of the week definitely is with the oil. You can see the price this morning fell below $30 and now we have a little bounce reaching till $23, $24.

However, that’s really a low price for the oil. The very low we have in 2015 is at 26. It couldn’t break the 26. It’s the lowest point we have with the oil and this might give us some great opportunities to buy actually.

The cryptocurrencies suffered the most from the Coronavirus

However, for all of that, I won’t be buying unless I see some upward movements probably short-term uptrend looking at the daily charts or at the H4 charts. There’s something very important, this down movement on the oil is not so much of the coronavirus, instead, it’s the OPEC meeting that we had. What we see from the CNBC news is that this move was sparked by Saudi Arabia slashing its official selling prices for oil after OPEC failed to arrange a deal on production cuts.

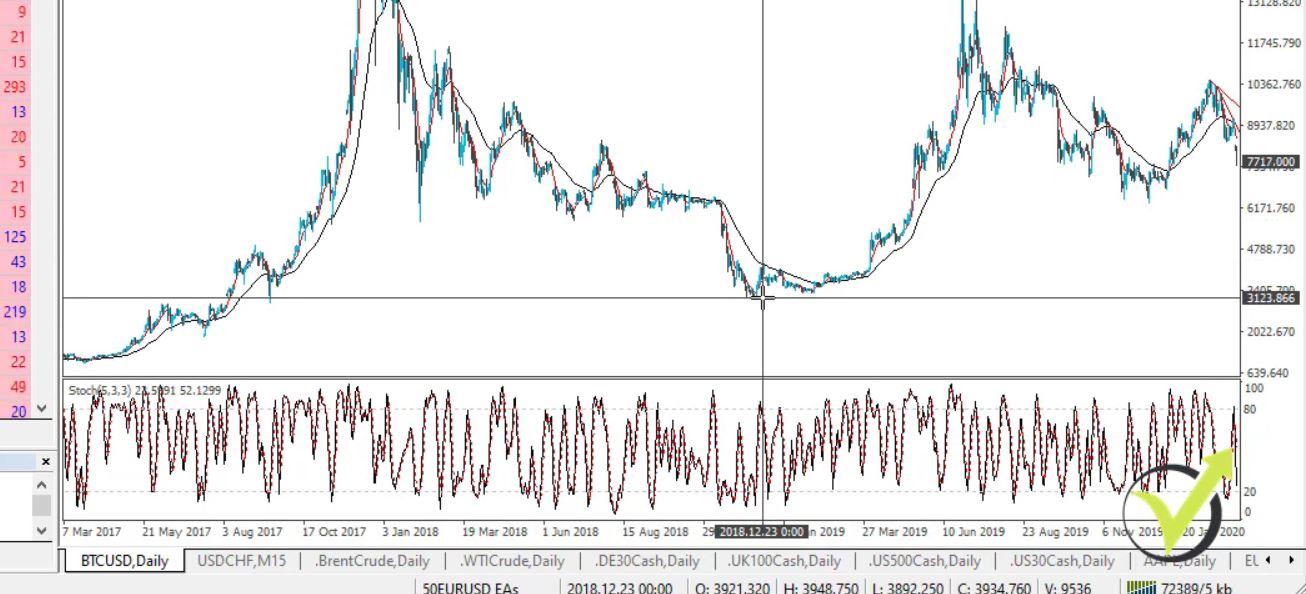

And that’s a 30% fall which is really huge. What more was affected by that was the Bitcoin. The Bitcoin is down below 8,000. What we are looking at in the Bitcoin at the moment is the support. On the daily chart, below are the supports that we have from December. If it falls below 6,000, well, we will go to the 3,000.

All the cryptos are very volatile as you know. We have seen it and we can expect it, however, this gives some great opportunities to the investors to buy some Bitcoins at a lower price. And this morning we had about 26 billion of losses from the cryptocurrencies which is really massive.

The safe currencies with the Coronavirus and the markets

A quick overview on the currencies we see gold is still very strong, the investors find it as a safe haven.

And the other safe haven, as you know I’ve been talking about it a lot in my courses, is the Yen. If I go to EURJPY, you can see it’s going down at the moment,

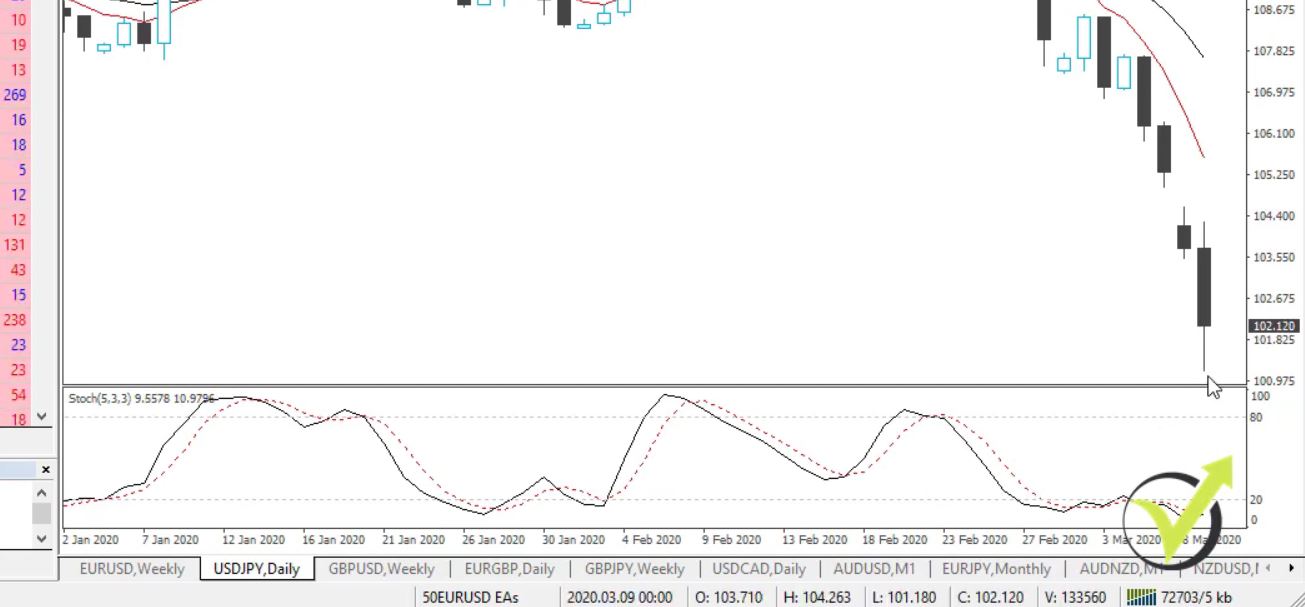

but USDJPY is the one that is really going down. If I go to the daily chart, you can see the USDJPY. It’s testing the 100, again a round number.

I’ve been talking a lot about the round numbers, they really matter at such times. But, one more time, we have a really strong yen at the moment. It’s considered to be a safe currency and in times like this, in times of market uncertainty, stocks go down and the investors always put some money into the yen. EURUSD is above 114. It was a really stable downtrend with the EURUSD. I had some great positions on EURUSD.

But when did I stop trading the EURUSD? Right over here at this short-term uptrend. Let me put the arrows so you can see it.

Don’t put emotions into the coronavirus and the markets

We had another push but after the talks about lowering the interest rates in the United States, we had a very positive euro. It’s two weeks now, into the third week we will see where it will go. And we have very obvious resistance lines, the ones I am looking at is 118. So this is what I’m looking at at the moment, strong yen, strong gold. Bitcoin, oil, and stocks are going down, I will wait a little bit to see how far they will go.

Probably there will be some good opportunities to buy cheaper Bitcoins and at the same time, I will be looking to buy cheaper oil for a little bit longer-term trades. For the short-term trades, I have the Expert Advisors trading. These are the new Expert Advisors that I launched in my new Top 5 Forex strategies course.

I lowered the size because it’s a really volatile time but actually I had some great profits during the last week.

There’s $400 from the last week. I started on the 5th of March with that account and I actually recorded some trading examples for the new top 5 course. So this is what’s going on on the market, I will keep you updated. And try not to put emotions so much while trading. Don’t be greedy. This is why I suggest trading with the Expert Advisors which might bring you more stable results.

Thanks for reading and always take care!

Cheers.